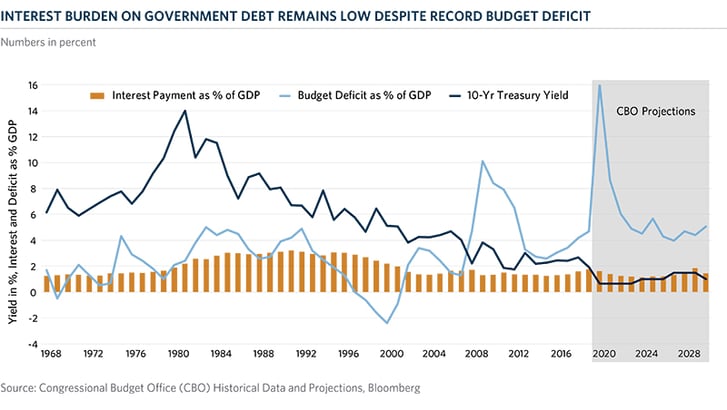

Few people would have predicted that U.S. equity markets would be higher today than at the start of 2020 if told that a virus would infect over 7.0 million people in the U.S., cause over 200,000 deaths and bring the economy to a virtual standstill. In order to support the struggling economy, Congress and the President enacted massive spending increases, driving the already large federal debt to its highest level since World War II. The Congressional Budget Office (CBO) projects that in 2020 the budget deficit will reach 16 percent of GDP, almost doubling the peak after the Great Recession in 2009 and the highest level since 1945. As a result, investors are concerned about the ability of the U.S. government to fight future crises and economic downturns as well as support critical government programs. For now, the debt is not a problem as governments continue to borrow at record low rates while corporate needs are being met by private lending as institutions continue their quest for yield. It is difficult to estimate at what level the debt begins to negatively impact an economy but record low interest rates should help governments to sustain these record debt loads for some time. As shown on the chart, as 10-year Treasury yields dip below 1.0 percent, interest payments on government debt are also expected to decline by around 10 percent in 2020. Projections from the CBO show that over the next 10 years, servicing the national debt as a percent of the size of the U.S. economy will be cheaper than at any time during the last 50 years. Even after a few Treasury auctions that saw a slight drop in demand, the government can now borrow for 30 years at 1.5 percent, the lowest interest level on record, (excluding the brief market dislocation in March 2020). However, servicing an ever-increasing debt load is unsustainable as it won’t always be this cheap. The CBO predicts that net spending on interest as a percent of GDP will quadruple from 2025 to 2050, while spending on major healthcare programs and Social Security also increases – a potential disaster scenario.