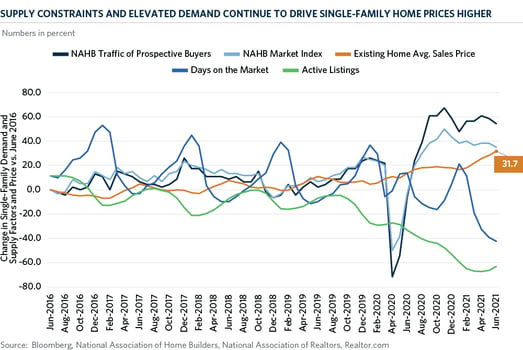

Housing demand appears to be slowing down in the first half of 2021, yet home prices have continued to climb at an accelerated pace. This month’s chart highlights the supply and demand factors driving single-family home prices, which have increased by 17 percent versus last year and 32 percent over the last five years.

On the demand side, the National Association of Home Builders (NAHB) reports a cooling in traffic by prospective buyers this year as compared to the second half of 2020 amid a deceleration in growth and higher prices. Although activity remained at historically high levels, mortgage applications from new home buyers have declined due to limited inventory. The NAHB Housing Market Index has also fallen from its November 2020 high, which is largely attributable to supply-side challenges including the availability and cost of building products.

On the supply side, inventories remain tight across a range of metrics including the number of active listings and days on the market for existing homes for sale. The number of days a home is on the market has fallen from an average of 72 days before the pandemic to 37 as of June 2021. In addition, the number of current active listings is lower by 52 percent compared to December 2019 and 65 percent lower relative to levels five years ago. Furthermore, housing completions remain below average after adjusting for the size of population.

Shipping bottlenecks and higher lumber prices are holding back construction, contributing to the higher prices of the limited supply of homes. Even though lumber prices have declined by 62 percent from the meteoric highs in early May, they remain 25 percent higher than December 2019. However, strong pricing power could enable builders to offset rising input costs and increase supply.

As a result of the significant recent home-price appreciation, housing affordability is approaching the lows last seen in 2008. The National Association of Realtors reported housing affordability has declined versus last year across all four regions within the United States with the biggest drop being in the Northeast. Despite the lack of inventory and higher prices, lower mortgage rates compared to last year have remained a key driver of U.S. housing demand and are crucial to the stability of the market as home prices reach (and potentially surpass) all-time highs.