Over the last year, there has been relentless reporting that the next shoe to drop for the economy and banking system is commercial real estate. The drumbeat runs counter to what we are hearing from our managers who see solid fundamentals at the operating level for most of the assets we own.

While we have no doubt that prices paid for real estate assets that were marked to cyclical highs are down, we disagree with this broader narrative. If you listen closely, the pundits mostly refer to the negative impact of work from home on commercial real estate values. The drumbeat got so loud we began to question whether we knew what the term commercial real estate represented. So, we did what any investor would do today and asked an AI bot, specifically Google’s Bard.

Here's what we learned:

“Commercial real estate is real estate that is used for business purposes, such as office buildings, retail stores, warehouses, and hotels.”

Well, right out of the gate we see even early AI bots understand that commercial real estate is more than just office. However, we were not satisfied with the response and believed Bard may know more. So, we probed further.

“What are other types of commercial real estate?” Here’s Bard’s response:

- “Multifamily properties are buildings that contain multiple housing units, such as apartments, condos, or townhouses.

- Self-storage facilities are buildings that provide storage space for individuals and businesses.

- Medical office buildings are buildings that house medical offices, such as doctor's offices, dentists' offices, and chiropractors' offices.

- Educational properties are buildings that house schools, colleges, and universities.

- Religious properties are buildings that house churches, temples, and mosques.

- Government properties are buildings that are owned and operated by the government, such as courthouses, libraries, and post offices.

- Special purpose properties are buildings that are used for a specific purpose, such as data centers, sports arenas, and convention centers."

While this is still not a comprehensive list of investable/lendable real estate it does highlight that commercial real estate is a lot more than just office buildings.

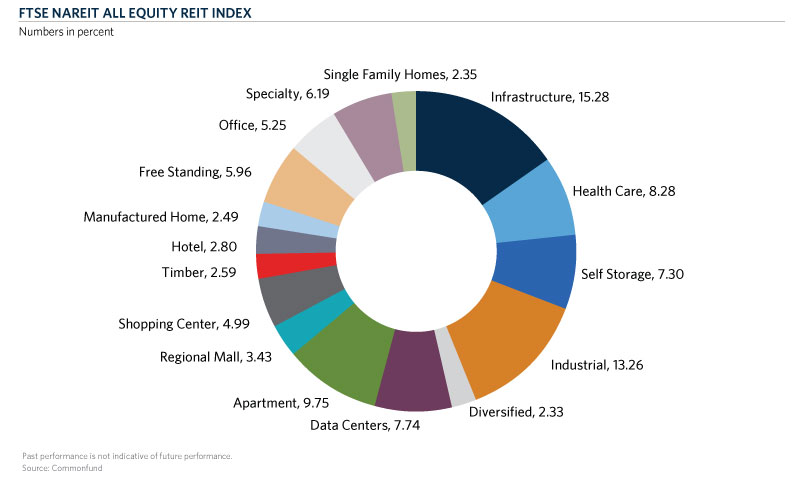

If we looked at the publicly traded REIT market to define the universe, office represents just 5 percent of the commercial real estate market.

Importantly, nearly every sector except office is exhibiting positive fundamental operating metrics today, over one year after interest rates were raised 500 basis points. Of course, these fundamentals are susceptible to future interest rate, economic and supply shocks but this brings us to one of the main reasons we believe this cycle will be different than previous downturns: supply. Supply remains relatively in check in many of these sectors outside of industrial and multi-family. Even still, vacancy levels for industrial assets sit at historic lows leaving room for some slack to form without significant negative impacts. Multi-family is also experiencing strong demand and higher interest rates are likely to maintain the relative benefit of renting over owning until rates recede. Further, with credit availability receding, supply pipelines are declining further aiding this positive supply backdrop.

To be fair, office does represent a larger share of the overall private real estate market with approximately 20 percent dedicated to traditional office, depending upon the index. If one hugged these benchmarks, they would likely be more concerned with the overall performance of their portfolio. But still, office is the minority exposure for both public and private market indices.

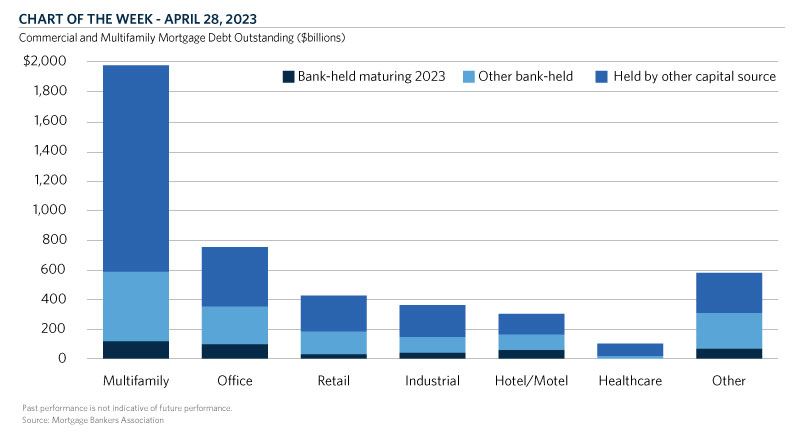

We acknowledge that much of the concern relates to the challenges facing the banking industry, which directly impacts the real estate sector and the broader economy. If banks suffer significant real estate loan losses, it could constrict overall economic activity. So, we looked at information regarding what banks owned to get a sense of the broader systemic risk.

According to the Mortgage Bankers Association, out of $4.5 trillion of commercial and multifamily mortgage debt outstanding, office accounts for $750 billion, or 17 percent of the total real estate debt, with banks accounting for less than half of that total with $339 billion, or 7.5 percent. Of this amount nearly $100 billion matures in 2023. If we assume that banks lent at approximately 60 percent loan to value and values have declined 50 percent for all the loans they hold, this implies a $16 billion loss in 2023 and a $57 billion loss on all loans. These numbers pale in comparison to Great Financial Crisis losses that totaled over $2 trillion, according to the IMF. In our opinion, the current environment is very different than prior real estate cycles where we expect the performance of real estate portfolios and the forward opportunity set to be more idiosyncratic than systemic. For currently owned assets, performance will be driven by when you acquired the asset, your ability to add value to that asset and how you financed it. If you purchased any stabilized asset at cyclical peaks with limited ability to add value and financed it with unhedged floating-rate debt that is maturing shortly, you are likely to experience a decline in your equity value, potentially materially so. Importantly, this does not mean the debt holder, i.e., bank, will take a loss on its position.

We do believe that transaction activity will remain muted for some period of time given pricing uncertainty and the ability for owners/sellers/lenders to make the math work. Part of this constraint will be driven by loan extensions, work outs and some realized losses limiting new debt capital availability. This more capital constrained environment will also provide an opportunity for high quality operators to generate strong returns on an asset-by-asset basis.