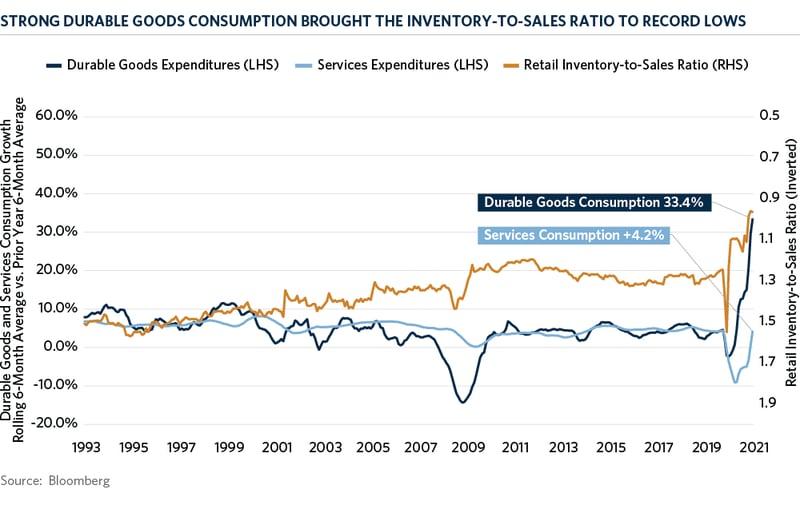

Supply chain woes continue to wreak havoc for retailers who are grappling with a strong rebound in consumer spending. Average six-month spending on durable goods, spurred by over $5 trillion in government support programs, increased 33.4 percent at the end of May 2021 compared to the same period one year prior. This is the strongest year-over-year level of consumer spending growth since at least 1993.

As vaccination rates improve further and mobility restrictions drop, consumers are also eager to get back to their pre-pandemic lifestyles and will begin spending more on services, too. Services consumption, which typically represents 65 percent of personal expenditures versus 35 percent spent on goods, was up only 4.2 percent in May versus the six-month rolling average of the prior year. Real GDP growth is expected to hit 13.0 percent in the second quarter of 2021 on a year-over-year basis and 7.2 percent at the end of the year, the fastest annual pace since the economy surged out of the deep recession of 1981-1982.

On the other hand, COVID-19-related issues continue to cause headaches for retailers who see backlogs in deliveries, materials supply shortages, and very expensive shipping rates, with little clarity on when the supply chain will catch up with market demand. In the services sectors, the labor market remains tight with restaurants and other businesses struggling to hire the necessary staff.

As a result of the unprecedented level of consumer spending, the ratio of current retail inventories to sales reached its lowest level since 1993. While it has been declining gradually over the last 20 years due to just-in-time inventory management, and typically declines during recessions such as in 2002 and 2008-2009, the ratio fell precipitously over the last twelve months. When done well, just-in-time manufacturing and inventory management can provide many benefits and savings to workers, owners and customers. It is a provisioning system that produces and delivers to consumers exactly what is needed, when it is needed and at the right price. However, the strategy has proven inefficient during the COVID-19 pandemic as both manufacturing and the global transportation network came to a halt.

Consequently, inflation pressures have picked up meaningfully in recent months, although much of the year-over-year increases are distorted by the base effects of comparing the current levels to the weak inflation prints during the pandemic. Whether the recent increase in inflation will be temporary or sustained is one of the key debates among market participants and politicians. At Commonfund, we believe that a substantial part of the overshoot in inflation is directly linked to the reopening of the economy and is likely to trend lower in the next two years. However, we do acknowledge that a steady pickup in wage inflation, particularly in the lower-income cohorts of the population which spends a higher proportion of income, could continue to support consumption and stoke inflation, if supply fails to catch up to demand.