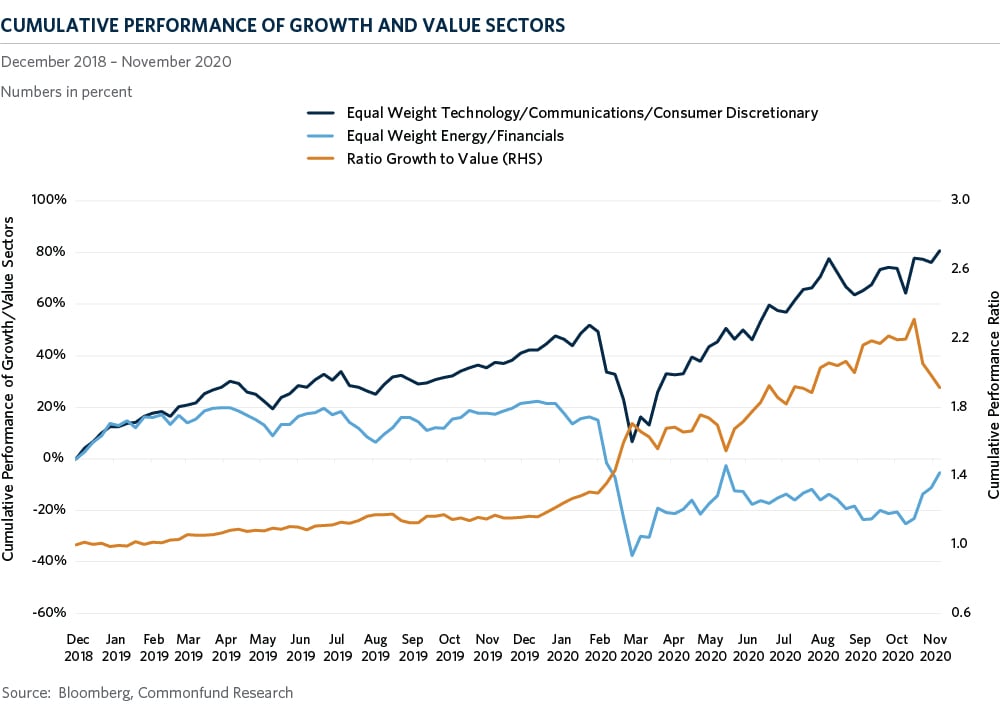

The month of November saw a sharp rotation into value equities at the expense of technology and communication services companies, causing investors to wonder whether the long-run dominance of growth equities has finally come to an end. As seen in this month’s chart, from the 6th to the 27th of November, an equal weighted index of the S&P 500 Energy and Financials sectors outperformed an equal weighted index of the S&P 500 technology, communication services and consumer discretionary sectors by 16.9 percent. The positive vaccine news and progress towards a final result in the presidential election were the main drivers of the surge in value stocks. While COVID-19 energized the outperformance of growth sectors this year, the trend has been in place for over 10 years through the disruptive integration of the internet, social medial and automation in business applications and consumer behavior. The question remains whether the latest performance is the start of a new trend of value outperformance or just another short-lived attempt like the one we saw in May/June this year following the reopening of the global economy. While economic activity continues to recover despite increasing cases of COVID-19 infections, the environment does not appear strong enough to support continued outperformance of value equities yet. Value typically outperforms at the beginning of a market recovery when economic and sentiment conditions have just bottomed. Currently, financial conditions and economic indicators have improved significantly, investor sentiment has already turned bullish and earnings from value companies continue to lag. Additionally, successful containment of COVID-19 is still elusive, creating headwinds for further economic growth and traditional value sectors like energy companies. Similarly, central banks remain committed to ultra-low interest rates, negatively impacting earnings for the financial sector. While we acknowledge that the globally synchronized expansion and positive vaccine news have propelled value equities higher, we continue to believe in a balanced approach towards growth and value factors. We favor quantitative and fundamental managers who are well equipped to allocate capital to the most promising companies within sectors and take advantage of opportunities in crowded and dislocated markets.