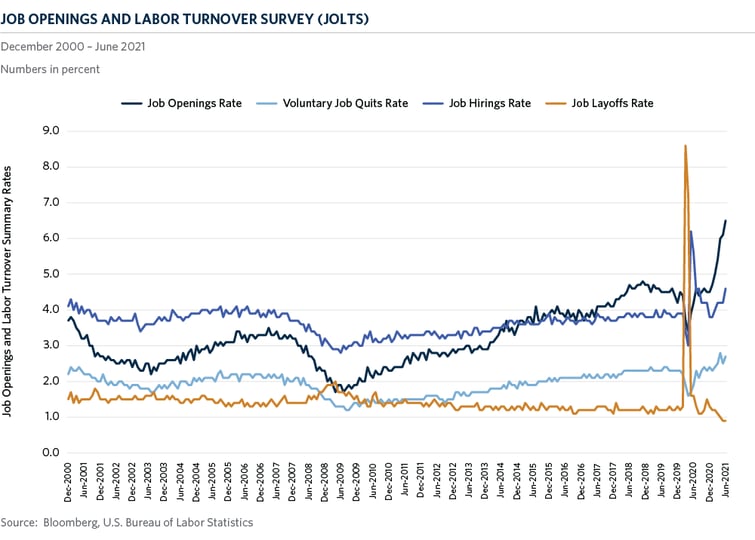

The U.S. labor market continues to recover from one of the worst declines in employment since the 1930s. In the early days of the pandemic last April, demand for labor plummeted and the unemployment rate reached 14.8 percent. Today, job openings and voluntary job quits are both at their highest levels since the Bureau of Labor Statistics “Job Openings and Labor Turnover Survey” (JOLTS) began in 2000. The record job vacancies indicate the surge in demand for workers as the economy continues to reopen. The sectors experiencing the largest increases in openings include those most impacted by the COVID-19 pandemic, specifically leisure and hospitality, accommodation and food services, healthcare and social assistance, retail trade and manufacturing. And yet, while jobs are plentiful in those sectors, employers have had a difficult time filling those positions as evidenced by the lackluster recovery in the hiring rate.

One explanation could be that government support programs implemented by the Trump and Biden Administrations have provided workers with enough time and financial resources to obtain new skills and re-train for higher-paying jobs in other industries. Other factors impacting the lower supply of labor include reduced immigration and general uneasiness among workers to return to work due to health concerns.

The trend continued in the August employment report, which showed employers added 235,000 workers vs. expectations of 733,000. A slowdown in hiring was expected compared to July due to the new wave of Delta variant COVID-19 infections, but the final report came in well below expectations. The biggest miss in hiring came from the leisure and hospitality sector which after adding 415,000 workers in July, was unchanged in August. Retail employment fell by 29,000 while government employment declined by 8,000 compared to a gain of 255,000 employees in July. The unemployment rate fell to 5.2 percent and the Fed forecasts unemployment to decline to 4.5 percent at the end of the year as openings eventually get filled, perhaps at higher wages.

Companies are beginning to take steps towards expanding wages and benefits such as creating advancement opportunities to hire and retain talent. Wage growth accelerated to 4.3 percent in August vs. last year as employment in retail and leisure and hospitality, two lower paying industries, declined. Companies have so far been able to absorb higher wage costs, but wage growth may slow as revenues are expected to decelerate over the coming quarters. Companies in the consumer discretionary, healthcare and industrial sectors, which historically generate the least revenue per employee are the most vulnerable to further wage pressures.

The latest miss in the employment report will likely push the Fed discussion on tapering its asset purchase program to November as officials will likely wait for the next two months of data to see if this was a one-off miss or potentially something more persistent. In the case of the latter, the decision to taper could be pushed into next year. At Commonfund, we continue to monitor labor conditions in our economic dashboard, upgrading the employment catalyst to moderately favorable in August. We believe employment has improved significantly compared to last year as the unemployment rate has dropped below its 18-month moving average. Additionally, we think hiring will continue to improve, supporting consumer spending.