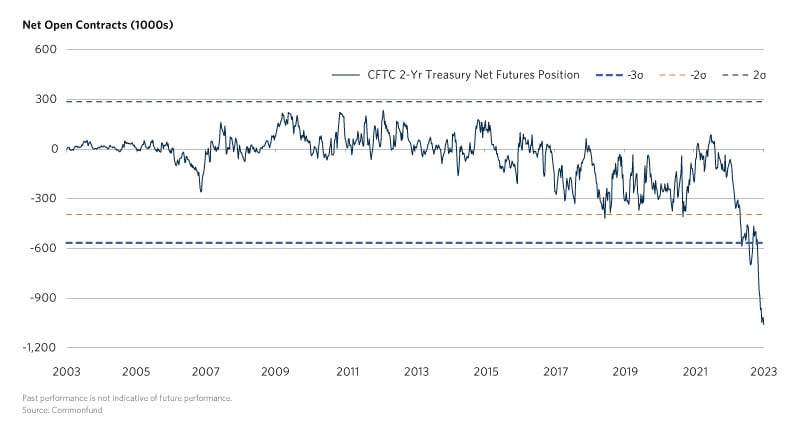

Market sentiment on bonds continues to trend lower, leaving the overall open interest in short-dated U.S. Treasury futures net short at an unprecedented level. There is the potential that these short positions will be under pressure unless a higher-for-longer rate environment sustains.

Open interest, or the outstanding contracts held by commodity trading advisors (CTAs) registered with the Commodity Futures Trading Commission on U.S. Treasury futures is one indicator of broad market sentiment towards interest rates. The futures markets provide investors and speculators with a liquid market to express a view on the direction of the equity and fixed income markets. When there is a net short interest rate position, it indicates investor expectations of higher rates (given the inverse relationship between price and yield). Over the last two decades, open interest has been mostly range-bound between a net long/short position between +/-300 thousand futures contracts. More frequent and longer sustained episodes of net short positions are a product of investors’ expectations of a “higher-for-longer” interest rate environment.

Market positioning indicates CTAs have become comfortable with the notion of a sustained period of higher interest rates. This Chart of the Month displays the open interest on 2-year treasury notes, which are the most traded tenor on the short end of the U.S. Treasury curve. Episodes of rapid increases in the number of short contracts on bonds (evidenced by significant downturns in the chart) have become more severe and frequent in recent years as the use of U.S. Treasury futures to express a speculative view on rates has increased.

Since 1993, the volume of short contracts has spiked, moving the size of the short position more than one standard deviation below the 20-year average 15 times—all within the last six years. Drifting even further from the 20-year average, the short position has grown to two standard deviations three times—all within the last five years. Taking an even more extreme case, the short position has grown to three standard deviations from the 20-year mean three times in the past eight months as the expectation for higher rates became more ingrained throughout 2022 and has yet to recover.

As of mid-July, the current open interest sits close to six standard deviations from the 20-year average. At this unprecedented level the traders holding bond shorts are poised for a squeeze should interest rates fall. In the wake of the generally positive CPI report in June, short bonds could be a precarious position should the FOMC choose to hold rates in a week. That said, more hikes are expected given the FOMC’s most recent Summary of Economic Projections and that more dovish FOMC officials have recently called for one or two more hikes. Regardless of the FOMC’s future rate decisions, such a staggering short position must be noted and is another example of the volatility that persists in rates markets.