As a result of the evolving landscape of the healthcare industry, organizations are increasingly being shaped by pressures affecting both the revenue and expense sides of the income statement.

On one side, you have revenue. These pressures take the form of tighter standards for government and insurance reimbursement. On the expense side, healthcare organizations have already carried out cost-cutting steps. However, it is clear that the larger organizations, with their ability to spread cost reductions over a wider patient and constituent user base and to weather reimbursement reductions, are the first movers and will reap greater benefit than the smaller and mid-sized organizations with their proportionately higher fixed cost base.

A Growing Reliance on Endowments

As a result of this changing environment, it seems inevitable that there will be much greater reliance by these organizations on the endowment to enhance surpluses and make up for losses. Doing this, however, will not be a simple task. Healthcare organizations continue to face constraints in optimizing the return from their endowments. This is because both their inpatient and outpatient facilities and related medical equipment have a relatively short lifespan as advances in healthcare treatment and technology accelerate their obsolescence and mandate renovation or rebuilding on a regular basis.

Many nonprofit institutions make use of bond issues to fund brick-and-mortar construction projects and improvements. A successful bond offering depends in large part on the ability of the bonds to earn a high rating from the bond rating agencies, which look not only to the ability of the healthcare provider to generate cash flow but also to the liquidity of its endowment’s financial assets as a potential backstop source of repayment. Indeed, liquidity measures have come to form a key metric in determining bond ratings.

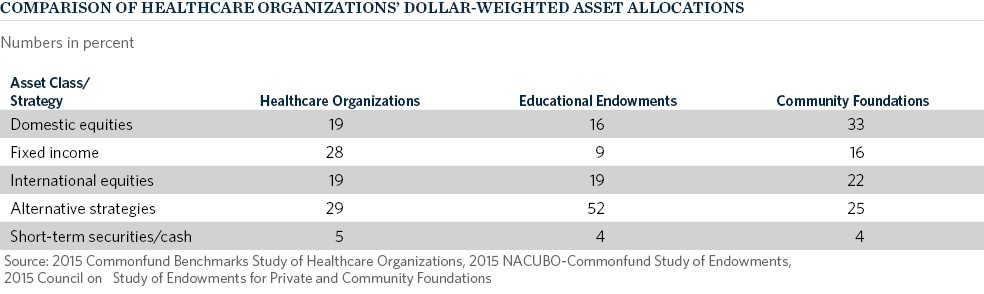

For this reason, the asset allocations of healthcare endowments have tended, on average, to be more heavily weighted toward cash and fixed income investments than those of other types of nonprofits.

The following table compares healthcare organizations’ dollar-weighted asset allocations to those of community foundations and educational endowments, as reported in the most recent Commonfund studies for the relevant sector.