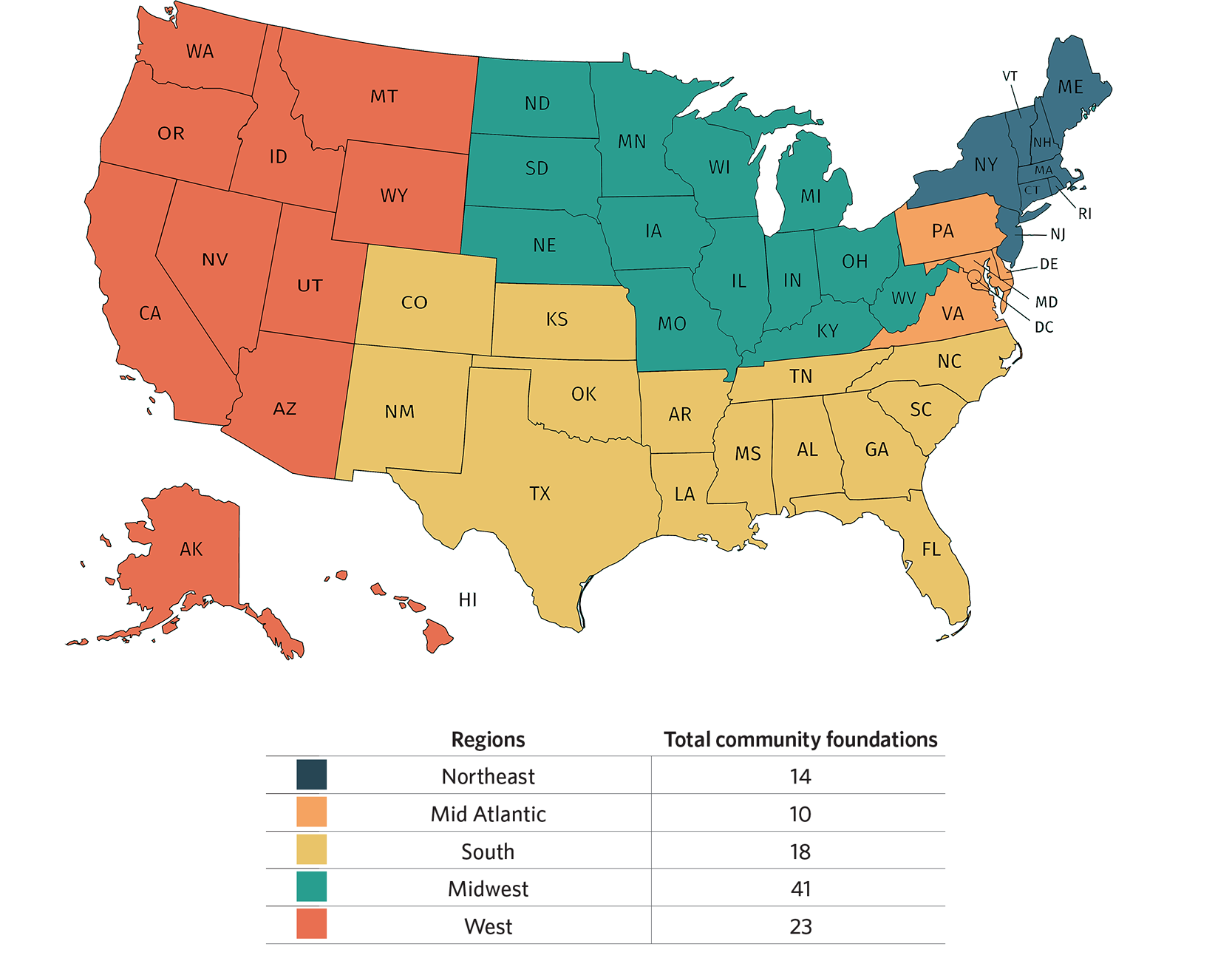

For the 2022 Council on Foundations - Commonfund Study of Foundations, we provided an analysis of community foundation data by five geographic regions. Community foundations lend themselves to this type of analysis, as they are more regionally focused than private foundations. They seek to act as agents of positive change by making grants within local, state or regional boundaries and typically have community representatives on their boards.

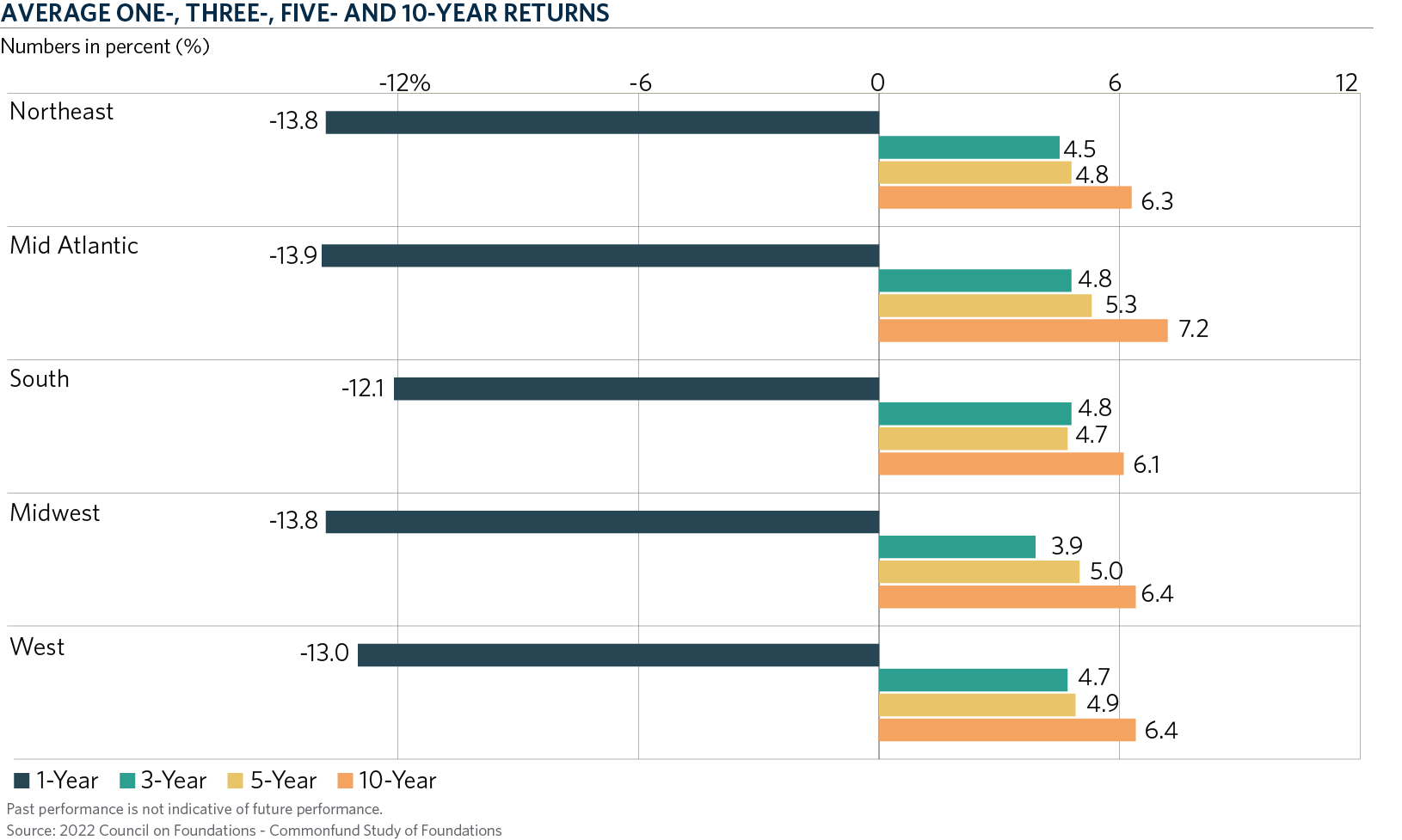

Regional Net Returns Reflect Larger Study

Like participating community foundations overall, 2022 community foundation returns were negative across regions. The best relative return was -12.1 percent for community foundations in the South. This region lagged in terms of 10-year returns, as Mid Atlantic community foundations led the way with a return of 7.2 percent. Community foundations in these two regions reported the highest three-year return, 4.8 percent, while Mid Atlantic foundations’ 5.3 percent return was the highest for the five-year period.

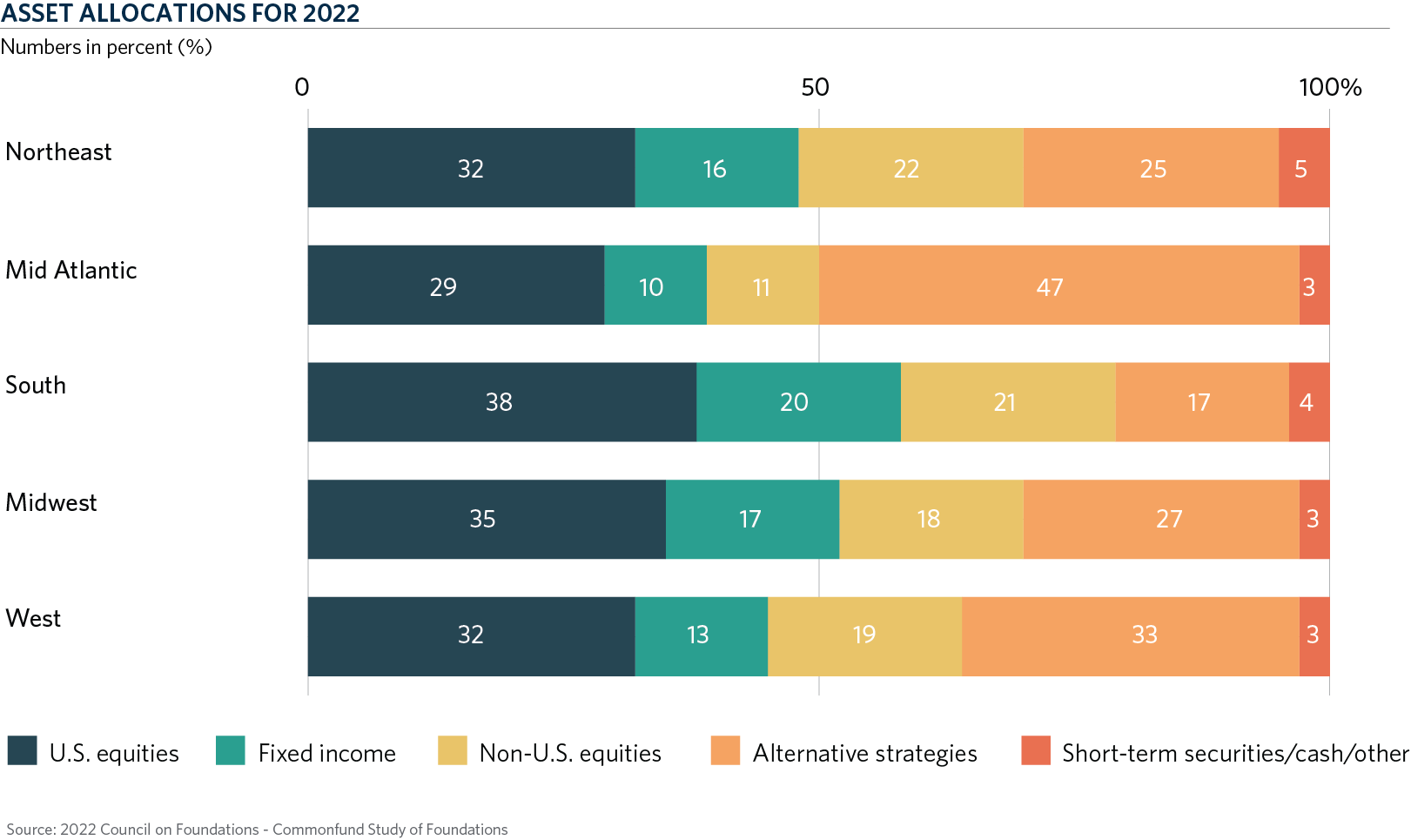

Asset Allocations Show Variability

Across regions, community foundation data showed significant variation. Alternative strategy allocations, for example, varied from 17 percent (South) to 47 percent (Mid Atlantic). Northeast foundations reported a 22 percent allocation to non-U.S. equities, twice that of Mid Atlantic foundations. Even in fixed income, a traditional asset class, the highest allocation was 20 percent (South) and the lowest was 10 percent (Mid Atlantic). Allocations to U.S. equities were more level, ranging from the South’s 38 percent to 29 percent among Mid Atlantic foundations. Community foundations in the West and Northeast allocated 32 percent each to U.S. equities, while in the Midwest the allocation averaged 35 percent.

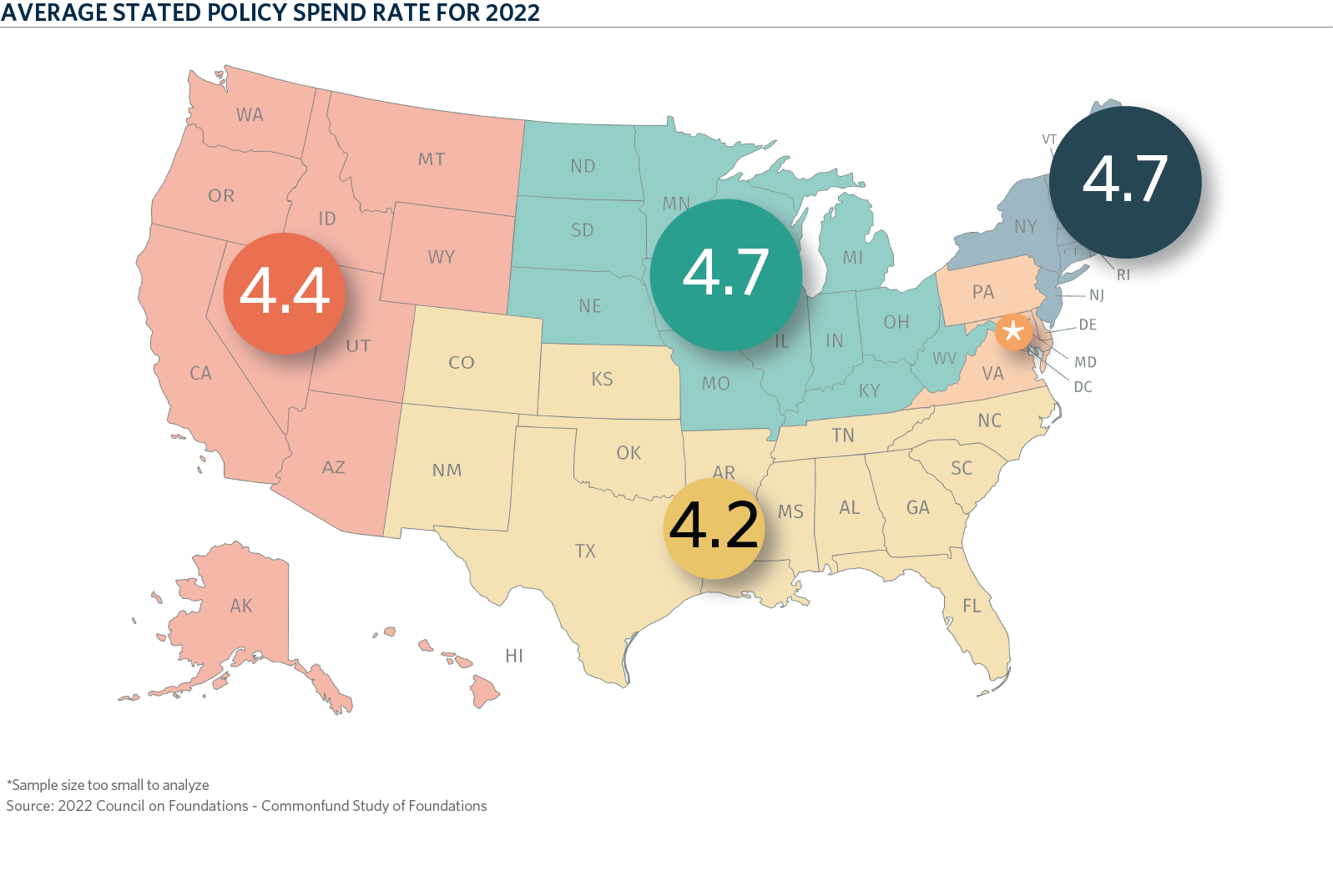

Average Stated Spending Policies in 4% Range

Community foundations in the Midwest and Northeast reported the highest stated spending policy rate at 4.7 percent. The average stated spending policy rate in the West was 4.4 percent, while in the South it was 4.2 percent. (The Mid Atlantic sample was too small to analyze.) Ninety percent to 100 percent of all community foundations reported having a spending policy.

Moving Average Most Frequently Used Methodology

Across regions, community foundations overwhelmingly use the percentage of a moving average value as their spending methodology. Foundations in three regions reported using this method in the 80 percent range while two were in the mid-60 percent range. The average spending rate went from 4.2 percent in the South to 4.8 percent in the Mid Atlantic. Only community foundations in the Midwest said their policy was to meet the IRS minimum spending rate of 5 percent. Foundations in the Mid Atlantic most frequently employed the approach of spending a pre-specified percentage of market value, at 20 percent. The Yale/Stanford rule (hybrid method) was used only by foundations in the West and Northeast.

Interested in learning more about the findings of the latest Study of Foundations? Request your copy today.

Commonfund partners with the Council on Foundations to create the Council on Foundations—Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF). The CCSF annual report studies, on average, nearly 300 private and community foundations that represent over $100 billion in assets.