Over the past year the Commonfund investment teams have undertaken research to identify and isolate a new factor associated with the environmental sustainability of a stock (or a portfolio of stocks).

There are two important reasons to pursue this objective:

-

- while company disclosures and reporting on sustainability metrics are improving, they remain wildly inconsistent today and so do the ratings of data providers as a result; and,

- isolating the factor provides the ability to identify and evaluate managers who pursue sustainability strategies as well as potentially develop a methodology for screening portfolios.

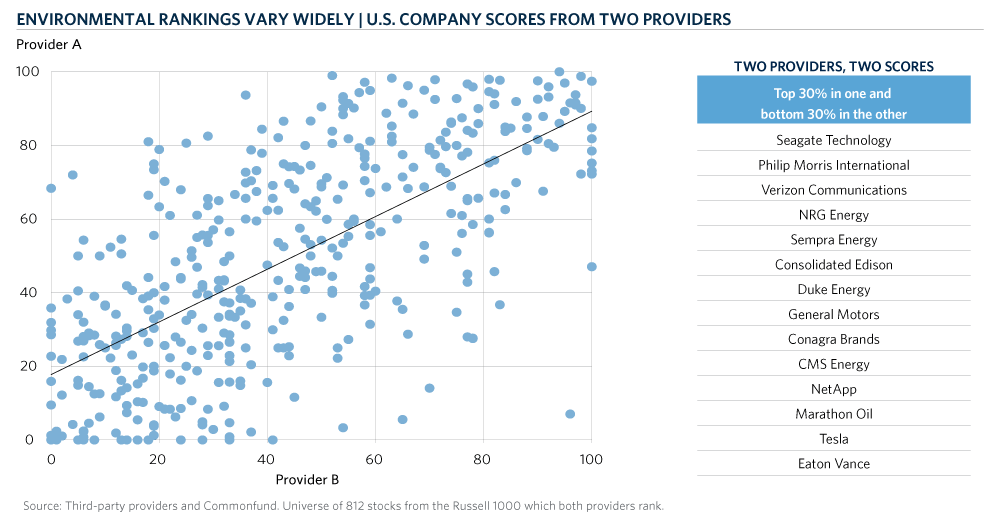

An example of the problem with data inconsistency can be seen in the chart below showing the environmental ratings of a group of 812 stocks from two leading providers of ESG ratings. The scatter plot clearly shows that each provider is assigning very different ratings to each company. Further, in some cases the providers are simultaneously rating the same company among the best 30 percent and the worst 30 percent.

Commonfund applied machine learning and other quantitative techniques to identify the “E” Factor using return series exclusively, thereby avoiding the problem of relying on inconsistent reporting and subjective interpretation.

Once the factor was identified, validation and testing indicated that it could accurately identify and categorize relatively “green” stocks and managers with more than 98 percent accuracy.

These early results are promising, and, we will continue our research on this important initiative while sharing the results and their implications with our investors.