Earlier this month, Commonfund held its second invitational Diverse Manager Day with 19 managers identified through our Diverse Manager Portal. These diverse managers1 , from historically underrepresented groups in the investment management industry, spanned a wide range of asset classes, including public equities (6), private equity (3), real estate (3), venture capital (2), hedge funds (2), private credit (2) and fixed income (1). Managers participated in a lively day of virtual presentations to our investment teams with the objectives of being added to our pipeline of diverse managers for consideration in client portfolios, and to our growing Diverse Manager Database.

This day was made possible by the successful re-opening of the Diverse Manager Portal last summer. We originally launched the Portal in 2019 to help us expand our diverse manager universe and source diverse managers within equities, fixed income, hedge funds, real estate and private credit strategies through the receipt and review of due diligence materials. After a successful initial phase, we decided to re-open the Portal on a permanent basis and expand eligibility to include additional asset classes, including private equity, venture capital and private real assets and sustainability.

The re-opening was met with a warm reception from managers:

- In the first three months, from September 1 – November 30, we received a total of 86 submissions from 65 different investment firms.

- These submissions included seven direct referrals from our valued partners at the National Association of Investment Companies (NAIC) and Diverse Asset Managers Initiative (DAMI).

- With these additions our Diverse Manager Database now includes more than 230 managers. We believe these managers represent a significant proportion of the institutional-investible diverse manager universe, which we estimate to be just over 1,100 managers.

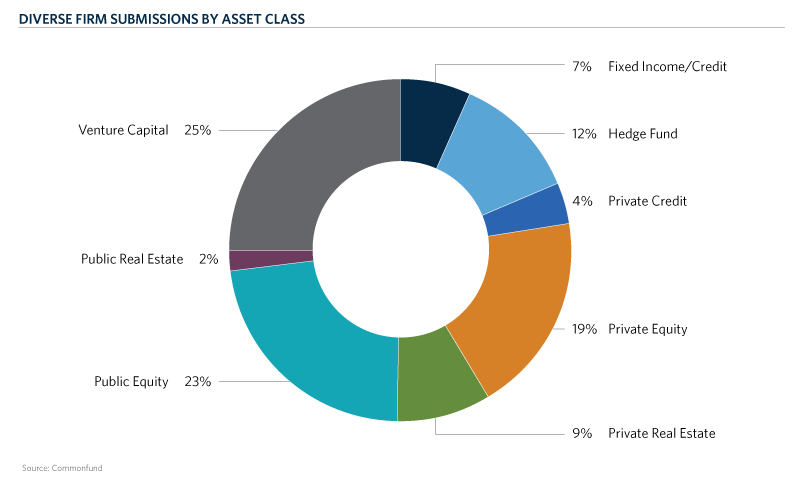

We were pleased that these submissions spanned all nine eligible asset classes, including 35 private strategies and 51 marketable strategies. The following chart provides a breakdown of submissions by asset class.

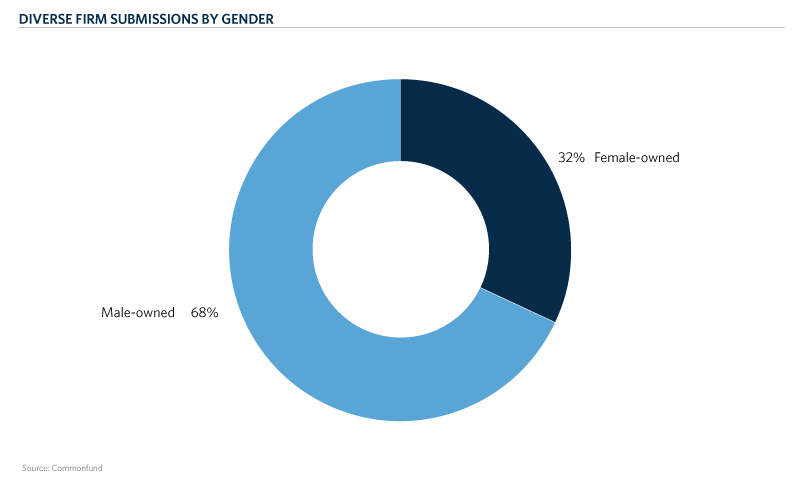

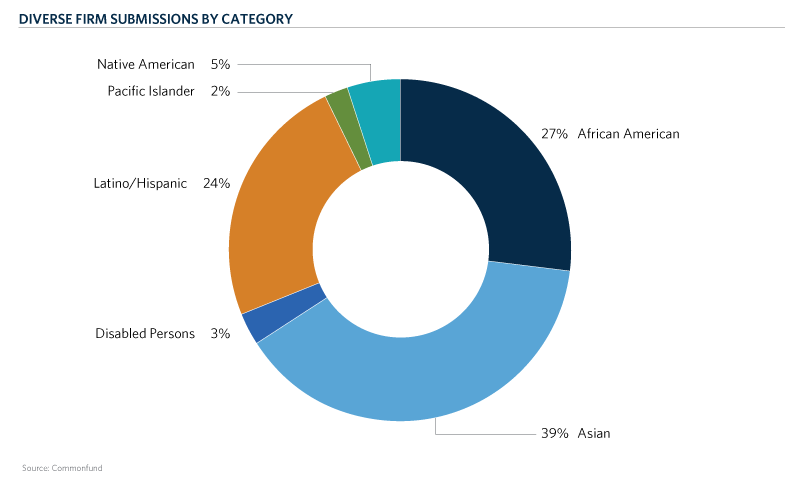

The diversity of the submissions is more complex, since some are represented by more than one diverse group, but the following charts gives a sense of the balance of submissions among women, racial and ethnic minorities, veterans and persons with disabilities.

After a comprehensive quantitative and qualitative review of every submission made between September 1 and November 30, 2020, we invited 19 managers to participate in our second Diverse Manager Day for virtual presentations to our investment teams from Commonfund Asset Management and Commonfund Capital. Due to the expanded asset classes and the quality of submissions, we were able to more than double the number of invitations to participate compared to our first Diverse Manager Day, when we met with nine managers.

Even in a virtual setting, the day proved to be a valuable and productive experience for all involved, with several investment teams interested in actively continuing due diligence in select managers.

Over the past three years we have sourced over twenty diverse managers for our client portfolios, amounting to approximately $560 million dollars in commitments. We’re optimistic that our latest Diverse Manager Day was an important step toward increasing that total, and we look forward to continuing our work with partners across the industry who share our dedication to sourcing, evaluating and allocating to these managers on an ongoing basis.

READ MORE ABOUT EMERGING AND DIVERSE MANAGERS

Visit our Commonfund website today to learn more about responsible investing.

- Diverse managers are defined as firms with 33 percent or greater ownership by any combination of US citizens who are: Female; Black or African American; Hispanic or Latino; Asian; American Indian or Alaska Native; Native Hawaiian or Other Pacific Islander; Disabled Persons; and Veterans. Further, those firms must be based in the United States.