For over 50 years, Commonfund has been working with boards and committee members on designing and implementing an investment structure that supports maintaining intergenerational equity or the purchasing power of their long-term pool. The Commonfund OCIO team recently hosted a roundtable luncheon in Portland, OR, for local nonprofit leaders. We aimed to convene a forum to share information and research on best practices while facilitating a meaningful dialogue among participants.

Attendees represented educational institutions and provided the platform for the discussion to focus on unique challenges this segment of the nonprofit sector is facing, as well as solution-based exchanges based on experience.

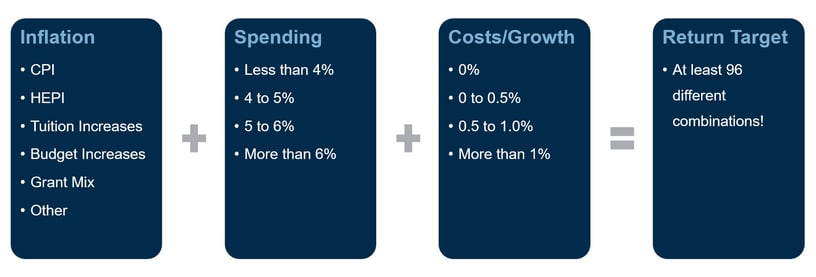

We began the roundtable with the question “What is Your Return Target?” and discussed calculation elements that help determine the performance threshold an organization is seeking to achieve. This led to a meaningful dialogue about inflation—defined as rising costs paired with a reduction of purchasing power. Conventional thinking defaults to the Consumer Price Index (CPI), with the mention of inflation, but most costs that make up CPI are derived from housing and transportation and may not be as applicable to higher education.

Today, many educational institutions use the Higher Education Price Index (HEPI)—designed specifically for higher education and may be a more accurate indicator for colleges and universities than CPI. HEPI measures the average relative level in the prices of a fixed basket of goods and services purchased by colleges and universities each year, i.e. faculty and administrative salaries, supplies & materials, fringe benefits, utilities, etc., making it much more reflective of the cost increases impacting the dollars available at the institution.

Another key topic of discussion was Spending Policy, the different methodologies institutions employ and how they work with an inflation marker (CPI, HEPI, tuition costs, budgets, etc.) to provide a framework that reduces spending volatility and cuts down the propensity to overspend during flush market environments. In general, investment policy statements and operating policy statements tend to get more attention than the spending policy, but investment committees should be spending significant time considering the appropriate spending policy for their institution as well. More detail on these can be found in our recent whitepaper – Endowment Spending Policy: Often Overlooked but Critical to Long-Term Success.

This productive and interactive discussion reinforced the importance of engaging committees on these and other topics as they strive to increase the potential of preserving real purchasing power of their long-term portfolio.

These concepts are covered in further detail in the video, Playing to Win.

Commonfund OCIO is on the road meeting with institutions to discuss the topics above and more each year. Interested in being a part of the conversation? If you are interested in attending a regional roundtable in your area please complete the form with your details. A member of our team will reach out to you with dates and locations of where we will be next.