The new and newsworthy in this year’s Council on Foundations–Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF) is headlined by responsible investing. No other area of inquiry showed as much year-over-year change or as much change over the past few Studies; to be clear, the changes would not be considered dramatic, but they are consistent and the trend line is easily discernible.

Last year’s Viewpoint offered an in-depth analysis of responsible investing among participating foundations. This year we are revisiting the topic, but in a more abbreviated form—an update, because changes from FY2016 to FY2017 are worthy of comment and we now have one more year’s data in this evolving investment discipline.

The news in brief: Among private foundations, 19 percent of Study participants said they seek to include investments ranking high on environmental/social/governance (ESG) criteria versus 15 percent that said so last year. Among community foundations, 18 percent said that they seek to include investments ranking high on ESG criteria, a sharp increase from 8 percent last year. Socially responsible investing (SRI), in which certain investments are excluded or screened out, was practiced by 22 percent of private foundations this year, up from 17 percent a year ago. Among community foundations, 21 percent said they practice SRI compared to 14 percent last year. Among private foundations, 30 percent allocated a portion of the endowment to investments furthering the institution’s mission (MRI, or mission-relate investing) versus 25 percent that did so a year ago. Among community foundations, 22 percent allocated a portion of the endowment to investments furthering the institution’s mission, a two-percentage-point gain year over year. (Definitions of these approaches to responsible investing may be found here.)

The changes from last year to this are the most dramatic in the period that this Study has probed the responsible investing practices of both private and community foundations—a period beginning in 2014 and extending through 2017, giving us four years of data. The series of tables that follows examines the growth of the three responsible investing approaches over this period of time.

Private foundations have consistently practiced ESG at a higher rate than community foundations, and after three years when private foundations’ rates of adoption were level, there was a four-percentage-point increase in FY2017. An even greater change took place among community foundations. This year, the frequency with which they reported implementing ESG criteria more than doubled and nearly pulled even with private foundations.

The pattern of SRI adoption among foundations is very similar to that of ESG. Private foundations’ implementation of SRI was quite level for three years and then expanded in FY2017. And, for all but one year (2015), private foundations more frequently have employed SRI at higher rates than have community foundations. Similar to ESG investing, in FY2017 community foundations reported a sharp increase in the rate of adoption of SRI, to the point where they used SRI at a rate only one percentage point lower than private foundations.

Mission-related investing is practiced at the highest rate of the three approaches to responsible investing. Over the four-year period, its rate of adoption among community foundations has grown by almost 50 percent. MRI has shown steady growth among private foundations, save for a decline in FY2016. This year, the rate of MRI adoption among private foundations reached a high for the period.

Other Aspects of Responsible Investing’s Evolution

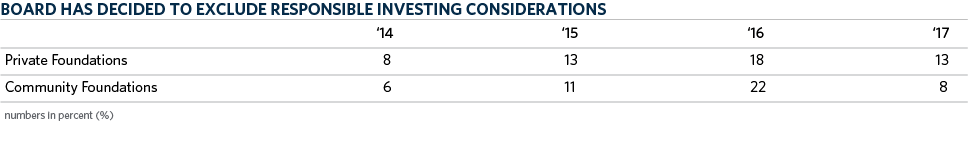

While adoption of responsible investing is expanding, there remains a group of Study respondents saying that their boards have decided to exclude responsible investing from consideration. And, in fact, this group was larger in FY2017 than it was in FY2014, although lower this year than it was at its height in FY2016.

Typically, boards reluctant to adopt responsible investing practices cite two factors: the perceived potential for lower investment returns and the possibility of not fulfilling their fiduciary duty. Additional reasons often cited are a relative lack of standards and definitions, and the difficulty of implementing such a program, particularly for foundations with a high share of passively managed assets.

What of the future? The Study has asked whether foundations are considering changing their investment policy to include ESG integration. For both private and community foundations, the trend is consistently upward, as the following table shows. While private foundations frequently have been ahead in adopting various responsible investing practices, community foundations may be expected to take the lead in ESG integration if these indications of future considerations in fact become reality.

Conclusion

This Viewpoint is intended to be an update of last year’s more in-depth analysis of trends in responsible investing. This is a subject that warrants revisiting periodically, as interest in it continues to grow and, oftentimes, leads to action as boards decide to implement some form of responsible investing policy.