Introduction

In recent years, growing attention has been paid to the use by endowed institutions of so-called responsible investing practices. The three main practices — environmental, social and governance (ESG) investing; socially responsible investing (SRI); and impact investing (also known as mission-related investing or MRI) — are defined in the gray box below.

Of the three practices, SRI has the longest pedigree, tracing its beginning to religious groups and abolitionists who, in the late 18th century, forbade their institutions from investing their endowments in businesses related to the trade in enslaved human beings. To this day, SRI is most frequently practiced (though not exclusively) by private, faith-based institutions rather than by public ones; for example, the 2016 NACUBO-Commonfund Study of Endowments shows that among institutions of higher education, SRI is practiced by 32 percent of private colleges and universities but just 18 percent of all public institutions and their supporting institution-related foundations (IRFs).

Among foundations, a similar division appears to exist between private and community (or public) foundations. In the study, we trace changes in the use of responsible investing practices by these two types of foundation, as illustrated by trends in a matched sample of foundations drawn from the last three years’ CCSF reports.

A surprising degree of looseness, and even disagreement, can still be found with respect to definitions of the various responsible investing practices. The definitions we supply on page 34 of the study (which also appear in the gray box below) were created in concert with a panel of experts for two targeted studies of responsible investing practices that we conducted in 2014 and 2016,1 and we have been careful to continue to use these definitions in our surveys to ensure that the questions are asked in a uniform way. This practice, together with the use of a matched sample of the same institutions from year to year, enables us to observe trends in the sector that might otherwise be obscured by definitional vagueness.

Environmental, Social and Governance Investing

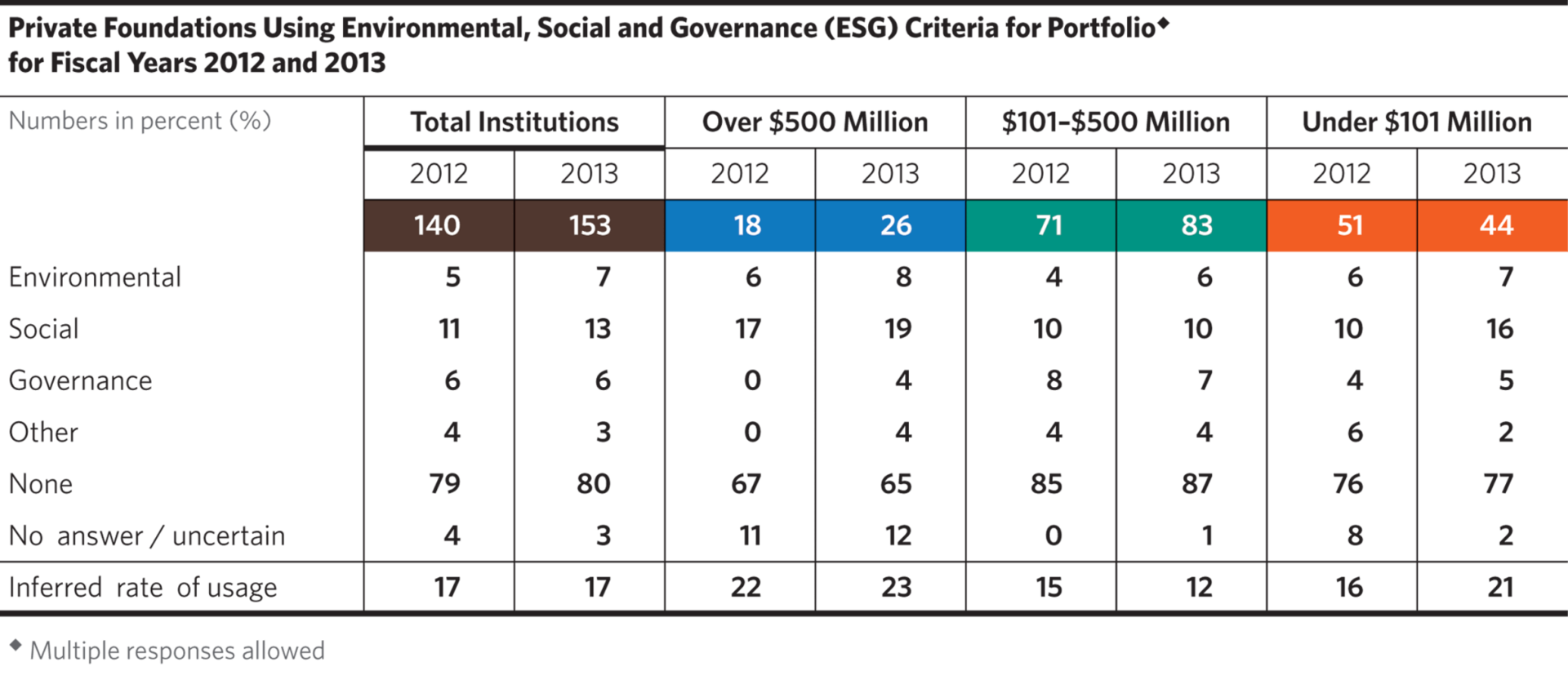

As far back as 2012, our research contained questions relating to ESG investing. In both the 2012 and 2013 CCSF, private foundations were asked whether they used ESG criteria for their portfolios. Their responses, as shown in the table below, indicated that a small but growing number did use these criteria, and that the practice was not limited to the largest foundations.

Among the three criteria, social issues were most frequently cited overall, with environmental and governance issues cited less frequently. Taken as a whole, if the “None” and “No answer/uncertain” responses are interpreted conservatively to mean that the institution did not use any of the three criteria, it can be inferred that 17 percent of private foundations used at least one of the ESG criteria in FY2012 and FY2013.

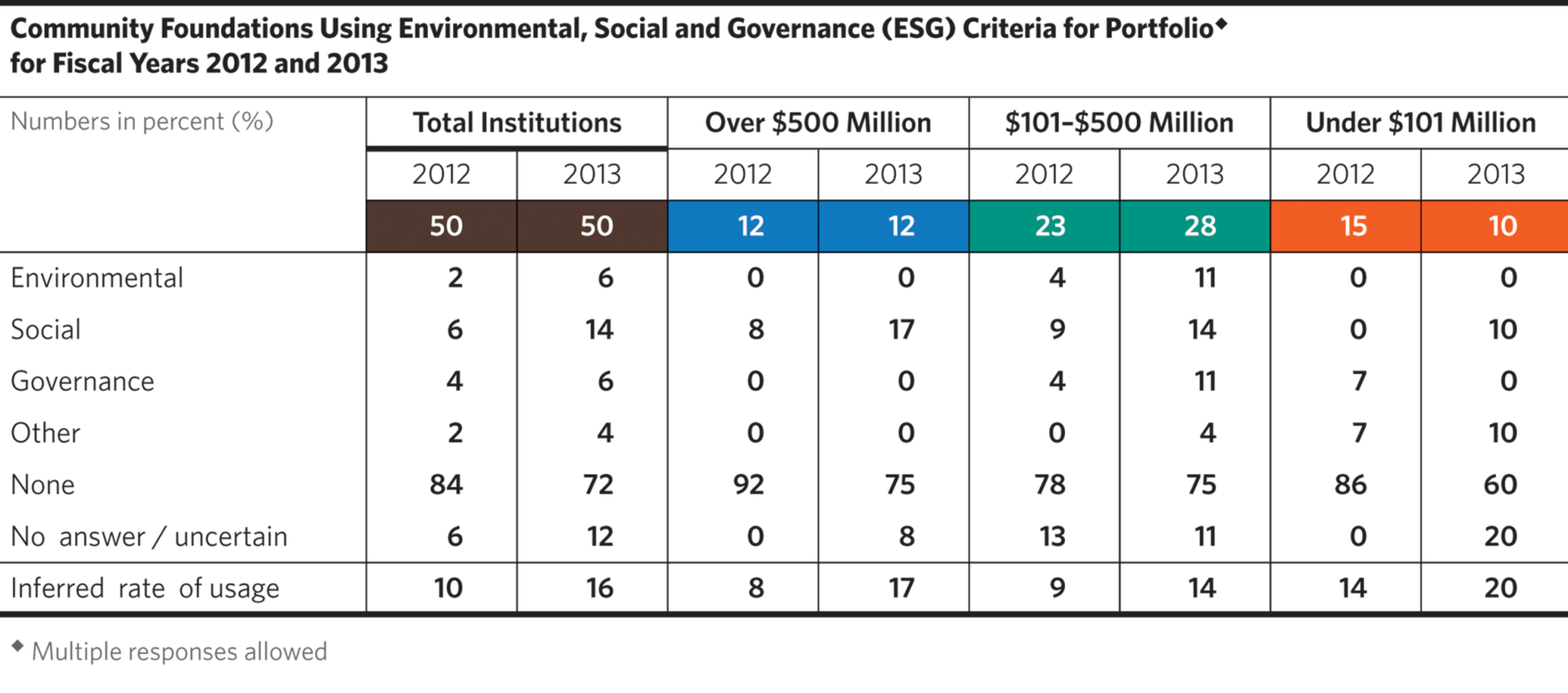

Among community foundations in the same period, the overall use of ESG criteria was less frequent than that of private foundations in FY2012, but very close to that of private foundations in FY2013. Again, among the Total Institutions group of community foundations, if the “None” and “No answer/uncertain” responses are interpreted to mean that the institution did not use any of the three criteria, it can be inferred that 10 percent of community foundations used at least one of the criteria in FY2012 and 16 percent did so in FY2013. The latter number is very close to that for private foundations.

Among private foundations, the largest cohort had a higher degree of ESG usage, with 22 to 23 percent implying that they used at least one of the criteria. Community foundations of comparable size had a somewhat lower rate of ESG adoption, with 17 percent of large institutions implying that they used at least one of the practices in FY2013. Significantly, the implied degree of ESG adoption increased in nearly every size cohort for both private and community foundations from FY2012 to FY2013.

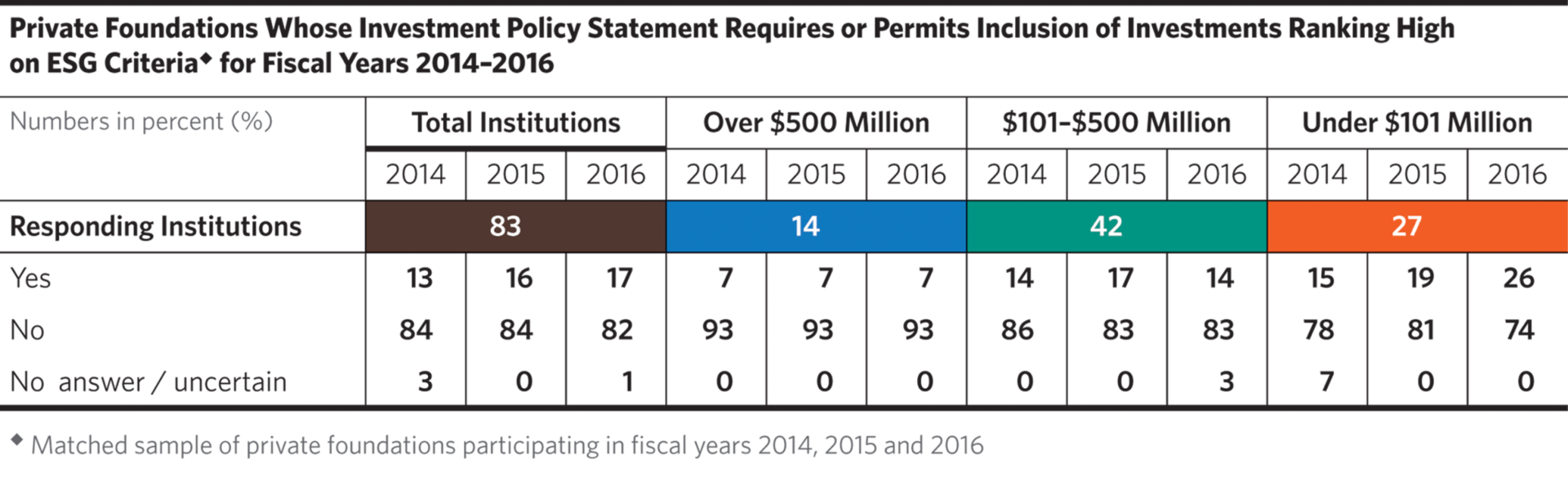

A Look at Three Years of ESG

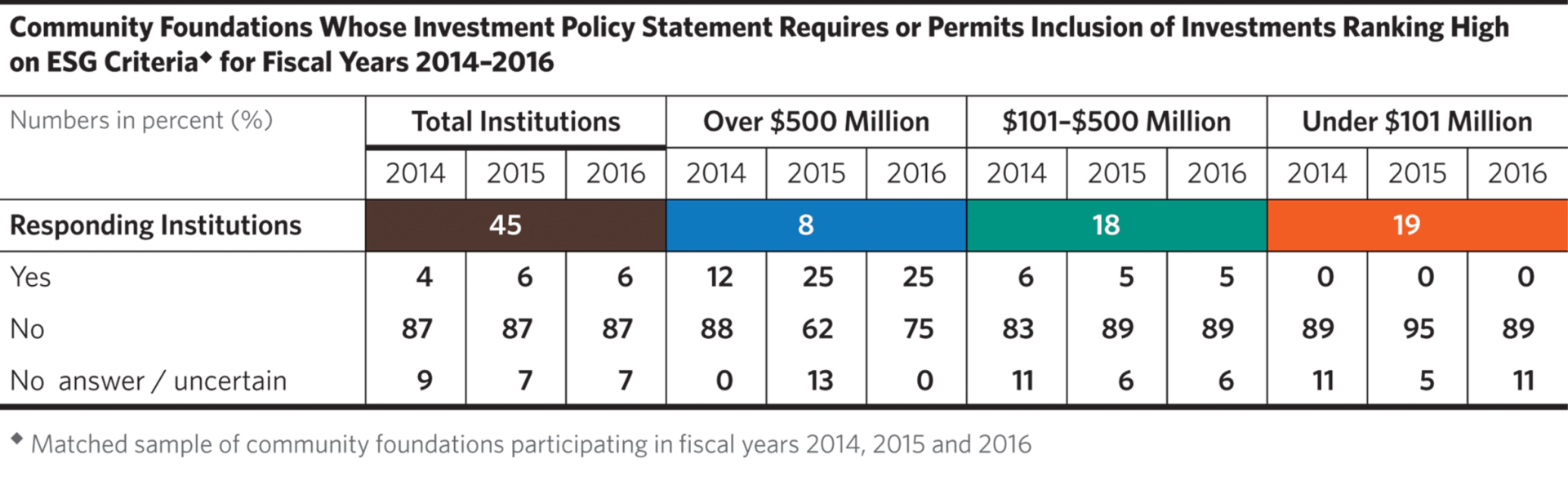

Beginning in FY2014, we began to inquire more systematically about responsible investing practices, asking whether any of the three practices were permitted or required by the institution’s investment policy statement. Continuing our analysis of ESG investing, if we examine a matched sample of the 83 private foundations that participated in the CCSF in fiscal years 2014, 2015 and 2016 we can see that asking the question in this more restrictive way yielded a lower rate of reported use than in FY2012 and FY2013. Also, while a consistent, but small, group of large and medium-sized foundations reported having an ESG policy, ESG usage increased by three-quarters among smaller private foundations with assets under $101 million over the three-year period, from 15 to 26 percent.

For community foundations, the picture is almost exactly the opposite. While caution should be exercised when dealing with the small number of institutions in our sample, it seems clear that ESG integration is practiced more frequently by larger community foundations and there does not seem to be a trend of increased adoption of ESG practices by medium-sized and smaller community foundations in the three-year period under study.

One possible clue to the increase in ESG investing among smaller private foundations may lie in the growing number of investment management firms that have integrated ESG criteria into their security analysis process. A significant number of data providers have begun offering databases by means of which analysts can draw quantitative conclusions about the relative environmental, social and governance rankings of the various companies that are candidates for investment. In this sense, ESG investing is increasingly becoming a part of standard security analysis and it may only be a matter of time before smaller community foundations, too, are employing ESG analysis in their investment process. For the moment, however, it appears that while ESG investing is growing among smaller private foundations and larger community foundations, among other cohorts in the Study it remains comparatively rare.

Socially Responsible Investing

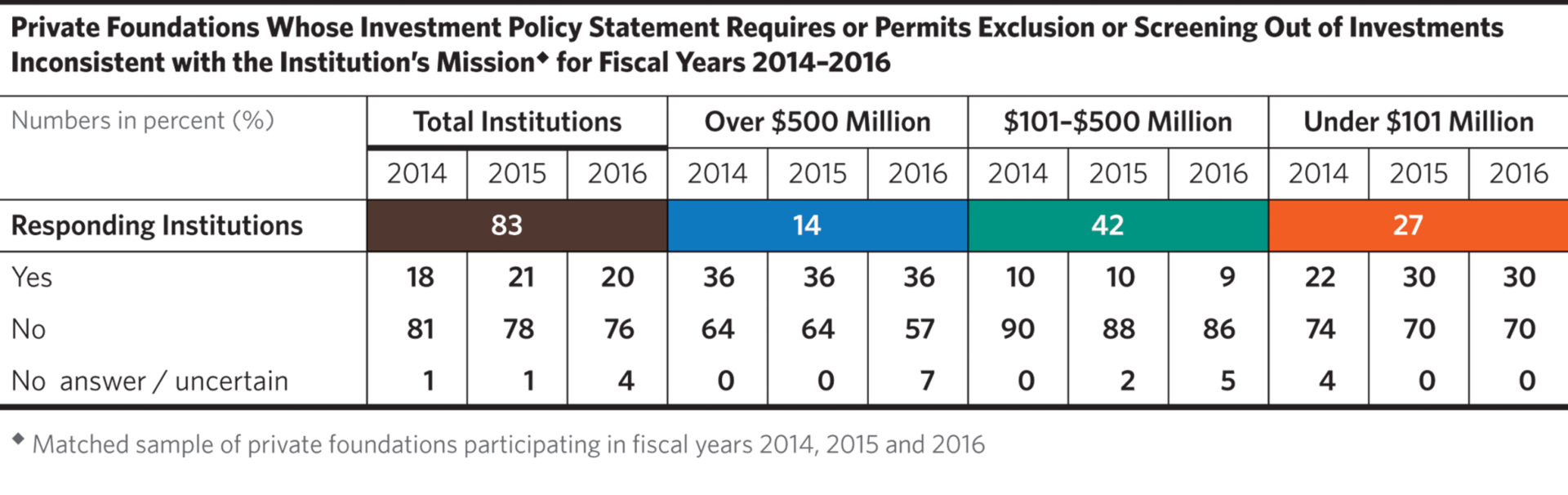

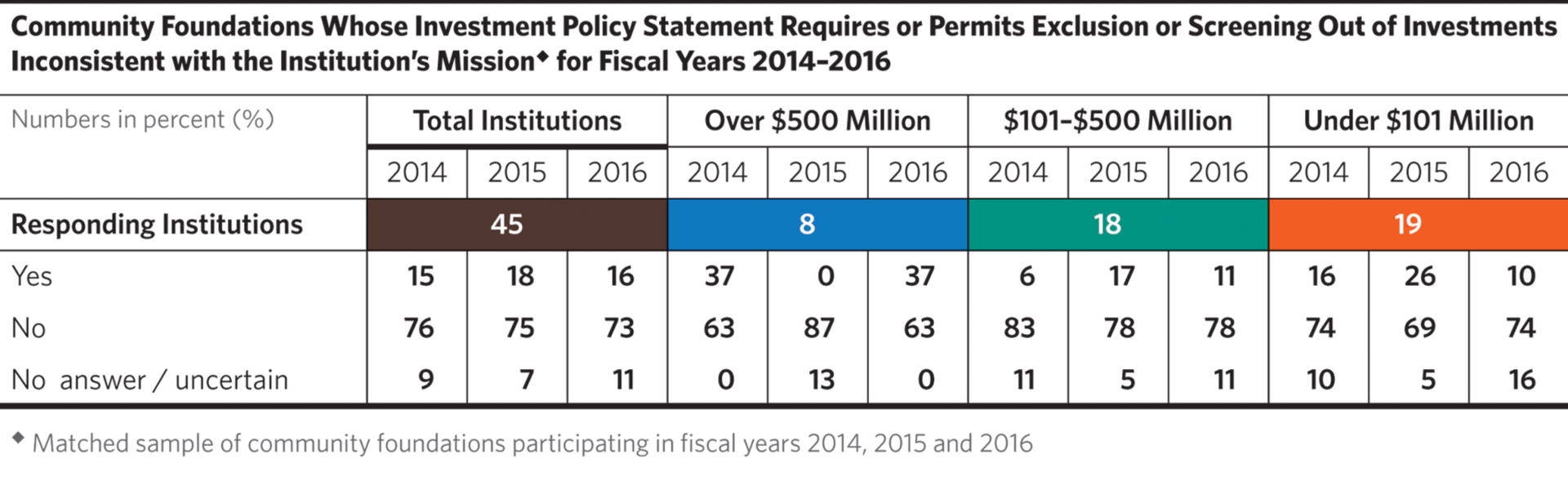

Turning now to the use of SRI practices by private and community foundations, between 15 and 21 percent of both private and community foundations overall have reported employing SRI screening in the last three years. For private foundations, SRI screening is frequently an expression of the values of the founder or the family; among community foundations those using SRI screens are often faith-based public charities whose donors and members would expect and support expression of the community’s values through the institution’s investment program.

Again, while caution must be used in interpreting small data samples, among both private and community foundations the use of SRI screens appears more prevalent in the largest size group, where more than one-third of institutions report using this practice. Among smaller foundations of both types it is harder to discern a pattern, but an increase in SRI usage can be observed in the cohort of small private foundations between 2014 and 2016.

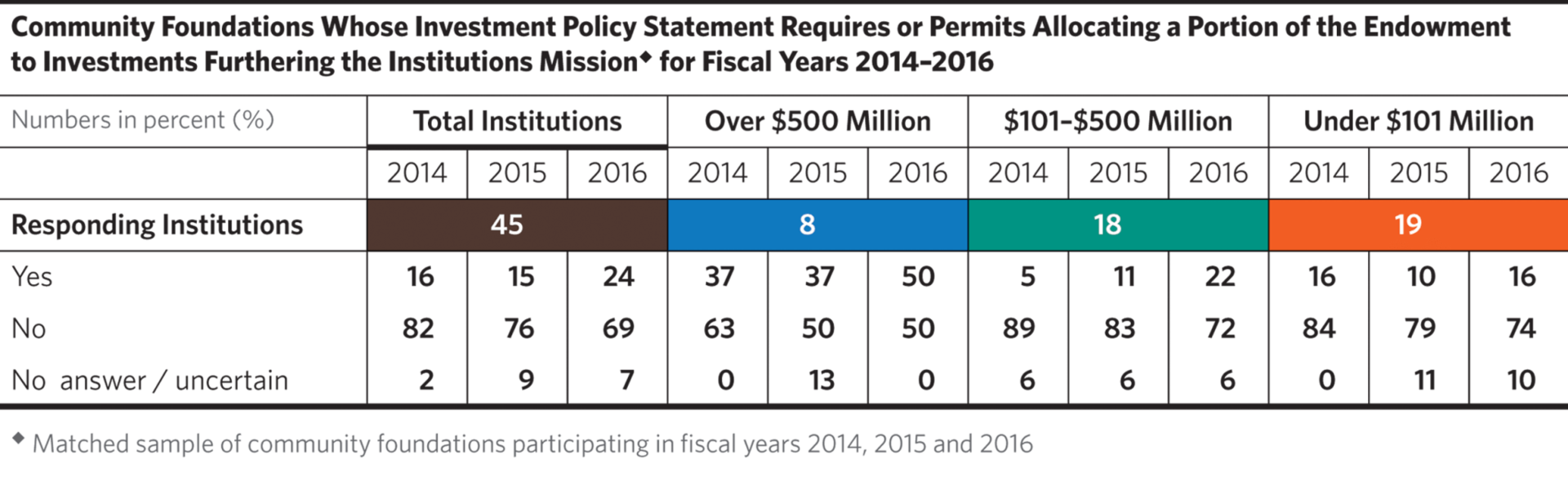

Impact Investing

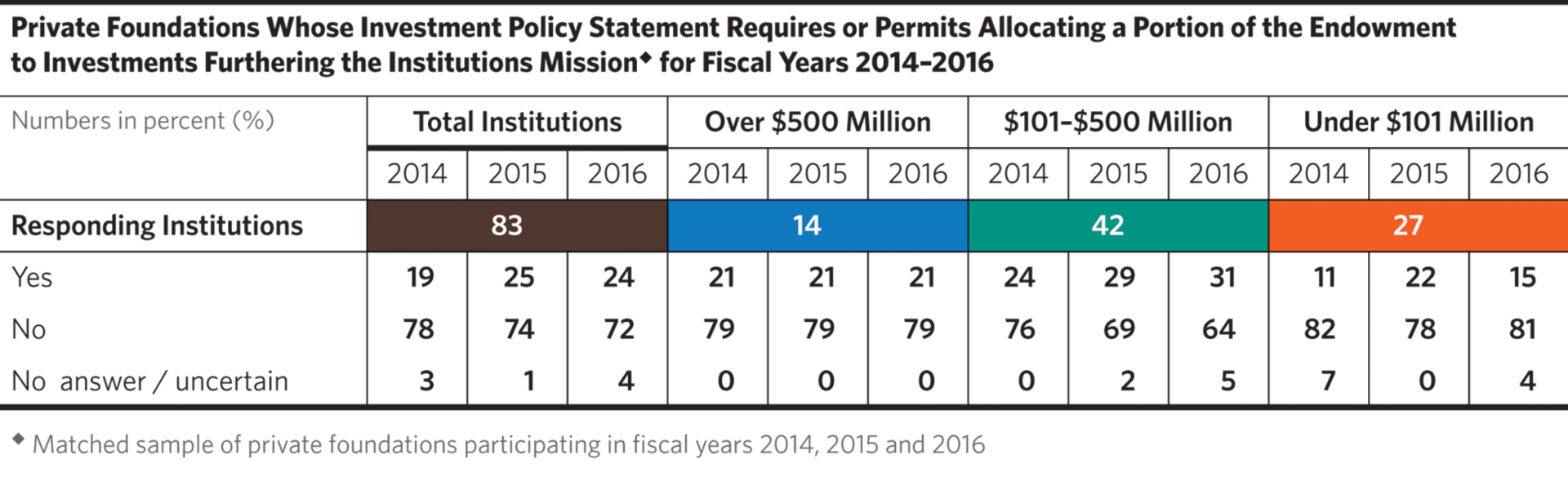

Turning now to the third responsible investing category, we find that there has been an overall increase in the use of impact investing by both private and community foundations over the last three years. This expansion is particularly notable among private foundations with assets above $101 million, where between one-fifth and nearly one-third of institutions now use some type of impact investing practice.

Among community foundations, impact investing is primarily found in the largest size cohort, where those institutions with assets over $500 million practice impact investing at a higher rate than their private foundation peers.

The prevalence of larger foundations in impact investing should not be surprising. By its nature, impact investing requires detailed analysis and record-keeping to ascertain whether and to what degree the investment is meeting its non-financial, mission-related goal. Private and community foundations that are successful at impact investing frequently employ specialist staff or outside consultants to assist in these measurements, and financial resources are required to build and maintain this capability.

Conclusion

The growth of responsible investing practices over the last several years has not been uniform among the various sizes and types of foundation that participate in the CCSF. In general, larger foundations seem more inclined to use these practices, an observation that may be primarily a result of their having more analytical and administrative resources at their disposal than their smaller peers.

Looking ahead, it would seem that while the use of SRI practices may remain fairly stable, the use of ESG could continue to grow as better data become available. As for impact investing, its use by larger foundations may enable the establishment of standards and processes that assist smaller foundations in being able to engage in this practice while performing the measurement and analysis that will increasingly be expected by donors and regulators.

This viewpoint appeared in the 2016 Council on Foundations–Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF) published July 2017.

- The 2014 Commonfund Study of Responsible Investing (for colleges and universities) and the 2016 Council on Foundations–Commonfund Study of Responsible Investing (for private and community foundations). Both can be downloaded at www.commonfund.org.