It’s straightforward to get an answer to that question, at least superficially: draw at random from a manager universe, build hypothetical portfolios with the selected managers, track performance, repeat thousands of times, and based on the average result, arrive at an optimal portfolio size.

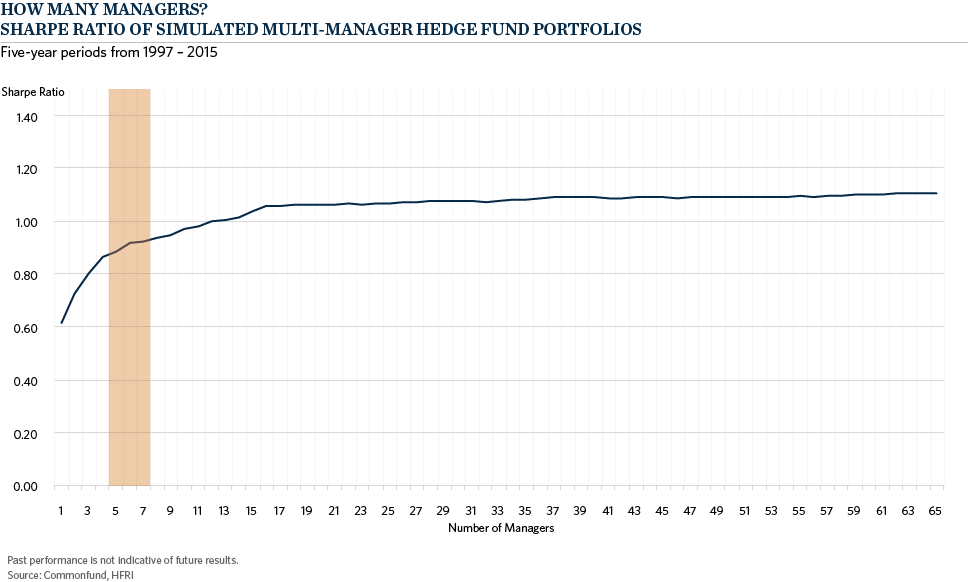

The example below is an example of such a simulation. Using HFRI universe data from 1997 to 2015, it draws five-year samples for 65 randomly selected managers at a time (restricted to only those with full track records in that time period), and estimates the Sharpe Ratio¹ of the resulting portfolios, from single-manager to the full 65. After tallying the results and charting them, it becomes clear that the answer is: “not very many.” Improvement in Sharpe tops out somewhere between 5-7 funds, and while it does continue to climb, it does so only in small increments, making a weak case for spending resources on finding and vetting new managers.

It is a powerful result, but by itself, simulation results such as these do not address what is perhaps the larger and more significant question: what is it about the hedge fund universe that makes random selection produce an answer of “not very many”? What is the answer sensitive to, and what does it suggest about the hedge fund universe that the answer is 5-7 as opposed to 10-20, or even 30-40? There are, after all, thousands of active hedge funds pursuing very different strategies.

It is a powerful result, but by itself, simulation results such as these do not address what is perhaps the larger and more significant question: what is it about the hedge fund universe that makes random selection produce an answer of “not very many”? What is the answer sensitive to, and what does it suggest about the hedge fund universe that the answer is 5-7 as opposed to 10-20, or even 30-40? There are, after all, thousands of active hedge funds pursuing very different strategies.

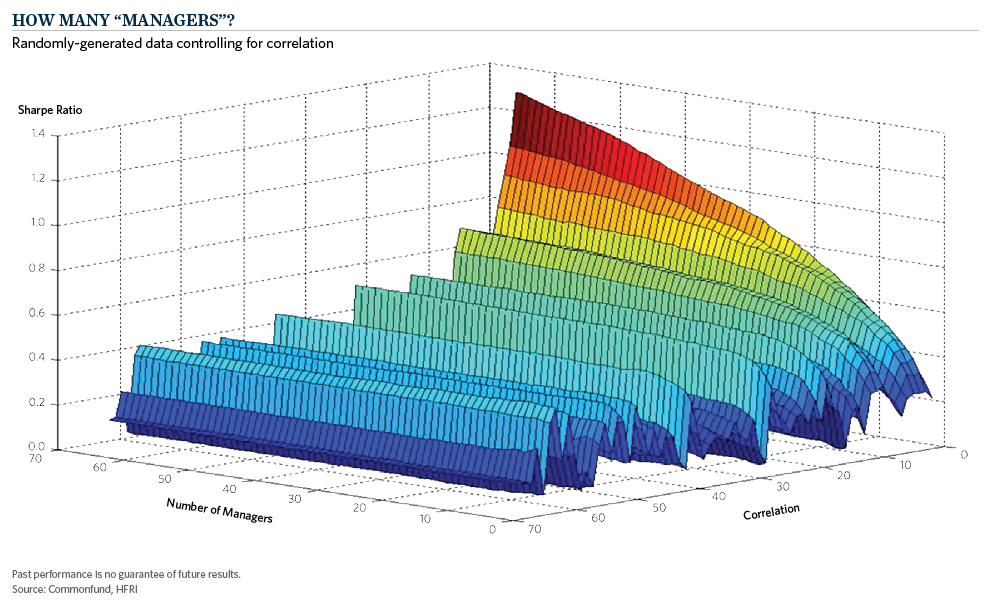

Consider the surface diagram below, a parallel experiment conducted this time on a hypothetical universe of returns; this time, they are randomly generated, but given the same means and standard deviations as managers in the real hedge fund world, but with controlled correlation. In other words, we can see how the shape of the “how many managers” arc changes along with correlation. As correlation along the x axis climbs from 0 to 1, the arc flat-lines, but at zero correlation, the line continues to climb through 70 managers.

The “how many managers” question is sensitive, then, to the correlation and commonality of risk of the underlying manager universe.

The “how many managers” question is sensitive, then, to the correlation and commonality of risk of the underlying manager universe.

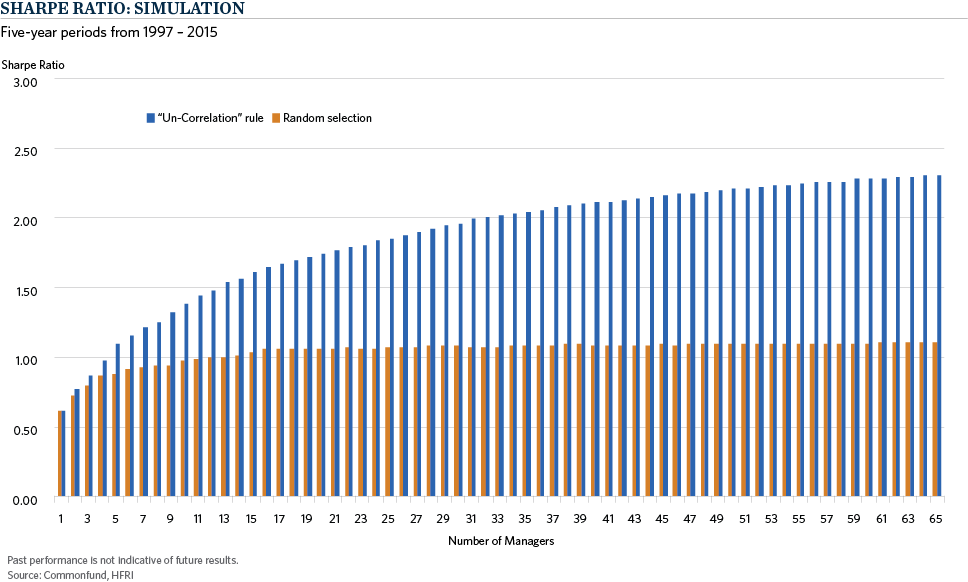

What if we return to the real world, and repeat the simulation, but this time instead of selecting randomly, we impose constraints on the random selection rule? While we cannot control correlation of returns in the real world, we can control the correlation of managers we add to our simulated portfolios.

In other words, if we use an “un-correlated” rule to add managers, in effect maximizing the aggregate diversification of the pro forma portfolio, and isolating the hypothetical large part of the curve, the results are quite different. Notably, it looks much more like the zero-correlation section of the surface diagram.

How do we consider the contrast in these two results? The randomly selected model suggests that there is a commonality of risk that essentially nullifies diversification benefit of adding hedge funds at random past a handful of managers. Return commonality is a hazard of hedge fund investing. The uncorrelated experiment, however, gives a much more robust picture of the hedge fund universe as a resource for potential diversification.

¹Sharpe Ratio: A risk-adjusted measure, calculated using standard deviation and excess return to determine reward per unit of risk. A greater Sharpe Ratio indicates better historical risk-adjusted performance.

¹Sharpe Ratio: A risk-adjusted measure, calculated using standard deviation and excess return to determine reward per unit of risk. A greater Sharpe Ratio indicates better historical risk-adjusted performance.