In just two years Commonfund will celebrate its 50th anniversary as a non-profit investment manager for educational endowments, foundations and other tax-exempt investors. Throughout those almost five decades, Commonfund has pursued a singular mission – to enhance the financial resources of our clients by delivering exceptional performance, service and insight. Beyond our focus on investment excellence, we have also shared our clients’ dedication to addressing the social, economic and environmental challenges of our time.

This past year Commonfund released its first Corporate Responsibility Report. In it, we provide a view into the work being done across all aspects of our business to further incorporate responsible and sustainable practices. As part of our commitment to sustainability, we made our annual client conference, Commonfund Forum, a carbon neutral event for the first time in 2019. View our Certificate of Climate Protection.

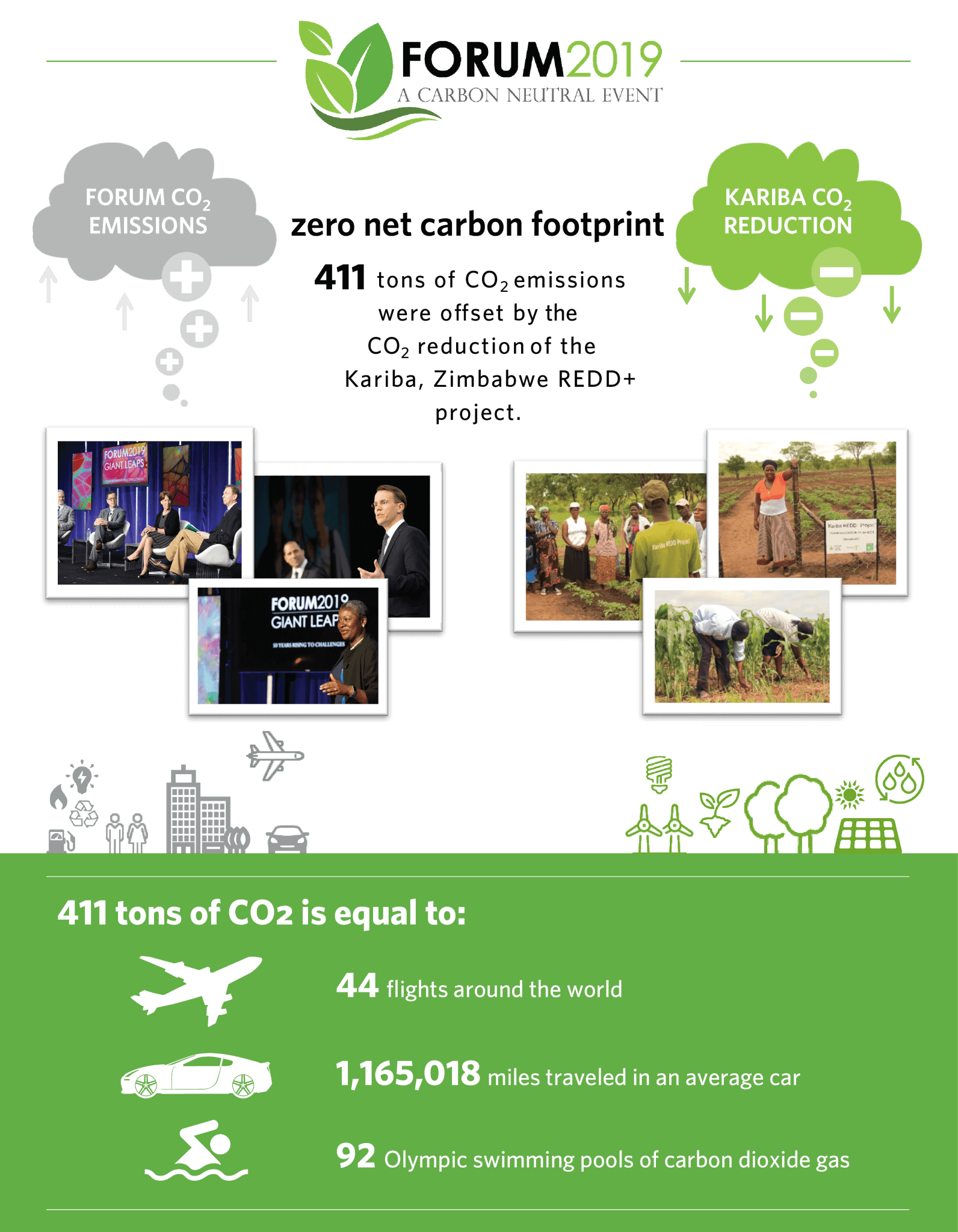

We engaged a carbon finance consulting firm, the South Pole group, to work with us on this project. They provided the accounting and audit services to measure our carbon footprint – everything from travel emissions to air conditioning and the food we ate – was included. The conference generated 411 tons of carbon. We, in turn, purchased carbon credits which are funding an exciting project – Kariba REDD+ in Zimbabwe, Africa. The funding will reduce carbon output by an equal amount, thereby making Forum net zero emissions. As a bonus, the project aligns with 9 of the 17 Sustainable Development Goals outlined by the United Nations and we are very proud to be contributing to it. We thank all of our clients and guests for joining us at Forum this year and for supporting the project, too.

Visit our Commonfund website today to learn more about responsible investing.