The inclusion of diverse managers in institutional portfolios offers access to a broader array of investment talent. Data indicate that foundations are beginning to recognize and act on this opportunity.

Diversification is the bedrock on which investors build their portfolios. Now another kind of diversification is emerging as a complementary principle. In the 2020 Council on Foundations—Commonfund Study of Foundations (CCSF), data show that foundations are beginning to reflect the growing interest in the investment industry to invest through diverse managers.

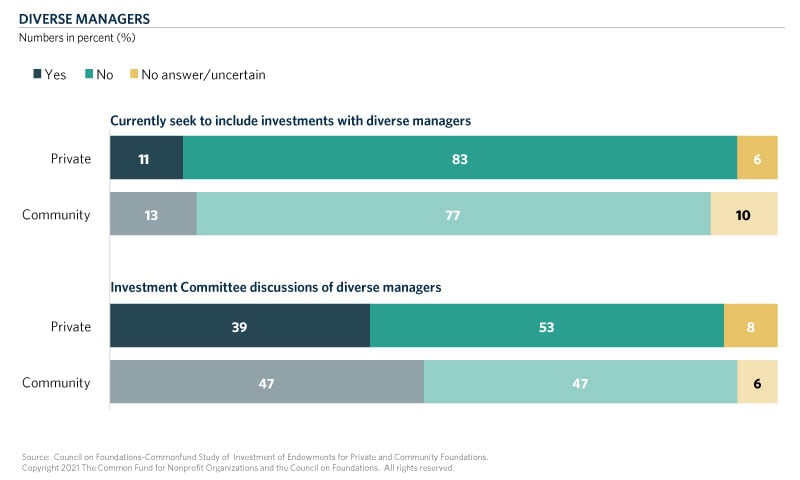

Community foundation data, in particular, showed a strong move in the direction of hiring diverse investment management firms. Thirteen percent of these foundations sought to include diverse managers, up from eight percent two years ago. Progress was slower on the private foundations side, where 11 percent said they seek out diverse managers compared to 10 percent in 2018. On this point, the rate of change is more impressive among the largest participating foundations. Here, 36 percent of community foundations with assets over $500 million sought to invest with diverse managers, more than twice the 2018 rate of 17 percent. Twenty-four percent of the largest private foundation sought to invest with diverse managers, up from 19 percent. Eleven percent of community foundations in the next largest category, those with assets between $101 and $500 million, sought diverse managers, nearly tripling the four percent of two years ago.

Diverse Managers in IC Discussions and Considerations for Inclusion in IPS

Diverse managers as a topic of investment committee discussion grew significantly over the two-year period, reaching 39 percent of private foundations compared with 20 percent in 2018 and 47 percent of community foundations versus 37 percent two years ago.

Adding diverse managers to the IPS in the next 12 months is under consideration for 24 percent of private foundations, well ahead of 13 percent in 2018, while 27 percent of community foundations are considering adding diverse managers, well over double 2018’s 12 percent. Survey responses showed that participating private foundations invest an average of 8 percent of their endowment with diverse managers; the data set for community foundations was too small to be included in the Study.

Asked about how they categorize diverse managers, an overwhelming majority of foundations of both types cited African American, Asian, Latin, Native American and women. Forty percent of private foundations and 55 percent of community foundations cited disabled. Twenty percent of private foundations and 45 percent of community foundations also cited veterans.

Another question involved defining ownership of a diverse manager firm. Forty-five percent of private foundations and 73 percent of community foundations defined it as being majority owned by women or a minority group. For 10 percent of private foundations, they defined it as having a majority of staff members being women or minorities. (No community foundation replied to this part of the question.) A significant share of foundations of both types cited “Other” (35 percent of private foundations and 27 percent of community foundations).

Conclusion

Responsible investing continues to evolve and along with it so does one of its key components, investing with diverse managers. A recent survey of diverse manager initiatives found that more than 50 percent of institutions surveyed noted “some level of interest and increased engagement with diverse managers” (Aon Institutional Investor Study: Diverse Investment Initiatives, 2021). The most important step will be converting interest into action. Future CCSF data will serve as one measure of progress among foundations in this area.

Commonfund partners with the Council on Foundations to create the Council on Foundations—Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF). The CCSF annual report studies, on average, nearly 300 private and community foundations that represent over $100 billion in assets.