Climate change is a source of concern around the world—from environmental scientists to government policymakers to ordinary citizens. In a more figurative sense, the climate for responsible investing appears to be changing at foundations—and in a more promising way.

The Council on Foundations—Commonfund Study of Foundations (CCSF) has included data on and analysis of foundations’ responsible investing policies and practices for as long as the Council on Foundations and Commonfund Institute have teamed to produce it, and before that in Commonfund Benchmarks Studies of Foundations. Owing to the time demands that the global pandemic placed on foundation trustees and staff members we did not include a suite of questions on this topic in last year’s Study. This year, we return to responsible investing—and find that after two years the data show far more change than we have detected in previous periods.

We believe this change—and what it may portend for the future—demands heightened attention and have published a blog specifically on the diverse manager data collected from the Study.

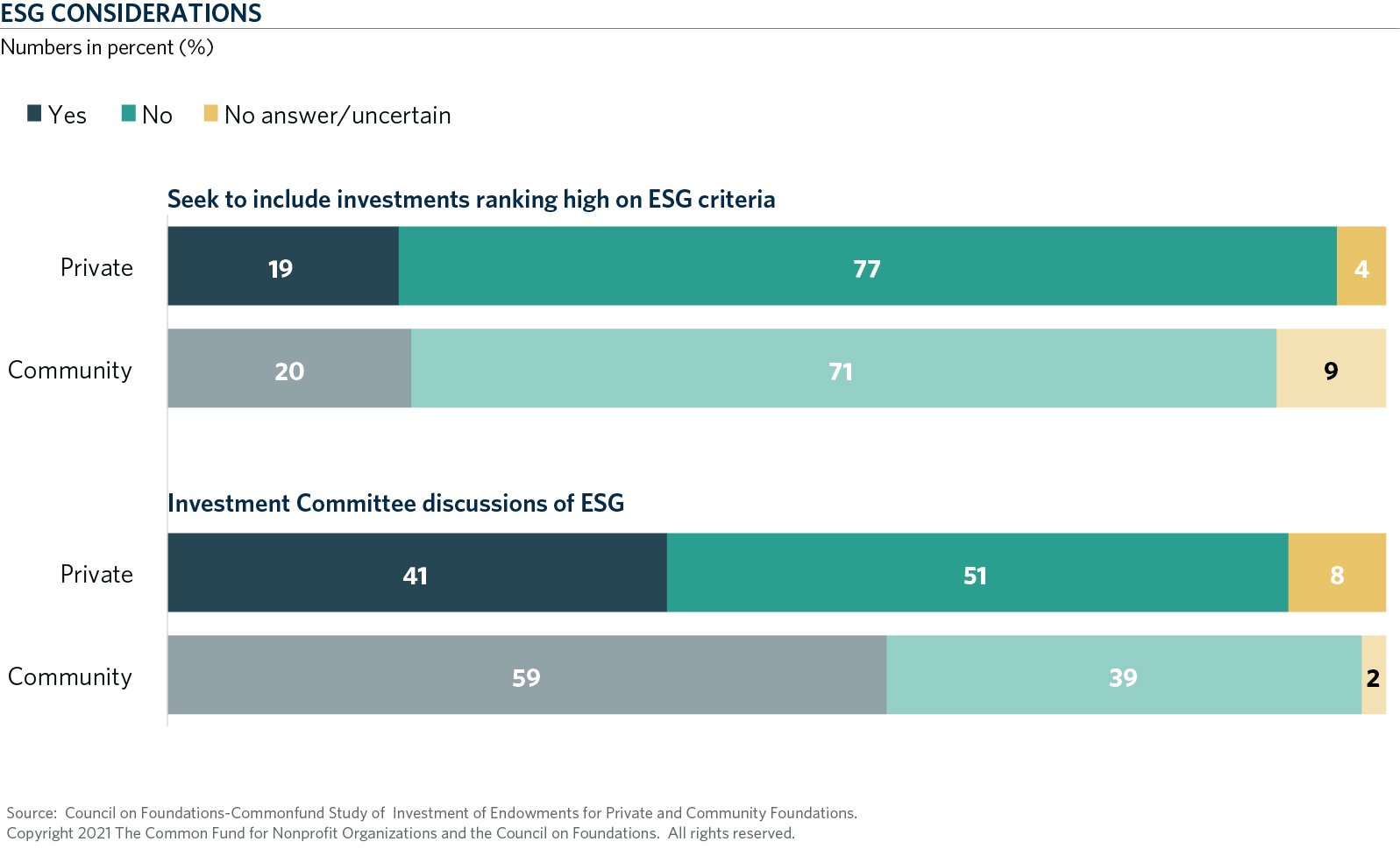

The primary takeaway: The data show clear increases in the rates of adoption for various responsible investing practices. For example, in this year’s Study 19 percent of participating private foundations said they seek to include investments ranking high on environmental, social and governance (ESG) criteria versus the 14 percent that said so in 2018—an increase of more than one-third. The rate of ESG adoption showed no progress at community foundations, but no reversal either as it held steady at 20 percent.

The practice of screening out or excluding investments that are inconsistent with a foundation’s mission—generally referred to as socially responsible investing, or SRI—showed even greater growth among private foundations. Twenty percent of these foundations require/permit this practice, well ahead of 12 percent in 2018. Once again, progress did not show up among community foundations, where the rate of adoption declined one percentage point to 12 percent.

Allocating a portion of a foundation’s endowment to investment that further the institution’s mission made little to no progress since 2018. Fifteen percent of private foundations implemented this practice, up just one percentage point, while 12 percent of community foundations do, representing a retreat from 16 percent in 2018.

Among the size/type categories, the data show no clear pattern. In some instances, there are dramatic gains; for example, among private foundations with assets between $101 and $500 million:

- Those seeking to invest according to ESG criteria rose to 13 percent from 7 percent

- Those seeking to practice SRI rose to 12 percent from 5 percent

- Those seeking to allocate a portion of their endowment to furthering mission rose to 15 percent from 10 percent.

In some cases, the data showed no change; importantly, however, nowhere were there significant reversals of direction from the levels of two years ago.

More Foundations Discussed Responsible Investing in 2020

Reflecting the growth seen since 2018, more investment committees discussed these approaches to responsible investing in 2020. Forty-one percent of private foundation investment committees discussed ESG in 2020 versus just 27 percent in 2018. Fifty-nine percent of community foundations held similar discussion, well ahead of 2018’s 37 percent.

The numbers were less impressive for SRI discussions, but represented growth nevertheless. Twenty-eight percent of private foundations discussed SRI versus 26 percent two years ago while 49 percent of community foundations did so, up from 44 percent.

Impact investing showed little movement. Forty percent of investment committee held discussions on this topic in 2020, up one percentage point, while 52 percent of community foundations did so, a slippage of two percentage points.

Adoption Rates Appear Favorable Over Next 12 Months

Looking ahead, data suggest the climate should be more welcoming in the next 12 months. Seventeen percent of private foundations said they were considering adding ESG to their IPS in the next 12 months, more than double 2018’s 8 percent. Similarly, community foundation responses indicated more than a doubling of the 2018 rate from 14 percent to 29 percent.

SRI responses showed less movement: a decline in the anticipated rate of adoption to 9 percent from 10 percent among private foundations and modest growth to 18 percent from 16 percent among community foundations. Data portend the potential for more rapid growth for impact investing. Twenty-three percent of private foundations and 26 percent of community foundations said they will consider adding impact investing to their IPS in the next 12 months, up from respective rates of 16 percent and 15 percent in 2018.

Fossil Fuel Divestment: Actions and Motivations

Divestment of fossil fuel investments has raised controversy from time to time in recent years, particularly on college campuses. Although hardly a groundswell, there has been some movement on the part of foundations. Investments in fossil fuels generally take one of two forms: publicly traded securities or private investments. Actions by foundations participating in the 2020 Study are fairly similar, regardless of whether the investment is public or private. For instance, 10 percent of private foundations said they are divesting certain publicly traded fossil fuel investments, up from 6 percent in 2018. Similarly, 10 percent of participating private foundations said they were divesting their private fossil fuel investments, up from 2018’s 5 percent. Figures were lower among community foundations. Two percent said they have divested their public investments in fossil fuels, up from 1 percent in 2018, while 4 percent said they divested their private investments, also up from 1 percent.

In a related question, we inquired about motivating factors behind the decision to divest from fossil fuels. Forty-four percent of responding private institutions said it was an economic decision while 68 percent said it was an ethical one. Twenty percent said it had some other basis. (Multiple responses were allowed; there were not sufficient community foundation replies to permit reliable analysis.)

Responsible Investing Considered When Hiring Managers

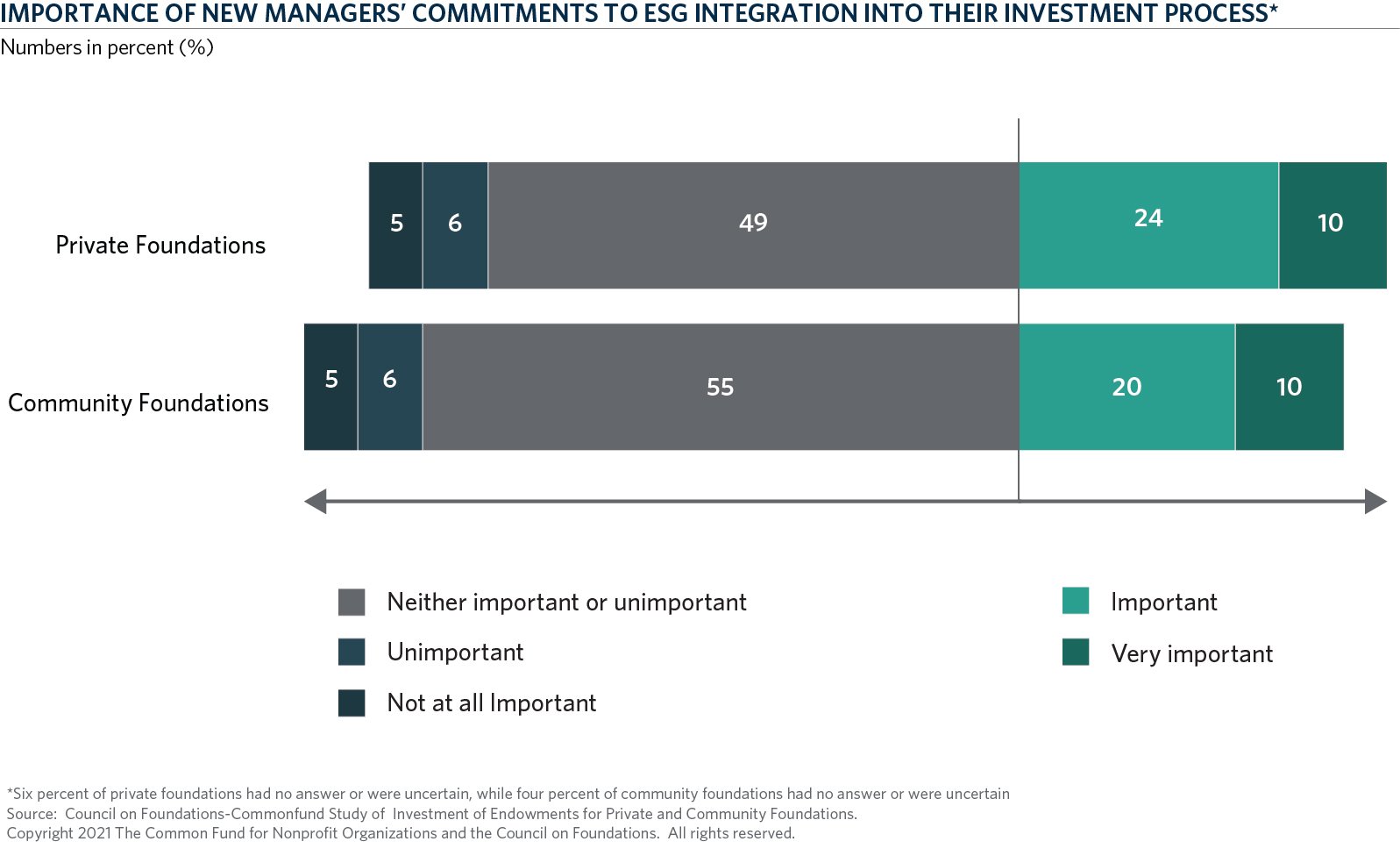

Another indication of future intent insofar as responsible investing is concerned is foundations’ hiring of new managers. We wanted to know how important new managers’ commitment to ESG is in the manager hiring process. Overall, 34 percent of private foundations said it is important or very important versus the 22 percent with a similar response two years ago. Eleven percent said it was not at all important or unimportant, down from 18 percent in 2018. Turning to community foundations, 30 percent said it was important or very important compared with 14 percent in 2018. Like private foundations, 11 percent of community foundations said it was not at all important or unimportant compared with 18 percent in 2018.

Responsible Investing Playing Larger Role in Portfolios

We also asked about the share of endowments represented by responsible investing practices. Private foundations said an average of 39 percent of their endowment was invested according to ESG criteria, while 23 percent of community foundations’ endowment was so invested. Private foundations said that 34 percent of their endowment was invested consistent with SRI principles, 5 percent consistent with impact investing and 8 percent in diverse managers. (Multiple answers were allowed; community foundation responses were too small to analyze except for the ESG response.)

Conclusion

Data indicate that responsible investing is growing and gathering momentum among foundations participating in this year’s CCSF. Looking back at previous Studies, in fact, it has been that way for five-plus years. But it is important to note that growth rates have been uneven and trends in three principal forms of responsible investing are very different:

- ESG is being practiced with greater frequency.

- The rate of adoption of SRI has tended to stay level or grow moderately.

- Implementation rates for impact investing have been declining.

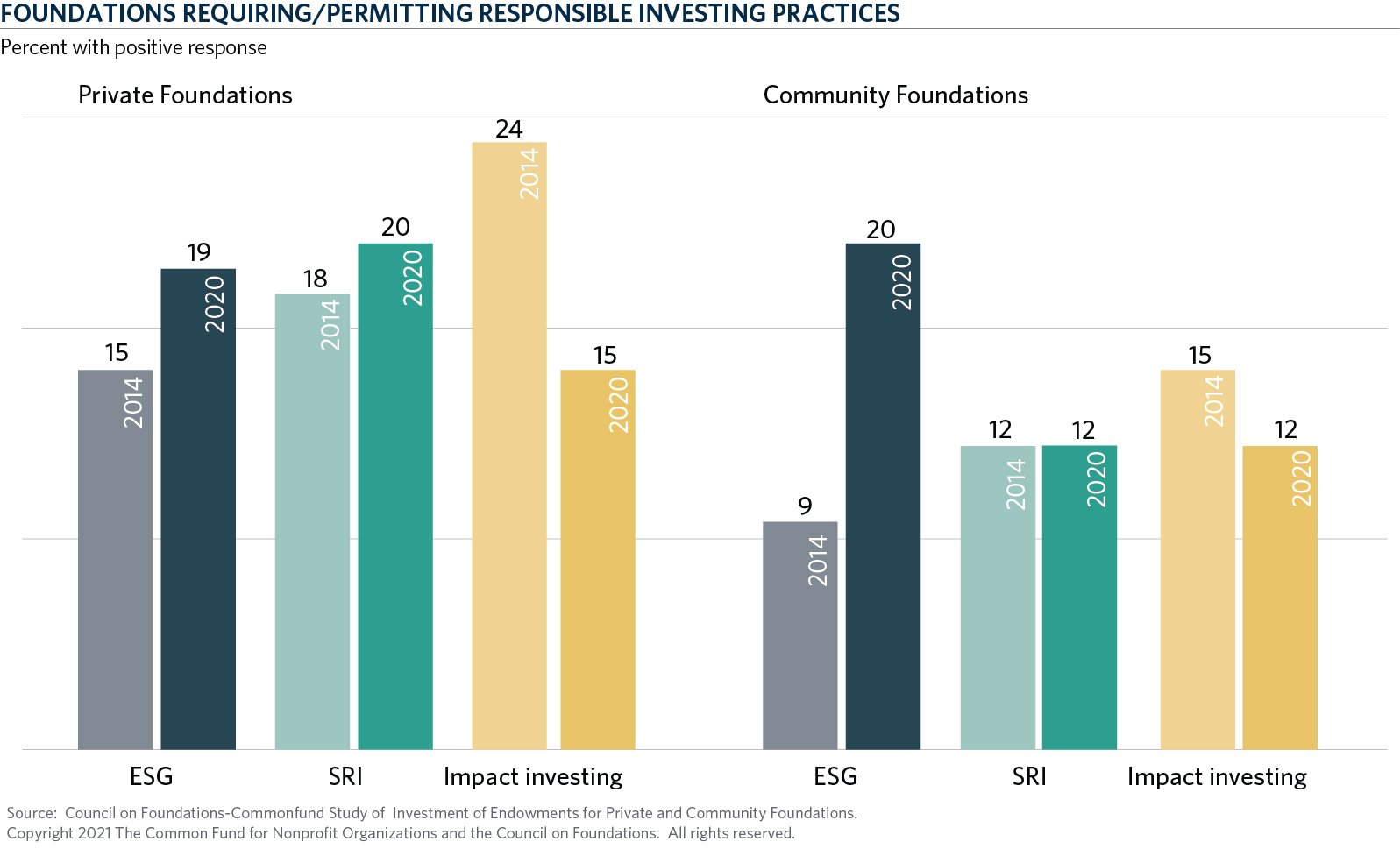

To these points, the Study for 2014 was the earliest to ask the question about currently required/permitted responsible investing practices worded in such a way as to allow comparison to the 2020 Study. The findings are shown in the following chart.

This chart shows that ESG has grown moderately among private foundations, but more than doubled the rate with which it is permitted or required among community foundations. SRI reflects modest growth among foundations of both types. Impact investing, on the other hand, has declined, especially among private foundations.

When breaking the data into size/type cohorts, ESG shows strong growth among the largest and smallest foundations. Among foundations with assets over $500 million, the 2020 figure is 24 percent requiring or permitting it, up from 16 percent in 2014; among community foundations of the same size, the 2020 figure is 18 percent, up from 9 percent. Turning to foundations with assets under $101 million, 26 percent of private foundations now permit or require it, up from 16 percent in 2014; among community foundations, corresponding figures are 19 percent and 7 percent. Only among private foundations with assets between $101 and $500 million did the rate of adoption decline, to 13 percent in 2020 from 14 percent in 2014.

SRI showed a clear decline in required/permitted rates among the largest foundations, falling to 24 percent from 32 percent among private foundations and to 18 percent from 36 percent among corresponding community foundations. On the other hand, it showed moderate growth among foundations with assets under $101 million and mixed rates of adoption among the mid-sized group.

Rates at which impact investing is required or permitted declined across the size/type spectrum except for private foundations with assets under $101 million, where it was unchanged.

An important note: Changes over the period between 2014 and 2020 do not graph in a straight line as rates of adoption may rise or fall moderately (or stay level) from year to year. But viewed over time, the trend comes into focus.

ESG is the “youngest” of these three approaches and the one that is evolving most rapidly. Earlier challenges are being addressed, for example, the relative lack of standards and consistent data. But institutional investors increasingly appear to agree that good governance, a commitment to sustainability and recognition of stakeholders’ interests are major factors in companies’ long-term prospects.

Commonfund partners with the Council on Foundations to create the Council on Foundations—Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF). The CCSF annual report studies, on average, nearly 300 private and community foundations that represent over $100 billion in assets.