Impact investing is showing growth around the world. According to the most recent J.P. Morgan/Global Impact Investing Network Impact Investor Survey, the number of institutional investors engaging in meaningful impact investing (committing $10 million or more to impact investments) increased by 26 percent in 2014, and the amount such investors planned to commit to impact investments was projected to increase by 19 percent to $12.7 billion in 2014 from $10.6 billion in 2013.

Yet, even with this increased focus on impact investing there is still confusion about how to implement the strategy. Similar to other responsible investing strategies, such as socially responsible investing (SRI) and environmental, social and governance (ESG) integration, there is a range of approaches to implementing impact investing, and interested investors need to identify which method best fits their institution’s particular goals.

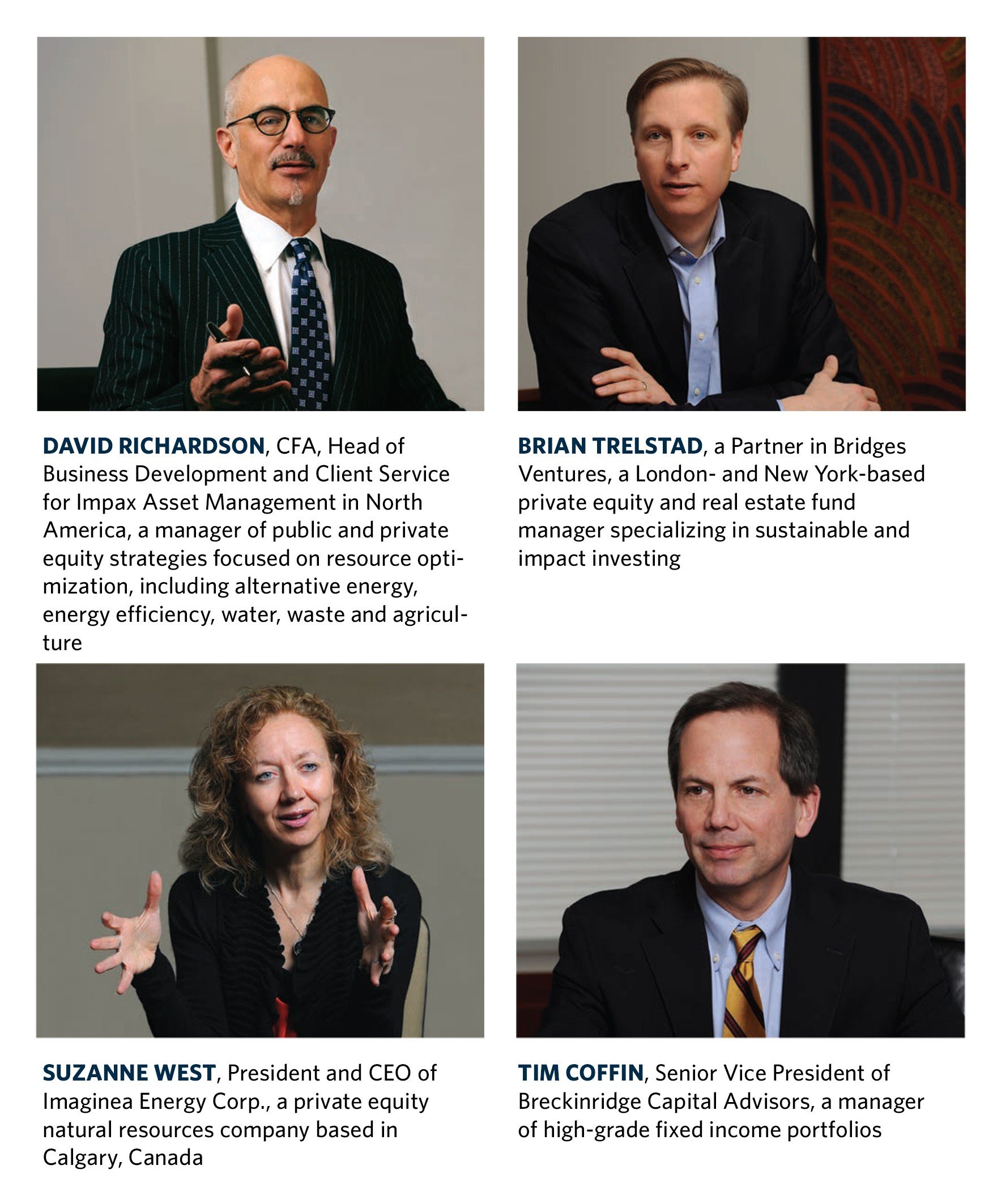

To provide a closer look at the different impact investing strategies being implemented today, Commonfund recently convened a roundtable exchange among four investment managers as a forum for them to discuss their impact investing practices. The roundtable shows that investors contemplating a commitment to impact investing have a wide range of investment styles and strategies from which to choose, affording them the ability to assemble a diversified portfolio.

The roundtable participants are:

The roundtable was moderated by LAUREN CAPLAN, former Commonfund Assistant General Counsel and ESG Policy Officer and Commonfund Managing Director PAUL VON STEENBURG, CFA. Excerpts from the panelists’ exchange follow:

LAUREN CAPLAN: WE SEE A LOT OF CONFUSION ABOUT IMPACT INVESTING AS A WHOLE AND THE STRATEGIES BEING USED WITHIN THE IMPACT INVESTING SPACE ITSELF. SO, WE WANT TO START BY ASKING HOW YOU DEFINE IMPACT INVESTING. IS IT A STRATEGY OR A SEPARATE ASSET CLASS OR SOMETHING THAT IS IMPLEMENTED ACROSS ASSET CLASSES?

BRIAN TRELSTAD: We view it as a strategy with multiple asset classes as opposed to an asset class itself. We focus on sustainability and societal impact in both growth equity and real estate, for example, and we’ve developed what we call an “impact-driven” approach to select and engage with our investments. That means focusing on opportunities across asset classes where investments can generate attractive returns by helping to meet pressing social or environmental challenges. To us, impact investing means deliberately deploying capital to solve a problem. So, in addition to using ESG criteria to assess how a business operates, we are focused on what it does to address a societal challenge.

DAVID RICHARDSON: I would agree. Some investors primarily focus on doing good and then doing well, while other investors believe there is an opportunity to do well by doing good—reversing the two. Impax’ focus is on market rate or above-market rate returns from investing in future opportunities as the world evolves and not focusing on investing in the status quo. There is a wide range of investment opportunities in resource optimization—in emerging technologies and companies that target a far more sustainable environment and economy, meaning that there is a way to do good and earn a strong return.

SUZANNE WEST: Here in North America and across the world there are a lot of energy companies that have big corporate social responsibility programs. The challenge, in my mind, is that they are doing this under the banner of “should,” which, ironically, means it might not be sustainable. What we are trying to do at Imaginea is create a new way of thinking that makes sustainability part of the fabric of our business…like when you wake up you don’t think about breathing, you just do it. If you make it part of your business and think of it as an opportunity rather than a cost, the possibilities that are showing up for us in this space are shockingly good. The magic of “and” is that both get better.

TIM COFFIN: At Breckinridge, we are a mainstream, high-grade fixed income manager. The foundation of our investment philosophy is preservation of capital, reliable and predictable cash flows, and improved risk-adjusted returns through security selection and common sense active management. What we recognize is that by integrating ESG factors in a formal and very measurable way into our credit analysis we can add to the predictability and reliability of cash flows by addressing dormant liabilities that aren’t addressed in traditional fundamental value analysis alone.

PAUL VON STEENBURG: GOOD RESPONSES, ALL. CAN EACH OF YOU TOUCH UPON THE FACTORS THAT LED TO THE EMERGENCE OF YOUR PARTICULAR STYLE OF IMPACT INVESTING?

WEST: My epiphany was the realization that energy is a huge part of peoples’ standard of living and raising the standard of living is one of the best solutions we have to address really big problems like food and clean water. Energy is actually part of the solution—we have the potential to be such a force for good. Too often in my industry, however, parties are relegated to being either tree huggers or greedy capitalists. As an entrepreneur, it occurs to me that we are missing all the amazing space in between, which has the potential to make the pie bigger for everyone.

— Suzanne West, Imaginea Energy Corp.

TRELSTAD: The vision of Bridges has always been that there is a huge opportunity for market-based solutions to pressing social and environmental challenges. In the last 12 years, we’ve been able to prove that it’s possible to identify businesses that are growing precisely because they’re addressing some of these huge societal issues.

Both as individuals and as a firm we are deeply driven by a sense of mission. Our view is that an impact-driven approach is crucial to building great businesses and delivering superior financial returns. It’s what motivates us as a team—and it also helps us to identify investment opportunities that others might overlook.

COFFIN: We believe that the history of responsible investing has largely been written in the equity market because a lot of it is based on negative screening and shareholder actions. From our perspective, ESG is a natural fit for the credit market as a risk issue, and we think it will become very widely employed in the credit market because of an increasing focus on effective pricing of long-term risk. A factor helping drive the interest is the increase in data availability. The more we study sustainable investing and the demand for it, the more we realize how much data has come online in the last five or six years. The evolution of data providers—Bloomberg, MSCI Sustainalytics and others—gives us the opportunity to perform analysis that is reliable from sector to sector.

VON STEENBURG: DAVID, MAYBE YOU CAN TELL US ABOUT THE EMERGENCE OF IMPAX AND ITS STYLE OF INVESTING.

RICHARDSON: Sixteen years ago Impax saw a high growth opportunity in addressing resource demand—not through more supply but, instead, through resource optimization. So, Impax started by defining an investment universe that, when we began, had 250 companies involved in resource optimization. Now, 16 years later, in our four sectors of interest—energy, water, resource recovery, and food and agriculture—we find that there are about 1,500 companies involved in these markets, and their earnings growth rate is about 150 percent of the broader global equity markets.

CAPLAN: LET'S GET INTO IMPLEMENTING IMPACT INVESTING AND TALK ABOUT WHETHER YOUR INVESTMENT APPROACH DIFFERS WHEN YOU ARE DOING IMPACT INVESTMENTS VERSUS YOUR TRADITIONAL INVESTMENTS IN TERMS OF HOLDING PERIODS, DIFFERENT LEVELS OF ENGAGEMENT AND DIFFERENT RISK PROFILES. TIM, DO YOU WANT TO START US OFF ON THIS ONE?

COFFIN: We integrate sustainability in our overall investment process, so the securities we follow are assigned a rating for credit quality and risk as well as a sustainability rating. Because we have these ESG ratings on our holdings, portfolios can be constructed with credits that get scored above the median—a top 50 percent of our sustainability scoring—and go into a best-in-class sustainable strategy that appeals to first movers in the space. These institutions typically have been environmental foundations, private foundations and similar organizations. These ratings also help with tailoring separate accounts because a lot of these portfolios come with customization requests.

COFFIN: We integrate sustainability in our overall investment process, so the securities we follow are assigned a rating for credit quality and risk as well as a sustainability rating. Because we have these ESG ratings on our holdings, portfolios can be constructed with credits that get scored above the median—a top 50 percent of our sustainability scoring—and go into a best-in-class sustainable strategy that appeals to first movers in the space. These institutions typically have been environmental foundations, private foundations and similar organizations. These ratings also help with tailoring separate accounts because a lot of these portfolios come with customization requests.

In terms of engaging with our investments, as bond holders we don’t get a vote but we are part of the capital structure, so we started an engagement program in 2013 in which we reached out to our larger holdings to discuss the business materiality of their sustainability initiatives.

CAPLAN: DAVID, CAN YOU TALK ABOUT THAT SAME QUESTION AND HOW YOU THINK ABOUT DIFFERENT SECTORS AND INDUSTRIES, AND WHETHER YOU HAD TO REALIGN THOSE CATEGORIES IN YOUR THOUGHT PROCESS?

RICHARDSON: Incorporating ESG research is core to our investment process; we only manage money one way. It doesn’t affect what we do, it is what we do. In terms of how we think about each of the four broad sectors of our investment universe, we evaluate all investment opportunities through the lens of a capitalist and recognize that there are times when various areas—however good their long-term prospects are likely to be—go through short-term periods of challenge. An example would be solar panel manufacturers, which are in our investment universe, but which have gone through periods of boom and bust, some of which have been greatly influenced by changing regulations and policy.

CAPLAN: SUZANNE, CAN YOU TOUCH ON HOW YOU LOOK FOR THAT “AND” HOW SPECIFICALLY YOU ENSURE THAT THE IMPACT COMPONENT IS PART OF THE INVESTMENT YOU ARE MAKING?

CAPLAN: SUZANNE, CAN YOU TOUCH ON HOW YOU LOOK FOR THAT “AND” HOW SPECIFICALLY YOU ENSURE THAT THE IMPACT COMPONENT IS PART OF THE INVESTMENT YOU ARE MAKING?

WEST: The challenge for the “and” is that it is mostly an intuitive solution, not an empirical one. There is no formula. It’s going through a pros-and-cons process and testing your assumptions. Could we make more profit? Could we be more sustainable? It’s testing both sides to make sure you’ve honored both. At the end of the day, that is what “and” is about. “And” is not prescriptive. It doesn’t have to be perfect. “And” doesn’t mean you have no environmental impact. “And” could mean lower, but still good profits. It means that you are honoring being profitable and honoring lessening your impact.

CAPLAN: BRIAN, CAN YOU DISCUSS THIS QUESTION AND ALSO MAYBE A LITTLE BIT ABOUT HOW YOU LOOK AT THE UNIVERSE OF OPPORTUNITIES YOU INVEST IN?

TRELSTAD: We’ve always been of the view that using an impact-driven approach can create superior returns for both investors and society as a whole. We use impact as a lens to select and engage with all our investments—because we believe this allows us to spot opportunities that others might miss and thus pick potential winners for our portfolio.

We start by focusing on our three core themes—education, healthcare and sustainable living. This means we develop a deep understanding of the structural issues inherent in each one, helping us recognize which business models have the most potential impact and in which context.

VON STEENBURG: Many investors are concerned that esg or impact investing strategies are constrained and will therefore lead to below-market returns. Can each of you talk about what returns, specifically, you are looking for and what risks you will accept?

RICHARDSON: We are seeking to outperform global markets by 2 percent-plus over an intermediate time horizon with similar levels of absolute risk. Some of our clients are also interested in not only measuring financial returns, but also the environmental benefits of their investments. It is an evolving process to be able to evaluate and measure things like carbon emissions and reductions; clean water created or treated; tons of hazardous waste cleaned up and materials recycled—things like that.

RICHARDSON: We are seeking to outperform global markets by 2 percent-plus over an intermediate time horizon with similar levels of absolute risk. Some of our clients are also interested in not only measuring financial returns, but also the environmental benefits of their investments. It is an evolving process to be able to evaluate and measure things like carbon emissions and reductions; clean water created or treated; tons of hazardous waste cleaned up and materials recycled—things like that.

One of the challenges this industry has is adopting a methodology that actually gets to the right number. We invest, for instance, in companies that make high quality insulation and they have a gross carbon footprint from that manufacturing process. But, the net number, including the reduction in carbon emissions by using their insulation, is what’s important.

WEST: We are seeking a 21/2 times return on invested capital. That is slightly below what we would normally look for, which would be three times, as this is a new concept and we have risked it to represent some of the unknowns we feel are out there. But I am hoping to actually deliver more than that, as I believe we will find better ways of doing business and making profits by having this new mindset and mandate.

TRELSTAD: At an investment level, it varies from deal to deal, depending on the investment stage and level of risk. But at the fund level, we target top-quartile returns, just like our private equity and real estate peers.

— David Richardson, Impax Asset Management

COFFIN: We typically bench to the Barclays Government/Credit Indexes. We are an active fixed income manager looking to beat benchmarks and to have superior risk-adjusted returns by building and protecting income. As a high-grade manager, we aren’t always swinging for the fences. We see the value of allocating to fixed income being those times when the broader markets are dysfunctional and bond investors can still collect their coupon and principal. This, of course, enables them to better tolerate volatility than other asset classes. By including sustainability in our credit research, we believe we are adding to the reliability of those payments, thereby boosting that tolerance.

CAPLAN: AS A WRAP-UP, CAN YOU SHARE AN EXAMPLE OF AN IMPACT INVESTING SUCCESS STORY?

TRELSTAD: In response to the challenge of climate change and air pollution, we backed an entrepreneur to recommission a disused waste oil processing plant in a highly deprived part of England. With our investment, the company refurbished the plant, which now re-refines a waste product—used motor oil collected from garages—for use in the manufacture of virgin-grade lubricant oil. As the first and only re-refining plant in the U.K., this company was a compelling commercial proposition, while also generating significant environmental benefits by avoiding carbon emissions and creating 30-plus semi-skilled jobs in an area of high unemployment in the heart of England. And its success also drove highly attractive returns for our fund investors.

TRELSTAD: In response to the challenge of climate change and air pollution, we backed an entrepreneur to recommission a disused waste oil processing plant in a highly deprived part of England. With our investment, the company refurbished the plant, which now re-refines a waste product—used motor oil collected from garages—for use in the manufacture of virgin-grade lubricant oil. As the first and only re-refining plant in the U.K., this company was a compelling commercial proposition, while also generating significant environmental benefits by avoiding carbon emissions and creating 30-plus semi-skilled jobs in an area of high unemployment in the heart of England. And its success also drove highly attractive returns for our fund investors.

COFFIN: Vital public infrastructure projects are financed in the capital markets through the municipal bond market. Sustainability is a key credit consideration for local government bond issues. We believe communities typically have strong commitments to essential services, such as K-12 education, clean water and improved transportation infrastructure. For medium- to long-term investors these are considerations that may reflect a community’s ability to strengthen its fabric, since well-managed local governments look beyond immediate budgets in order to avoid future destabilizing scenarios.

RICHARDSON: Impax invests in resource optimization, or RO, namely those companies addressing resource demand through more efficient products and services. We think of this approach as sustainable capitalism.

While a number of data providers can tell you the gross amount of greenhouse gases (GHG) emitted by a company, the real question is net GHG emissions. For example, one of our longtime holdings is Tomra, a Norwegian company involved primarily in materials recycling. In 2013, Tomra’s recycling activities led to net GHG emissions avoidance totaling 20 million tons. Put another way, the sustainable activities that Tomra is involved in allowed it to avoid GHG emissions that were more than 140 times higher than GHG emissions from its own operations—a highly positive environmental impact.

WEST: We are just beginning our process of successful application of “and” solutions. One of our challenges is that, so far, there are so many ideas out there that potentially save costs and improve our environmental footprint.

We are developing processes to filter, rank and research all of these ideas so that we apply discipline to finding the ones that will be relevant and successful. One success that we have implemented so far is among the easiest “ands”—our operators don’t let their trucks idle, which is a very common practice in the oil and gas industry. It saves fuel and reduces emissions. We hope to set an example of what is possible so that others follow, which will multiply our impact.