In June 2023, the Commonfund Institute hosted 36 nonprofit leaders on the campus of Yale University for our premier educational event – the Investment Stewardship Academy (ISA). Much has changed since the last convening in 2019 – a global pandemic, a deep racial reckoning, war in Ukraine, inflationary pressures, ongoing and distressing impacts of the climate crisis, and more. At the same time, the need for fiduciaries to shepherd endowment capital into the future to support their institutions has not changed. Throughout the three-day program, external thought leaders gathered with Commonfund experts to present their most insightful thoughts on how to be the most effective stewards of long-term capital.

Participants spanned 34 institutions, 3 countries, 19 states, in addition to Washington D.C. and the Virgin Islands. The value of diversity of thought and experience was apparent throughout the program. Participants representing different types of institutions, from community foundations to nonprofit hospital systems, higher education, and holding various positions, from CFO to investment committee member to board chairs, raised questions for enlightening discussion to help all in attendance to understand the nonprofit ecosystem and all its complex, interconnected challenges.

The economic backdrop

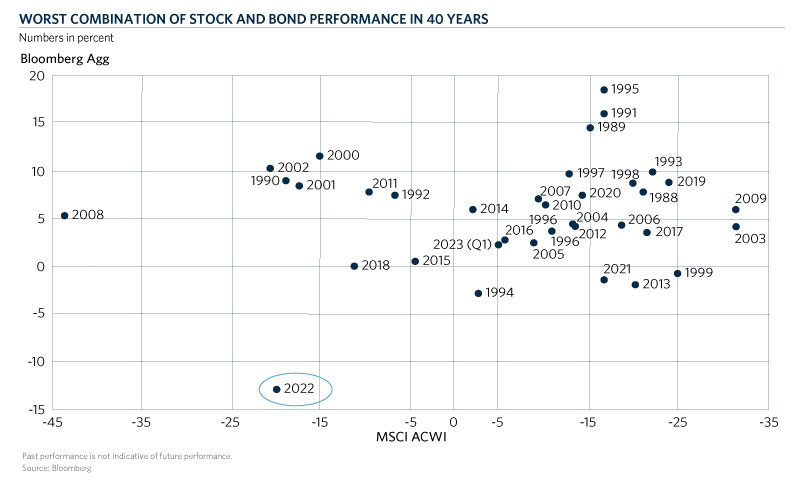

Across all institutions, one mutual challenge faced is how to grapple with the current economic and investment context. The chart below, taken from the opening session delivered by Commonfund Chief Executive Officer and Chief Investment Officer, Mark Anson, most clearly demonstrates the conundrum facing investors attending this year’s ISA. Last year was an outlier among down years, in that there was no safe haven for capital.

Furthermore, banking and geopolitical risks have added to uncertainties in 2023, and some signs, including the ongoing inverted yield curve and the federal reserve’s anticipation of pushing interest rates even higher, are pointing toward a looming recession. This context puts a finer mark on the importance of the following insights, as investment boards and committees continue to persevere and maintain adequate capital and spending to serve their institutions’ missions. Among the most important considerations in continued resilience are outlined below: asset allocation, governance, and diversity, equity and inclusion (DEI), all of which were covered in depth throughout the program.

Asset allocation

Being at Yale felt appropriate, as endowment management, especially for higher education endowments, has been led by the “Yale Model” of investment management in which alternative investments are a key driver of intergenerational equity. Data continue to bring the value of this theory to bear as there is a strong correlation between endowment performance and illiquid allocations. Data from the 2022 NACUBO-TIAA Study of Endowments presented at the Investment Stewardship Academy show that institutions with higher allocations to private assets have better returns than those with less, in every return period. For example, 1-year returns for those with more than a 20 percent allocation to private investments were -5.7 percent compared with -11.4 percent for those with less than a 20 percent allocation. Looking at the longer term, the 10-year disparity was 1.5 percentage points (7.9 percent versus 6.4 percent) and the 20-year disparity was 0.9 percentage points (7.5 percent versus 6.6 percent)1, which amount to sizeable dollar differences.

For this reason, ISA 2023 dedicated a meaningful portion of its program to exploring the current state of private equity (PE), including the challenges and opportunities in venture capital, secondaries, and real assets and sustainability. In addition to upskilling on concepts and providing market insights, presenters offered practical considerations for conducting due diligence with managers in each of these strategies. While private equity is a multi-trillion-dollar market segment, not all PE investments are created equal. There are sizeable disparities in returns between high and low performing PE managers, and access to the best and most reliable managers can be limited. Further, access can be constrained not only by networks, but also by size. Smaller institutions typically have a lesser share of assets invested in PE due to constraints in asset size, liquidity, and staff capacity. One way for resource constrained institutions to access leading PE managers (and returns) is by working with an outsourced chief investment officer (OCIO) program that can pool resources and staff capacities. As the data show, investing in alternative strategies is an important decision, but it must be right sized to fit an institution’s liquidity needs, risk profile, and willingness to lock up capital for the long term.

Governance

Having structures in place to guide decision making is critical in every market environment, but perhaps especially in downturns. These structures will look different depending on your institution. Here are some key governance considerations from this year’s ISA.

Lead with purpose

In the midst of challenging moments and trends, how do boards operate best? Monika Kalra Varma, President and CEO of BoardSource, would argue purpose-driven leadership is the best place to start. Monika, in partnership with George Suttles,2 offered a set of four guiding principles for purpose driven leadership that include centering social outcomes, respect for one’s place within the institutional ecosystem, advancing equity, and authorizing voices and power of those impacted by one’s work. And with those principles in mind, there are three core modes of board governance – oversight mode (fiduciary), strategic (planning), and generative (reflective, values orientation) – any of which can be most important depending on the specific challenge faced and goals or tasks at hand.

Proof is in the data

Purpose-driven leadership can be practiced while striving for a broader set of best practices. Research conducted by professor Chris Merker of Marquette University and colleagues have quantified best board practices, particularly with respect to investment returns. The following governance attributes are correlated with institutions that have gained top quartile returns during the 2016 to 2020 period. Most institutions with top quintile returns have the following:

- Gender and racial/ethnic diversity – most effective boards include a diverse makeup of >25% women board members and >10% board members who are people of color, with a focus on using these percentages as a floor.

- Professional qualifications – not all have to have a background in investments or finance, but some do – e.g., 25-50% of board members in top quintile institutions had a background in investments and/or accounting.

- Once per year review of investment policy statement (IPS).

- Once per year board self-assessment, and once per year board training.

- Other factors such as board size cannot be limited to a one size fits all solution, but research has shown that relatively smaller boards help with defining roles and responsibilities, increased participation, camaraderie, and ease and efficiency of decision making.

- See more measured board characteristics in the Commonfund-FGA Benchmarking Study of Governance in Higher Education here.

Policy puts purpose into practice

Across any model or leadership methodology, one of the central guiding governance practices is the creation and maintenance of an Investment Policy Statement (IPS). This living document should reflect the mission, investment goals, and strategy, including risk management and spending methodology, and offer a standing guidepost for discussion and deliberation, especially in turbulent times. As put best by Institute leadership in Commonfund’s The Investment Policy Statement white paper:

“The investment policy statement sets forth in writing the overall strategy, key guidelines and operating plan of the board of trustees for the management, investment and spending of the investment pool or endowment. It is crafted and managed based on recognized and accepted principles that are often legally binding requirements. While strategic in approach and long-term in scope, the investment policy statement (IPS) identifies parameters within which more tactical actions may be taken; moreover, it should be reviewed periodically and updated as needed. The IPS is often viewed as a shield in that it guards trustees against misguided decisions in response to short-term or transitory pressures; but it is also seen as a sword used by the board to support the fulfillment of institutional mission and adapt to changing needs and conditions through time… [and it] should be uniquely tailored to each institution’s mission, preferences, resources, culture and situation.”

Diversity, Equity and Inclusion

Foundations and endowments provide funding for institutions that serve students, communities, and causes. All capital has a societal impact, whether it is guided intentionally or otherwise. So while, as the name indicates, the Investment Stewardship Academy emphasized economics and financials, it also integrated DEI considerations.

Risks of inequity

The largest social uprisings in our lifetimes took place due to existing and ongoing racial injustices within our society. Presenters Monique Aiken, managing director of The Investment Integration Project (TIIP) and Paris Prince, director of justice, equity, diversity and inclusion (JEDI) at the Intentional Endowments Network (IEN) shared that vulnerable systems lead to suboptimal outcomes, which lead to value extracting behavior and further unjust outcomes. Those unjust outcomes are bad for everyone, as all people bear the burden of a less than true democracy. Further, due to a history of racial injustice across institutions, people of color have faced poorer educational opportunities, fewer wealth building opportunities, are more likely to be incarcerated, which all together detract trillions of dollars of economic productivity, relative to parity. The presenters implored fiduciaries to take responsibility and address these systemic shortcomings and mitigate societal risks (e.g., climate risk, social instability and injustice) through intentional investing.

Challenges require reaffirming mission

SCOTUS struck down affirmative action, or the ability to use race as a factor in admissions and other programs, anti-DEI legislation is taking hold in states, and a looming economic downturn is tightening belts across sectors. These actions and trends could lead institutions to deprioritize goals like diversity, equity, and inclusion, and focus more strictly on financial stability. But, as we learned, equity and stability are inextricably linked. Furthermore, in challenging times, organizational leaders need to ask themselves what they stand for, and for whom their institutions exist to serve. At ISA, we heard about an institution that took drawdown risk (spending above a sustainable level) to mitigate mission risk, or the risk of not fulfilling their mission. Grounded in history and purpose, that organization was able to make dramatic, meaningful contributions to the community they were founded to serve and use good governance structures and planning to ensure their resources would continue in perpetuity by rebalancing over the course of the following years.

Conclusion

This year’s ISA aspired to create a dynamic community of learning and practice, and made clear the importance of regular training on best practices and the value of perpetual, reflective learning. Topics such as asset allocation, governance, spending, risk management and DEI are all dynamic, institution and context specific, and as we have seen, are fundamental to meeting mission and financial goals. Commonfund Institute, through this annual program, strives to offer the best setting in which stewards of capital can grapple with these myriad issues, reconnect with their personal and institutional purpose, and most effectively do this critical work.

Interested in learning how you can attend this event? Be the first to know when details are available for the 2024 ISA by completing the form Below.

- All data reflect the differential between institutions with more or less than 20% of total allocations to private capital. Return data from NACUBO-TIAA Study of Endowments, 2022.

- Although Monika was unable to join us in-person she shared some of her best thinking with George Suttles who delivered a presentation on Purpose Driven Leadership at ISA.