Private capital investors use a particular set of quantitative and qualitative measures to assess performance. While the standard benchmarks used for marketable securities are sometimes applied to private investments, they have limited value. And, as in other investment fields, historical results tell only part of the story.

Another dimension that is unique about private equity is the way it is measured. Returns in private equity tend to be cyclical, so any risk/return analysis must include data from long periods of time. For certain types of private investments, notably emerging markets and natural resources, data are more limited and less comparable than for developed economy private capital investments.

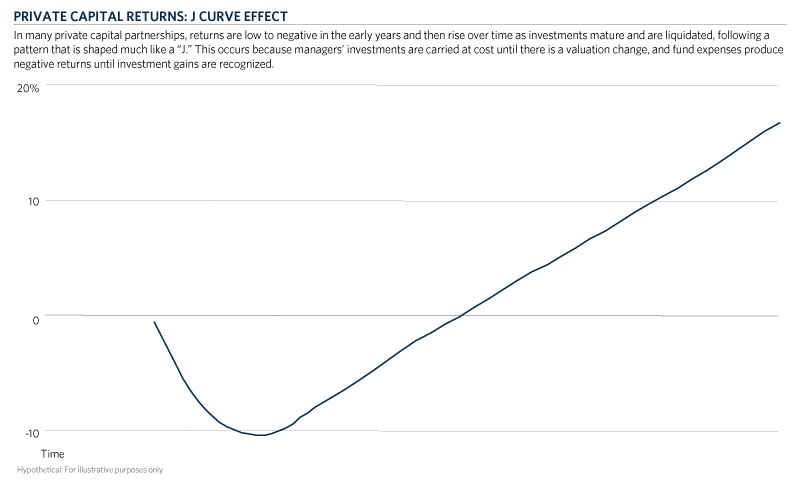

What is the J Curve Effect?

In a typical private capital partnership, returns are low to negative in the early years and then rise over time as investments mature and are liquidated, following a pattern that is often referred to as a “J curve” as seen in the display below. This occurs because the manager’s investments are generally carried at cost on the books of the partnership for an initial time period until the value-enhancing efforts have a chance to take hold, thereby justifying a higher value. In addition, expenses incurred by the partnership are not offset by gains over the first years because investments are younger with less time for value to diverge from initial acquisition cost. This phenomenon often creates losses in the early years of the partnership and contributes to the J curve effect.

Private capital managers will write down the value of an investment when a company is having difficulties and, within the context of fair value accounting, write it up if the company is doing well. The J curve effect tends to be more exaggerated in times when the investment pace and early value creation are slow, making the impact of management fees even more pronounced.

How do you measure risk in private equity?

There is no single way to measure risk in private capital. Both quantitative and qualitative factors play a role. Most quantitative analyses show that private capital is not perfectly correlated with other asset strategies and, therefore, enhances diversification in the overall portfolio.

Since many private investments are exited via sales to strategic investors or initial public offerings, however, private capital funds often show robust returns when the public markets are strong. In general, private capital is a subset of equity investing and encompasses similar risks to public equity markets. Private capital managers view their ability to influence a company’s management, and thereby the timing of a sale, as one mitigator of public equity market volatility. Other risks vary by investment strategy; for example, technology risk may be a factor in venture capital investing, while in energy investing, two factors are commodity pricing risk and international exchange rate risk.

How do you measure return in private equity?

There are three basic measurement tools that are used in calculating return in private capital investing.

-

Internal rate of return (IRR) - This is the most frequently used measurement. This methodology differs significantly from the measures applied to public securities managers, who are gauged principally on the basis of time-weighted returns that are not affected by cash flows. Time-weighted returns on a private capital investment can differ significantly from IRR; it is therefore considered misleading to combine the two in a single return presentation. You can find more details on IRR versus TWR here.

-

Multiple of invested capital - A second measure, which is used in conjunction with IRR, is the “multiple of invested capital” approach, which compares the appreciated value to the original cost basis of the investment.

-

Benchmarks - There are few established benchmarks for measuring private capital returns. The most common technique is based on peer group analysis as opposed to a continuous standardized index. In addition to benchmarking a single vintage year, investors who take a cyclical approach to committing capital can also benchmark against multiple years. Similarly, there are an increasing number of benchmarks that are geography specific, for example looking at Europe or Asia.