As a non-profit organization, Commonfund is proud to partner with our clients to

help them meet their missions. These partnerships can take many forms, traditional

endowment model portfolios or more focused efforts that underscore the client's mission. Increasingly, we are engaging actively with those clients wishing to incorporate their underlying missions within their endowment portfolios, or helping clients to navigate local impact projects in their home regions. To meet the differentiated needs and levels of engagement in these processes, we work with clients to articulate the depth and breadth they wish to take and then help them put those objectives into action.

For clients and prospective clients with mission-aligned investment objectives, Commonfund has developed several tools to work alongside, or as a supplement to their investment policy statement (IPS).

The first is a policy template that can be added as a supplement to the IPS for those institutions seeking to engage in socially responsible investing (SRI), ESG investing, impact investing, or total or partial divestment of fossil fuel-related investments. The section outlines considerations and roles and responsibilities for fiduciaries to consider.

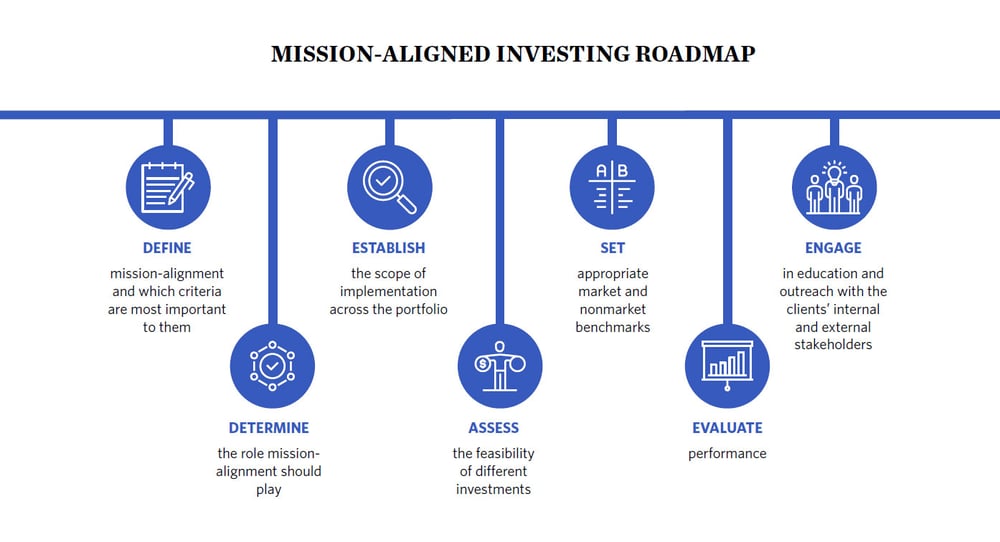

Secondly, drawing on the international standard Impact Management Protocol (IMP) and the Operating Principles of Impact Management (OPIM), Commonfund uses a mission-aligned investing roadmap (The Roadmap) for clients seeking to integrate mission-aligned investing into their investment portfolio and broader organization. The Roadmap assists boards of trustees and investment committees to articulate the manner and objectives underlying their mission-aligned investment, the scope and role of different asset classes in the endowment portfolio, the parameters for measurement of those objectives, and the process for engagement with client stakeholders to help inform and educate.

Importantly, clients determine the depth and breadth of implementation for their mission-aligned investments.

This image is for illustrative and discussion purposes only. Represents market commentary and Commonfund's point of view. Please see Important Disclosures.

Best practices in responsible investing integration are continuously developing. That’s why we continuously reevaluate our approach through insight gained as a result of conversations with peers, involvement in industry working groups, and original research in partnership with our investment managers.

We were founded with the mandate to educate institutional investors on current best practices, which we provide through the Commonfund Institute. The institute serves as the center of our resource library, providing blog articles and white papers about best practices, as well as events and convenings where investors can share insights. The Institute also reports on responsible investing practices among leading nonprofits through the Commonfund Benchmarks Studies.

Commonfund OCIO and CF Private Equity engage with third-party investment advisors who manage commingled portfolios of securities within their respective funds. Those third-party investment advisors are generally directed to vote proxies on behalf of their clients in a way that is consistent with Commonfund OCIO's or CF Private Equity's respective proxy voting policy. Both policies note that The Common Fund Nonprofit Organizations (TCF) is a signatory to the PRI and that, as such, Commonfund OCIO and CF Private Equity, as the case may be, believes that ESG factors and RI can materially impact investment performance. Accordingly, Commonfund OCIO and CF Private Equity, as applicable, asks those investment advisors to consider whether ESG factors and RI are material to the investment performance of the company in question and, if so, to support proposals addressing such factors when those factors are material.

Launched in 2018, Commonfund’s Diversity, Equity and Inclusion Office was created with the mission to intentionally promote and foster inclusion and equity across Commonfund and its investment process, thought leadership, and professional and organizational development.

Truly responsible investing is impossible without an effective risk management strategy. Learn more about our approach to risk management and the ways we strive to create a secure investment plan for your organization.