The calamities known as the financial crisis and Great Recession are now a decade in the past. But far from fading into history, the memories remain fresh. And we are reminded of those days regularly (headline from a recent New York Times: “Biggest Banks Easily Pass Fed Stress Test“).

The past few years stand in stark contrast to the 2007-2009 period. The recovery that took hold with the equity market's turn in March 2009 has seen consistent GDP growth; muted levels of inflation and historically low interest rates; and a steady improvement in the labor market to the point where the unemployment rate fell to 3.8 percent in spring 2018.

This Viewpoint is excerpted from the 2017 Council on Foundations – Commonfund Study of Foundations (CCSF). The Study documents the investment and governance practices of 224 private and community foundations that participated in the survey.

An environment like this creates welcome conditions for better returns on endowed funds and, generally, this has been the case as the current bull market marches into history as one of the longest on record. Importantly for community foundations, moreover, it is also an environment conducive to gift-giving and donations, and that is what we consider in this Viewpoint.

The central question: To what extent do market and economic performance influence gift-giving for community foundations participating in CCSF? The answer appears to be that an extremely poor financial/economic environment has a clearly negative impact. When conditions are generally positive, so too is gift flow, but the impact is not as great as it is in down-market/down-economy conditions. We caution that our data on disruptive environments is only one event deep, that event being the previously mentioned financial crisis and Great Recession.

To what extent do market and economic performance influence gift-giving for community foundations participating in CCSF?

Financial Crisis Impacts Gift-Giving

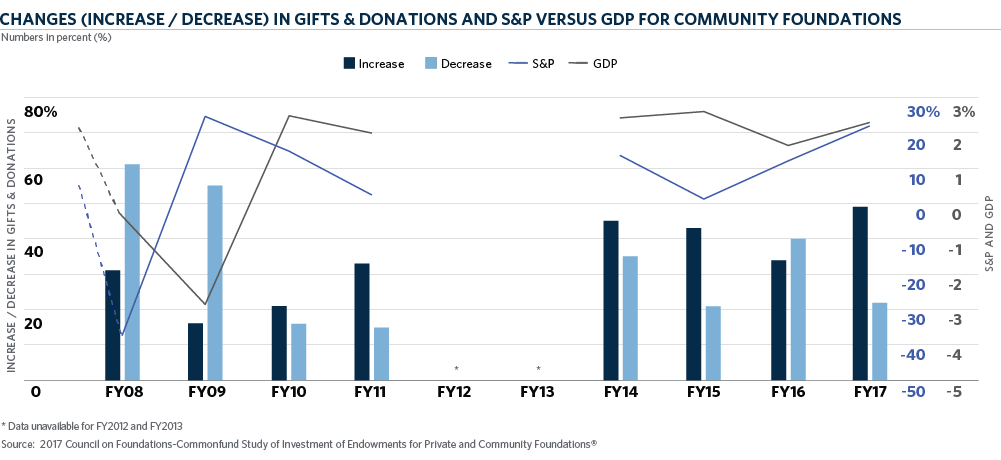

Two thousand eight will be remembered as the height of the crisis. Stocks returned -37.0 percent, using the widely followed S&P 500 Index as a proxy for the U.S. equity market, and real GDP was negative at -0.3 percent. Foundations participating in the Commonfund Benchmarks Study® Foundations Report[1] for that year realized a return of -26.0 percent on their endowed funds. In terms of gifts and donations, only 31 percent of participating foundations reported an increase in FY2008, while 61 percent reported a decrease.

Fiscal year 2009 saw further weakness in the economy, as real GDP contracted 2.9 percent, but after a perilous beginning the S&P 500 wound up with a 24.5 percent return for the full year. Foundation endowments participated in financial markets' reversal of direction and secured an average return of 20.9 percent. But the lag effect from the poor FY2008 made itself felt by extending the feeble gift flow: Only 16 percent of foundations reported an increase in gifts and donations, while 55 percent reported a decrease.

Turnaround Takes Hold

Conditions improved markedly in FY2010. Real GDP growth returned to the plus side at 2.5 percent and the S&P 500 returned 15.1 percent. Foundations participating in the Benchmarks Study for that year reported an average return of 12.5 percent—not nearly as strong as the prior year of rebound, but a double-digit gain nonetheless. Donors shaken by the financial crisis remained wary, however, as just 21 percent of foundations participating in the Study reported an increase in gifts while 16 percent reported a decrease.

Two thousand eleven may be viewed as a transition year for foundations' gift flow. The equity market showed little change—the S&P 500 returned 2.1 percent—and real GDP grew just 1.6 percent. Foundations participating in the Benchmarks Study reported an average return of -0.9 percent. Despite the indifferent statistics, gift-giving took a turn for the better, as 33 percent of foundations reported an increase in giving while just 15 percent reported a decrease—the best overall increase/decrease combination since the financial crisis.

With FY2012 came the first CCSF, the ongoing joint effort of the Council on Foundations and Commonfund Institute. As the Study got off the ground in this year and FY2013, data were gathered from private foundations only and gift flows were not reported for either year.

An Era of Relative Calm

In recognition of the distinct differences between private and community foundations, CCSF began collecting and reporting data separately for the two foundation types with the Report for FY2014. In a larger perspective, five years removed from the end of the financial crisis, an air of confidence settled over the financial markets, and central bank actions to shore up the economy were showing results. The era of relative calm had taken hold.

The S&P 500 Index posted a solid 13.7 percent gain in FY2014 and real GDP grew 2.4 percent. Community foundations participating in the CCSF for that year reported a return of 4.8 percent on their endowment assets. Gift flow increased for 45 percent of community foundations participating in the CCSF, but it wasn't all good news, as 35 percent reported a decrease. With the data segmented into the size cohorts currently in use, it is worth looking at differences among community foundations across the size spectrum. In this instance, the largest gap within a size cohort occurred among community foundations with assets between $101 and $500 million, where 61 percent reported an increase in gifts (high for the Study) while 18 percent reported a decrease in gifts (low for the Study).

Fiscal year 2015 saw a moderate advance in the S&P 500, just 1.4 percent, and only a modest improvement in real GDP, to 2.6 percent. Community foundations realized a return of -1.8 percent that year, and the news on the donation front was mixed. Forty-three percent of community foundations reported increased giving—a two-percentage-point decline year over year—but the good news was that the proportion of foundations reporting a decline was 21 percent, down from 35 percent the prior year.

In FY2016, the S&P 500 generated a 12.0 percent return, as GDP grew an anemic 1.6 percent. Community foundations reported a return of 7.3 percent. Gift-giving remained muted, however, as just 34 percent of community foundations reported an increase versus 40 percent reporting a decrease. Two size cohorts fared best: institutions with assets under $101 million, where a high of 41 percent reported an increase, and those with assets over $500 million, where 33 percent reported a decrease, low for the Study.

The best year of the four comprising the FY2014– 2018 period came in FY2017. The S&P 500 returned 21.8 percent and real GDP grew 2.3 percent. Community foundations reported an average investment return of 15.1 percent. Gift flows were strong: 49 percent reported an increase and only 22 percent reported a decrease. Community foundations with assets over $500 million enjoyed a strong year for donations, with 54 percent reporting an increase and just 8 percent reporting a decrease. Among the other two size cohorts, about one-half reported increased gift-giving while a quarter reported a decline.

Conclusion

Gifts are essential to the life and operations of community foundations. They both maintain or grow the corpus of the endowment and support current and planned spending on mission. Despite a positive environment in the financial markets and consistent improvement in virtually all measures of economic activity, there has not been a single year in which a majority of participating foundations have reported an increase in gifts and donations. In the period from FY2014 to FY2017, a more positive observation is that community foundations reporting an increase in gift flow exceeded those reporting a decrease in three of the four years. Granted there are, and always will be, countervailing forces. Geopolitical issues have hung over financial markets in recent years, and the enactment of the Tax Cuts and Jobs Act of 2017 raises questions about gifts and donations for nonprofits of all types, not just foundations.

Much more study is needed to draw conclusions rooted in long-term data. But experience over the past decade suggests that a financial and economic crisis, such as that of 2007–2009, has the power to severely erode the flow of gifts and donations for periods longer than a year. Positive market and economic conditions restore a more positive flow, but multiple years may be needed to fully offset crisis-induced decreases. Like the adage about the equity market itself, “it can be a staircase going up, but an elevator going down.”

- The Commonfund Benchmarks Study Foundations Report was the predecessor to the current CCSF. The Foundations Report commenced in 2003 (for FY2002); the first CCSF was issued in 2013 for FY2012. We note that gift and donation data for community foundations only were not broken out separately from private foundations until the CCSF for FY2014.