Endowments, like the organizations they support, are generally intended to operate in perpetuity. To accomplish this goal, those responsible for endowments—trustees or directors—make decisions based not on myopic thinking or daily machinations in the financial markets, but on the unique mission, resources and culture of the organization whose interests they represent. The document that usually maps out the intended route to their institution’s envisioned future is the investment policy statement, or IPS. Typically, the IPS spells out the institution’s philosophy of investment management, its goals and objectives, and its strategies for reaching them: return targets, asset allocation guidelines, portfolio rebalancing, acceptable risk parameters, spending methodology and other considerations.

All of these strategies play a role in the pursuit of a risk-adjusted rate of return sufficient to support the institution’s long-term mission. Over the short and intermediate terms, some organizations lean heavily on their endowment to support operations, others less so. For nonprofit healthcare organizations and systems, the endowment is one of multiple sources of support that include operating revenue, reimbursements and philanthropy.

This Viewpoint is excerpted from the 2016-2017 Commonfund Benchmarks Study® of Healthcare Organizations (CSHO). The Study documents the investment and governance practices of 56 nonprofit healthcare organizations that participated in the survey.

In this year’s Commonfund Benchmarks Study® of Healthcare Organizations, respondents told us that, for 2017 at least, the long-term return target for their investable assets is 6.0 percent. It was slightly higher, at 6.3 percent, for organizations with investable assets over $1 billion, but slightly lower for the other two size cohorts: 5.3 percent for organizations with assets between $501 million and $1 billion and 5.5 percent for organizations with assets under $501 million.

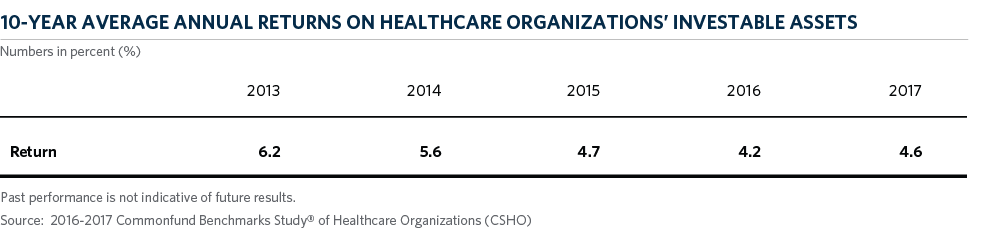

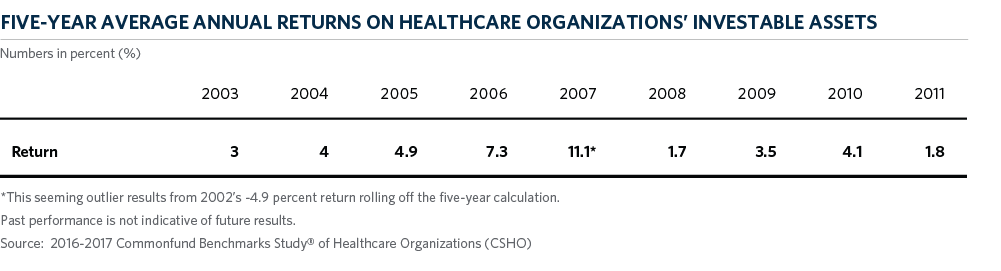

Naturally, that leads to a question: How are they doing against their goal? Data in the following tables (from the current and past Benchmarks Studies) give us an indication. The first table shows trailing 10-year returns, a metric that started with the Report for 2013. The second table shows trailing five-year returns, which were the long-term periods used for Reports for 2003 through 2011. (The initial Study, for 2002, reported a one-year return of -4.9 percent.)

One is the role of investable funds in supporting the organization’s balance sheet.

The conclusion is clear: Past performance shows there is a gap between the current long-term target of 6.0 percent and the historic ability of participating healthcare organizations to deliver on it. Only in 2013 did the trailing 10-year return exceed 6.0 percent. And only in two years between 2003 and 2011 did the trailing five-year return exceed that level.

Asset allocation has long been identified as the key factor in investment return. In 1986, what is perhaps the seminal study of asset allocation, the “Determinants of Portfolio Performance,” was published by Gary P. Brinson, L. Randolph Hood and Gilbert L. Beebower in The Financial Analysts Journal. The authors’ analysis attributed 91.5 percent of the variability of quarterly volatility to asset allocation, while security selection accounted for just 4.6 percent of return and market timing accounted for just 1.8 percent.

On that basis it is useful to look at healthcare organizations’ asset allocation and compare how these organizations allocate funds versus other participants in the nonprofit sector.

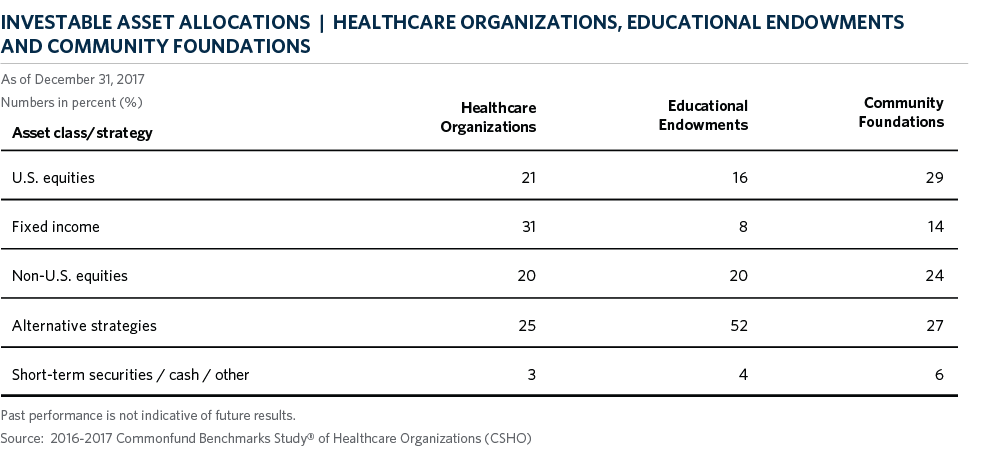

The high allocation to fixed income investments by healthcare organizations marks a consistent difference between these organizations and others in the nonprofit sector. Healthcare organizations reported a 2017 fixed income allocation of 31 percent among their investable assets, but among other types of nonprofits, fixed income allocations were substantially lower. In the NACUBO-Commonfund Study of Endowments® (NCSE), the fixed income allocation for fiscal year 2017 averaged 8 percent and in the Council on Foundations–Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF) for 2017 community foundations reported an average fixed income allocation of 14 percent.

In the following table, we compare healthcare organizations’ investable asset allocations as of December 31, 2017, to those of colleges and universities and community foundations participating in the most recent NCSE and CCSF[1].

As the table shows, there are major differences in asset allocations among the three organizational types, particularly in fixed income and alternative strategies.

Healthcare organizations have the largest allocation to fixed income—almost four times that of educational endowments and more than twice that of community foundations. Over the course of many Commonfund Studies, it is evident that of the three types of nonprofit organization, colleges and universities have been the most aggressive in their asset allocation. They have a clear equity bias, which is one of the key tenets of the endowment model (the others being a high degree of portfolio diversification, the acceptance of lower liquidity and a perpetual investment horizon). Community foundations[2] tend to fall in the middle between educational endowments and healthcare organizations. Their allocation to alternative strategies is quite similar to that of healthcare organizations, but they have larger allocations to U.S. and non-U.S. equities.

Healthcare organizations’ focus on maintaining their bond ratings, and the attendant balance sheet liquidity required by the rating agencies, will likely keep their allocations to fixed income securities high relative to others in the nonprofit sector. In fact, as we have seen, the 2017 allocation to fixed income is higher than it was in 2015 (31 percent versus 28 percent). And while healthcare organizations had been increasing their allocation to alternative strategies in recent years, that trend appears to have paused, if not reversed direction (25 percent in 2017 versus 29 percent in 2015).

Thus, while we opined in the last Study that healthcare organizations appeared to be adopting more of the characteristics of an “endowment model investor,” we would no longer hold to that view in light of asset allocation shifts illuminated by the data in the current Study.

As an aside, we note that when healthcare organizations’ investable asset allocations are viewed on an equal-weighted basis, for 2017 the allocation to fixed income declines only one percentage point, from 31 percent to 30 percent. The allocation to alternative strategies, however, falls to 21 percent from 25 percent, indicating that only the largest healthcare organizations are participating in this market in any meaningful way.

For further information, view the 2016–2017 Commonfund Benchmarks Study® of Healthcare Organizations.

CONCLUSION

Referring back to the discussion of the IPS, we should acknowledge the importance of the statement of purpose of the investment pool. Different organizations have different purposes for their endowed funds. Endowments are composed of individual funds given by donors over time, usually to support particular activities or missions of the organization. Apart from these restricted funds, donors sometimes give with no restriction as to purpose. In addition, organizations themselves may elect to treat operating surpluses, unrestricted bequests and other similar amounts as “quasi-endowment.”

We recognize that healthcare organizations have several factors that make them unique. One is the role of investable funds in supporting the organization’s balance sheet. If the endowment is there to support the budget, its role is quite clear. But if it is also meant to support a credit rating, that introduces a new set of considerations. Often, especially with hospitals, the credit rating agencies will have a guideline as to how many days’ cash on hand an institution should have and how much underlying capital should be in place. This has to be worked into the institution’s risk and return expectations; a growing number of organizations are doing this and are also addressing gifts and debt in their investment policy. So, although this point comes last, it is certainly not least. In fact, it ties back to our earlier discussion point: What is the purpose of the investment pool? There is a strong case to be made for linking the investment policy with the institution’s balance sheet as well as its long-term strategic plan.

- College and university returns are not directly comparable with those of other nonprofits, owing to the different fiscal year end observed by these institutions. Healthcare organizations and foundations report on a calendar year ending December 31, while colleges and universities report on a fiscal year that ends June 30.

- We cite community foundations here instead of private foundations because the latter are funded by a donor (individual, family or institution) and do not pursue additional gifts or donations, as is the case with community foundations (and healthcare organizations).