When calculating return targets for an endowment portfolio, a conventional piece of the equation is often the Consumer Price Index (CPI). CPI plus 5% is the common short-hand formula for institutions to achieve intergenerational equity, focusing on growing the endowment and maintaining purchasing power. With that said, although CPI +5% is used widely, we believe it does not best capture the expense structure for colleges and universities.

The Higher Education Price Index (HEPI) is an inflation index, calculated on a July 1 – June 30 fiscal year that matches that of most higher education institutions, that is designed specifically for higher education and may be a more accurate indicator for colleges and universities than CPI.

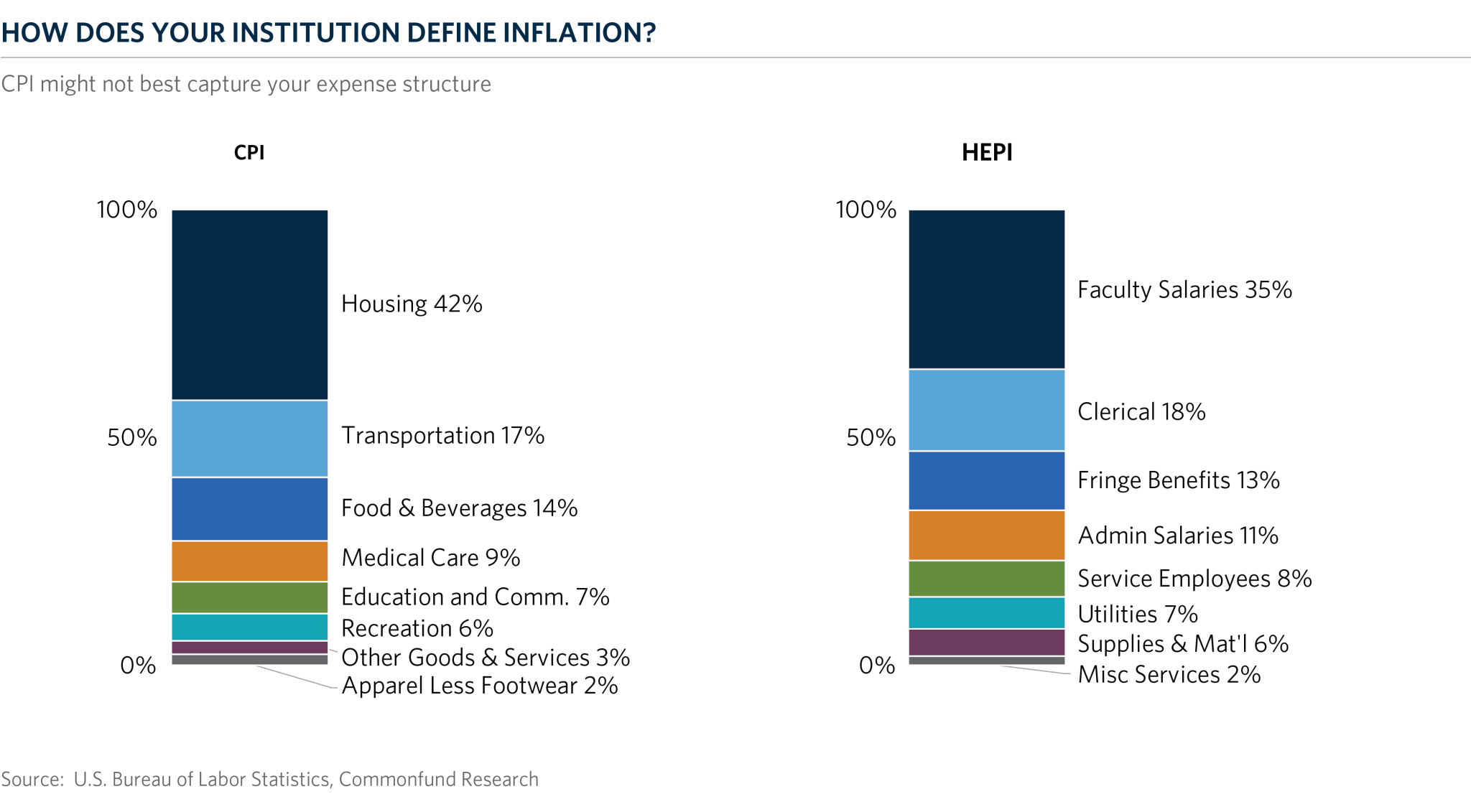

Compiled from data reported by governmental and industry sources, HEPI measures the average relative level in the prices of a fixed basket of goods and services purchased by colleges and universities each year through current fund educational and general expenditures, excluding research. HEPI includes eight components that cover most of the current operational costs of colleges and universities and is an essential tool enabling schools to determine increases in funding necessary to maintain purchasing power and investment. The CPI, on the other hand, measures goods and services that consumers buy day-to-day.

HEPI components are based on price data for 45 budget components that all schools can report, organized in eight component sub-indexes: faculty salaries; administrative salaries; clerical salaries; service employee salaries; fringe benefits; miscellaneous services; supplies & materials; and utilities.

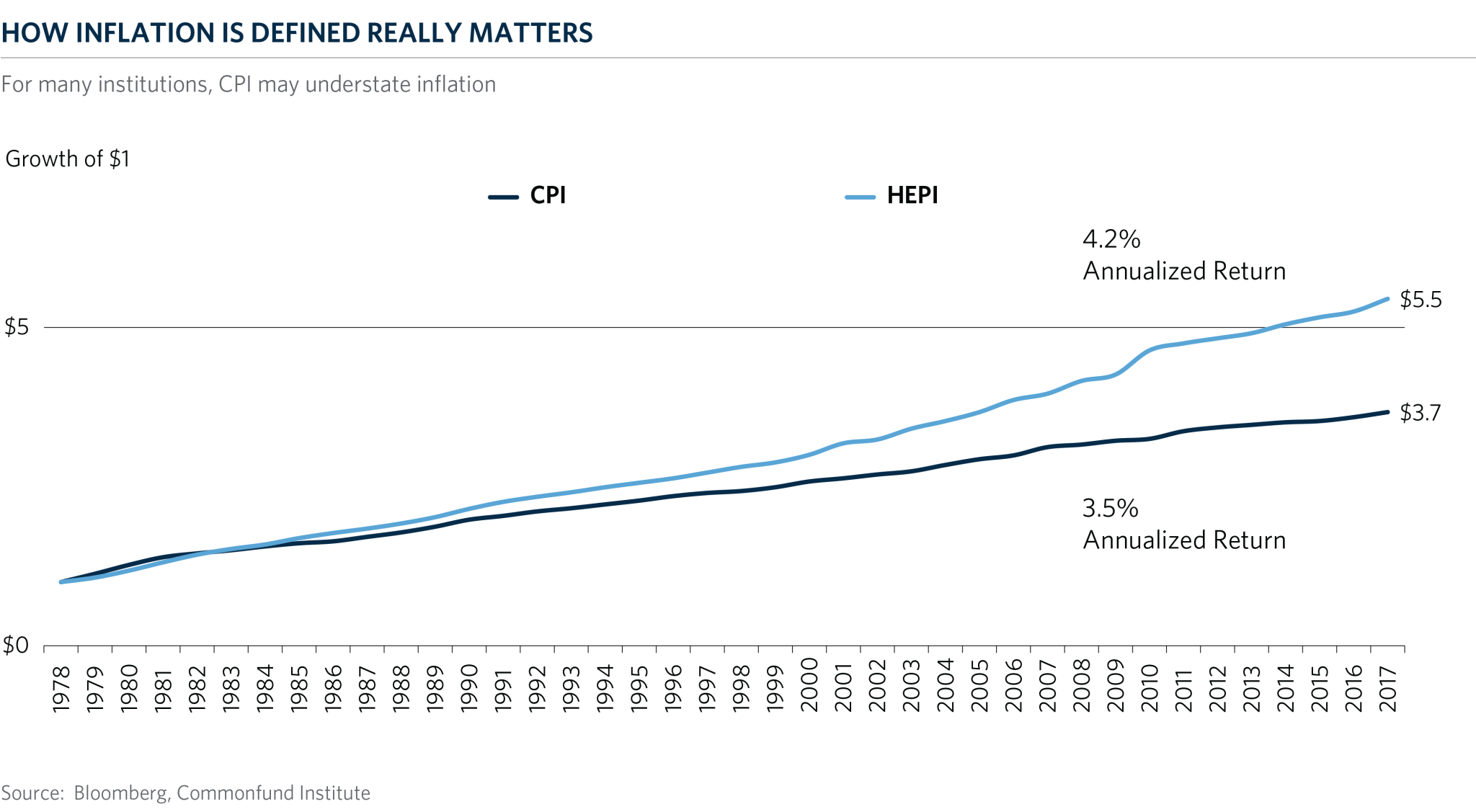

HEPI is used primarily to project future budget increases required to preserve purchasing power. It is a measure of inflation for current operations, for budget hearings to justify the minimum funding requirements to maintain purchasing power, and a guideline for trends in other expense areas such as faculty salaries. For colleges and universities, how inflation is defined really matters to their ability to meet current and future spending needs as can be seen in the chart below comparing the growth of $1 dollar inflated by CPI versus HEPI.

Download the latest HEPI Report Today.

HEPI has been widely recognized as the only benchmark to effectively monitor changes in the purchasing power of higher educational institutions. Further, as many institutions have found HEPI to be a practical tool in the successful establishment of important policies, The Commonfund Institute will continue to produce and widely disseminate it within the higher education community.