With the equity markets retracing some of the losses that occurred in the first calendar quarter of 2020, endowment market values are likely recovering more quickly than we may have feared during the recent lows of mid-March. And while there is no certainty that we won’t retest those lows or experience more bouts of volatility, the beginnings of a market recovery is undeniably welcome news.

Unfortunately, however, the good news has not yet begun for the financial outlook for many nonprofits. The immediate shock to revenues this spring and the increased costs associated with trying to adapt to a new reality are stressing nonprofit budgets in ways that were difficult to imagine just three months ago. Moreover, without any visibility as to when revenue sources will return to “normal,” nonprofit leaders are forced to navigate their institutions through a raging storm made worse by a dense fog.

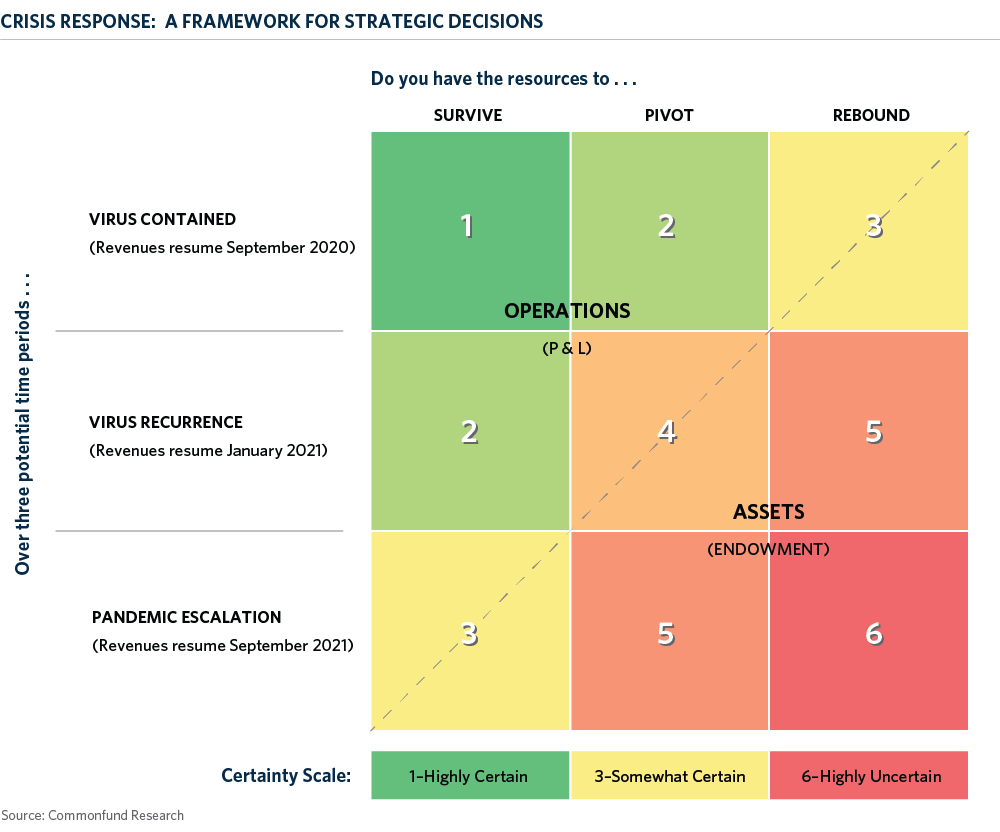

We have all lived through bear markets and recessions, but we have not lived through the confluence of dynamics caused by the COVID-19 pandemic: 26 million Americans losing their jobs in just five weeks, many millions of students at home, and countless museums, symphonies, and aquariums shuttering their doors indefinitely. And, of course, we are all saddened by the tragic loss of so many lives to this virus. As such, this crisis is and will continue to be “different this time” and will require distinct actions and reactions. In conversations with our nonprofit clients, there are a few things on which many agree. First, we are not going back any time soon to the “way it was.” This will be transformational for many nonprofits. Second, this is an existential crisis for some, if not many, nonprofits. Third, those that have the resources to navigate their institutions through this storm will emerge on the other side and may even do so in a better place than before. The journey ahead will not be easy and is exacerbated by two fundamental unknowns: how long it will last and what the other side looks like. Because of this challenging journey and the unknowns ahead, many of our nonprofit clients are struggling with strategic decisions, such as taking a special appropriation from their endowment. In response to this crisis, we have developed a three-by-three framework to assist them in this daunting task. The depiction below represents a simplified example of this framework for an institution that is in “equilibrium”, meaning, its unique situation is relatively balanced across potential outcomes.

The first part of the decision framework is the time frame on the left axis. We are not medical experts and offer no opinions on important variables, such as testing for the virus, treatments or vaccines. However, we do think it is critical to consider multiple scenarios and the work McKinsey & Company did earlier this month on scenarios for the resumption of normal operations for higher-education institutions is a good starting point for all types of operating nonprofits, not just higher ed. As they describe, there are three basic scenarios. “In the first scenario (virus contained), COVID-19 is contained in the next two to three months. In the second, more pessimistic scenario (virus recurrence), physical distancing and other restrictive measures last in some regions for several more months. In the final, most extreme scenario (pandemic escalation), the public-health response fails to control the spread of the virus for an extended period, likely until vaccines are widely available.”

The second part of the framework identifies three phases of the crisis that every institution should process. First, does your institution have sufficient resources survive; second, does your institution have the resources to pivot or reset, and last, do you have sufficient resources to rebound and grow again. While these three categories may seem simplistic, each nonprofit will have its own unique variables to consider. It will be difficult work to define what each of these categories mean and there will likely be conflicting views within institutions. What does it mean to survive? What actions will be required to pivot? How will you measure your rebound? Once you have defined what these categories mean to you, you can begin to measure levels of certainty across the pandemic scenarios. In this stylized and simplified example, the institution is highly confident that it will survive if revenues return in the fall. As the time frame for the return of revenues extends or the need for resources to pivot and then rebound increases, so too does the uncertainty increase. The dashed line shifts up and to the left, or down and to the right, based on the certainty scale of the framework and represents tradeoffs between short term resources, such as operational adjustments, and long-term resources, such as endowment assets.

If we return to the example of a special appropriation from endowment, the matrix can help frame the decision of whether to spend more from endowment today or not. If there is a lot of green in the upper left of the chart, then it likely means you can save long-term resources for the potential (and much more difficult) lower right scenarios on the matrix. If, however, the upper left is pink or red and the dashed line is positioned further to the upper left then you will likely need to use all resources, including unrestricted endowment, to survive today. Needless to say, without survival, there will be no pivot and no rebound. Private foundations don’t have the same operational challenges perhaps but are facing equal pressure to increase their payouts, increase their grants and funding, and facing the same dilemma of funding today’s needs at the potential expense of future needs.

It has become cliché to say that we are living in unprecedented times and indeed the challenges many nonprofits are facing are unrecognizable. In these difficult times, though, we continue to be encouraged and inspired by the work across so many nonprofits. We know scenario planning is happening across many organizations and paths forward are being charted with contingencies to help deal with the unknowns. We stand ready and willing to assist in any way we can and commit to continuing what was part of our original grant 50 years ago from the Ford Foundation – to share best practices, research and education with all of you.

1 Bevins, Frankki et al. 2020 "Coronavirus: How Should US Higher Education Plan for an Uncertain Future?” McKinsey & Company, April. https://www.mckinsey.com/industries/public-sector/our-insights/coronavirus-how-should-us-higher-education-plan-for-an-uncertain-future.