On the surface, hiring two (or more) multi-asset managers to manage an entire portfolio may seem like a good idea. Intuitively, it would seem to reduce manager concentration risk, and provide Investment Committees with different investment outlooks and an easy performance comparison. In fact, it is not rare for committees to create these so-called “horse races”. But, instead of reducing risk, such institutions may inadvertently be creating unwanted risks in the portfolio.

Where’s the Risk?

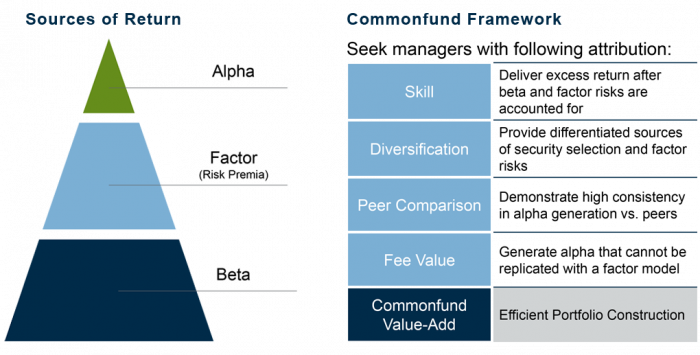

Manager performance and risk comes from three sources:

- market (beta) exposure;

- factor exposure; and

- manager skill (alpha).

Ideally, a portfolio should be managed to a pre-determined beta exposure level (i.e., your strategic asset allocation) and diversified along factor and alpha dimensions.

Considerations in Portfolio Construction

Source: Commonfund. For illustrative purposes only.

Achieving desired market (beta) exposure begins with implementing strategic asset allocations (e.g. equities versus fixed income) and is seemingly straightforward. But it’s not always simple as, for example, fixed income managers can often have disguised equity beta exposure in their portfolios, typically in high yield and distressed strategies that carry risks that are correlated to the equity markets. In a horse race where market betas are not measured and managed on a total portfolio level, this can lead to more equity market exposure than the investment policy might specify.

Factor exposures (also known as risk premia) are less understood, and many times managers lump returns from factor exposures in with alpha. So, what are common factor exposures? Today, there are scores of identified factors, but among the most common are size and value. Size relates to market capitalization, i.e. small cap versus large cap. Value relates to style, defined as relative valuations based on a measure like price-to-book, i.e. value stocks versus growth stocks. Importantly, the returns resulting from these exposures, factor timing aside (which is notoriously difficult), are not the result of manager skill (alpha). Rather they are risk exposures that one is willing to accept for a commensurate return. For example, small-cap stocks tend to have higher risk and over long periods of time, investors have earned a premium for that risk compared to large-cap stocks. In a horse race, the factor exposures of each manager are not controlled and can result in unwanted concentrations or simply an expensive index fund. In contrast, a total portfolio level approach can lead to more informed risk exposures and lower costs.

The final source of return and risk is the most elusive – alpha, or true manager skill. Here, too, it is important that the sources of manager alpha are differentiated. Consider a typical horse race that includes two multi-manager firms. One risk is that both managers allocate to some of the same underlying sub-advisors in the portfolio, which can create a concentration risk on the source of manager alpha. Alternatively, each manager could be making opposite bets in their portfolio, thereby cancelling each other out. The potential for unintended consequences in a horse race are numerous. A portfolio level approach whereby sub-advisor allocations are considered based on their contribution of risk to the portfolio can mitigate these unintended consequences.

Concentrate to Diversify

The natural question remains, can Investment Committees concentrate and still feel appropriately diversified? We believe so and suggest the following check list:

- Consolidating portfolio oversight and management with a single provider, as long as that provider allocates to independent sub-advisors – and not proprietary product – is a first step.

- Second, managing risk on a portfolio level (not asset level) is vital, and press your advisor to provide sub-advisor level risk and return transparency.

- Third, be wary of advisors that seek to generate significant sources of return from tactical asset allocation (TAA). Our view is that an overly weighted “house view” expressed in TAA can overwhelm contributions by sub-advisors.

- And finally, to mitigate operational and enterprise risk concentration, diligence your advisor’s back office, its controls, audit procedures and independent custody operations.