Costs matter. With expectations for lower market returns over the coming years, every basis point of net performance is particularly important. Furthermore, the compounding effect of high fees can significantly impact spending for mission over time, so understanding the true cost of portfolio management is vital, but also a challenge.

One option is simply to invest passively, although over time that has not proven to be an effective approach to achieve a real return sufficient to cover spending draws/distributions. If you elect to combine active with passive strategies and allocate to illiquid strategies, calculating your total fees and costs can be a complex undertaking.

Fees that are directly invoiced are largely understood, but those that are reflected in the NAV (net asset value) of a portfolio such as third party manager fees and fund servicing expenses and other items like audit, legal, and transaction charges are rarely transparently reported. Further, when evaluating OCIO providers in RFP responses, it is critical that criteria like returns and fees are presented in such a way as to ensure clarity and apples-to-apples comparisons.

One of the responsibilities of a fiduciary is to understand the costs associated in their institution’s portfolio, as well as the factors that drive differences in fees and expenses. In fact, UPMIFA (Uniform Prudent Management of Institutional Funds Act) requires that fiduciaries incur only “appropriate and reasonable” costs in managing the portfolio.

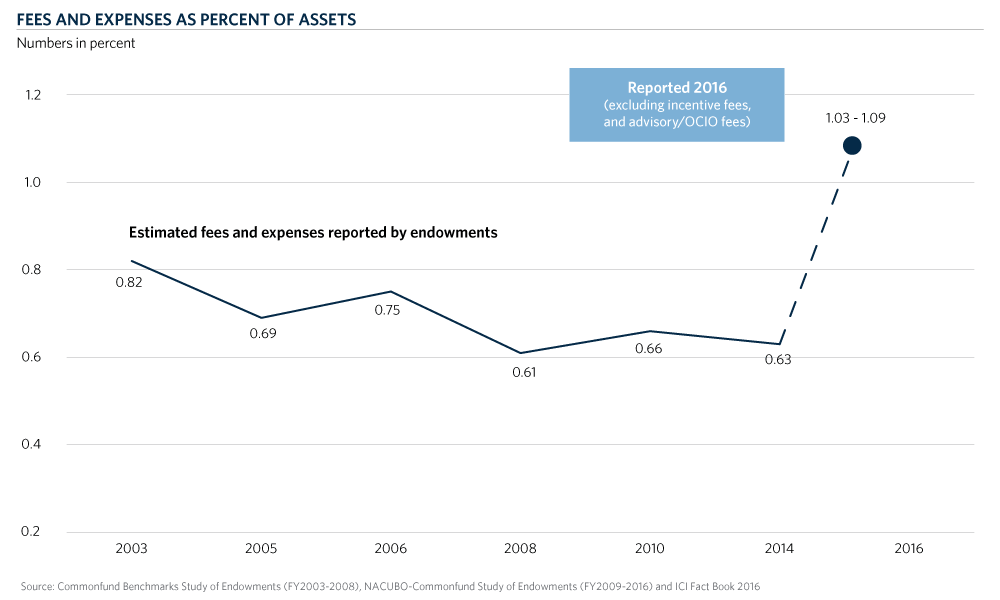

We have found that most endowments and foundations significantly underestimate their total investment costs, reporting total fees and expenses of 60-70 basis points historically (Source: NACUBO | Commonfund Study of Endowments). In more recent analysis we observe that total fees and expenses for a diversified portfolio with a 15-20% allocation to illiquid strategies, average 100-130 basis points (excluding incentive fees).

How can you manage your fee budget and better compare potential advisors? Following are five questions to ask you advisor today.

- Am I paying for alpha (manager skill) or beta (market exposure), or risk premia? (deconstruct the source of returns)

- To what extent are my interests aligned with those of my advisor (are fees structured to properly incentivize the manager)?

- What are the specific fund expenses that are reflected in the NAV of my investments?

- Is my advisor receiving any compensation from underlying investments/managers, including negotiated manager fees or revenue sharing?

- What is included (excluded) in an OCIO fee?