As we have undergone the process of re-underwriting all of Commonfund’s equity managers and funds over the last 6 months, we have tackled anew the age old question of how many funds does one multi-manager equity portfolio require to offer appropriate levels of diversification?

While there is no single universally appropriate answer, our research has indicated that, upon closer inspection, many multi-manager equity portfolios may not be quite as diversified as intended from a potential excess return perspective.

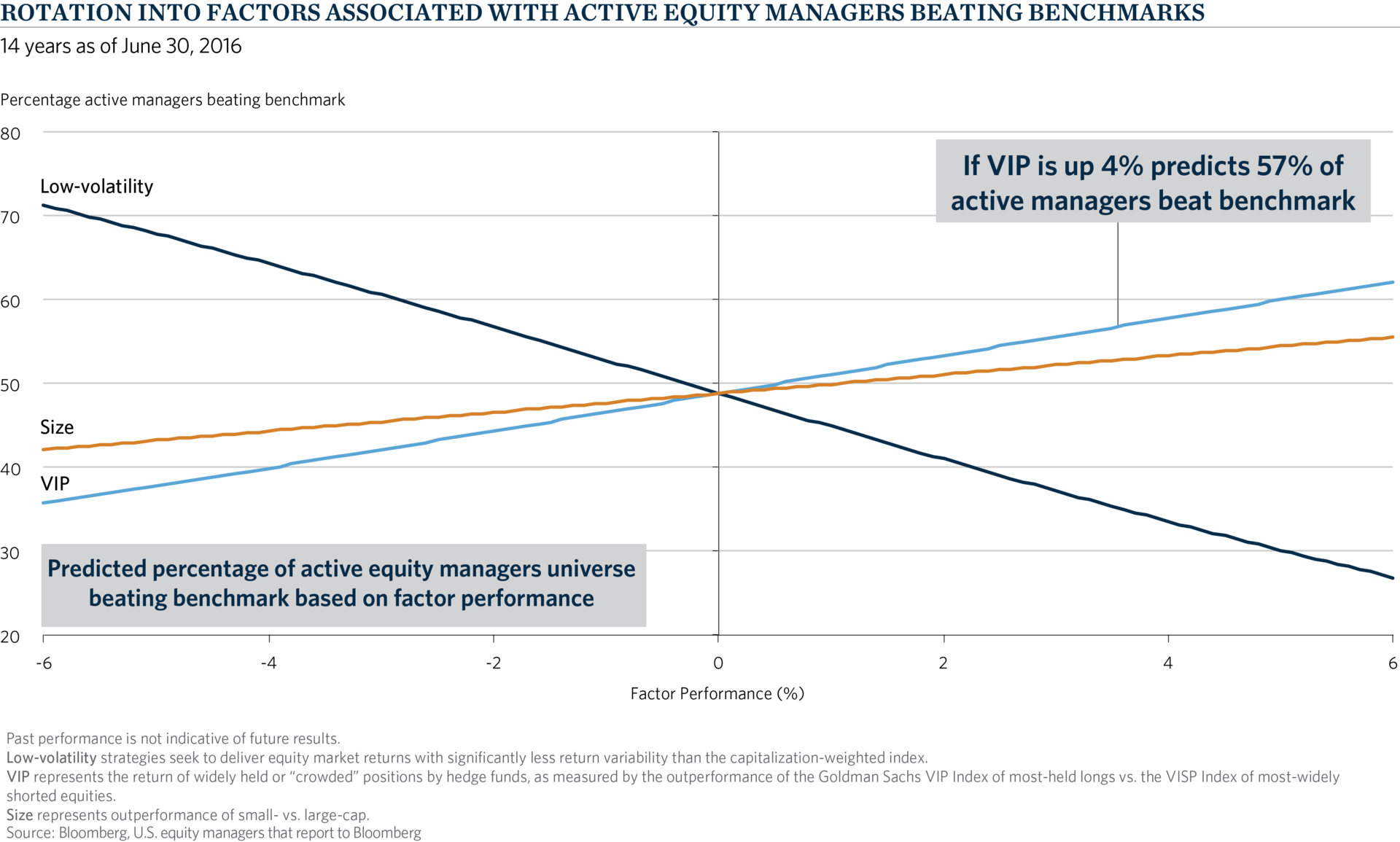

By and large, traditional active equity managers, as defined in our research by more than 2,000 US equity managers who report their results to Bloomberg, do well or poorly together in significant lock-step with how three second-order market risk factors are performing. In the chart below we examine how active managers’ performance moves in response to three equity factors – size (small cap vs. large cap), volatility (high vs. low), and crowded trades (as represented by the Goldman Sachs VIP index). Specifically, if small caps perform better than large caps, crowded trades outperform less-favored trades and higher volatility names do relatively well, chances are good that your traditional stock pickers will outperform their respective benchmarks. In the reverse environment, the likelihood is that active managers will underperform.

Our findings are particularly relevant as some investors struggle with the question of whether to persevere with their actively managed equity portfolios or to throw in the towel and join the throngs of those investing passively. At Commonfund, we firmly believe that active management will be a necessary ingredient in meeting long-term performance goals as we believe the passive beta available to investors from equity and fixed income allocations simply will not be enough to meet long-term spending and capital growth needs.

The implications of these findings are nuanced but important.

-

First, and admittedly ancillary to this particular research, this does not indicate to us that one would want to abandon active management. On the contrary, coming out of a difficult environment for active management, reversion to the mean alone might portend better times to come. We want to make sure that our client portfolios are positioned for any rebound in the active management environment by having verified alpha-generating stock pickers in our portfolios. Furthermore, we will concentrate in our highest-conviction manager partners.

-

Second, it is important to recognize that “traditional” active managers, or stock pickers, tend to gravitate towards equities that bubble up to express similar factor bets at the portfolio level. This indicates to us that while investors may gain comfort in feeling sufficiently diversified by having multiple stock pickers in their portfolios, the true diversification of the excess returns they are producing may be overestimated.

-

Finally, we are spending considerable resources to find and bring “non-traditional” active or excess return sources to our equity portfolios in pursuit of demonstrable diversification benefits. In other words, we do not want to have all of our eggs in the traditional active management basket. We are executing this strategy through the targeted and risk-aware addition of quantifiably uncorrelated risk premia and diversified alpha strategies. Needless to say, identifying managers that meet this criteria is no easy task, but well worth the effort.

Our investment philosophy is grounded in the three tenets of the endowment model – an equity bias, broad diversification and prudent use of illiquid investments to capture the premium they can offer – we believe they remain the foundation of a successful long-term investment portfolio. But today we are executing the model using refined tools, like those described here, to isolate portfolio risks and identify uncorrelated sources of return more reliably.