At Commonfund, we understand the challenge institutions face of maintaining the purchasing power of their endowment. In fact, achieving a rate of return sufficient to cover inflation, distributions and investment costs – typically CPI + 5 percent – is much harder today than previously.

How Big is the Gap?

Over the last 30 years, large endowments have achieved CPI + 5 percent, even beating it by more than 300 basis points annually. The big lead has come to a startling halt; for the most recent 10 years, even the largest endowments have started trailing CPI + 5 percent by more than 100 basis points per annum.**

What Happened?

The loss of nearly $20 trillion in global public equity markets during the financial crisis did not help; neither did the $12.7 trillion expansion of monetary policy. Interest rates have been kept artificially low, corporate debt issuance has doubled since the crisis, active equity managers have lagged, investors have been forced to take on more risk – high yielding equity sectors became the new bonds. We have been in a new era. The question posed by many investors is whether this new era will persist, or evolve.

How we met the challenge?

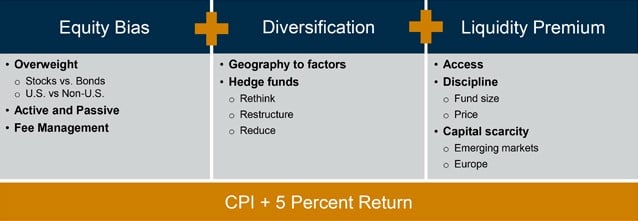

Commonfund is a pioneer of the endowment model of investing, and we realize that as the market environment has changed, how we apply the endowment model has evolved. Its underlying tenets – that of an equity bias, the benefits of diversification and the advantage of the liquidity premium remain. But today we seek to benefit from more advanced tools in return and risk analytics that provide the opportunity to execute more effectively – to access low cost beta, to uncover more diversified and persistent alpha, and to measure and access the premium for illiquid assets more effectively – all designed to help Commonfund investors achieve CPI + 5 percent.

How will we get there? Commonfund's View

Appropriately, the theme of Commonfund Forum 2017 was Bridging the Gap. Together. Over 500 attendees and speakers focused on this challenge for three days in San Antonio, Texas. To kick off the meeting there was a presentation on “Meeting the Challenge of CPI + 5%”. Final reflections concluded that the strategy outlined – emphasizing an equity focus, leveraging diversification, and capturing the liquidity premium – continues to offer the promise of reaching the desired return target. Yet, the crucial element remains adept execution tailored to today’s market dynamics.

Important Notes

Past performance does not assure future results. Returns are net of fees.

**The NACUBO-Commonfund Study of Endowments (NCSE) is an analysis of financial, investment and governance policies and practices at endowed institutions of higher learning. For fiscal 2016, 805 U.S. institutions representing $515.1 billion in endowment assets participated. For additional information on the NCSE data shown, please go to http://www.nacubo.org/Research/NACUBO-Commonfund_Study_of_Endowments.html. Copyright 2016 The Common Fund for Nonprofit Organizations and the National Association of College and University Business Officers. This is the most recent NACUBO-Commonfund Study of Endowments (NCSE) to date.

Source: NACUBO-Commonfund Study of Endowments and Commonfund Research. Copyright 2016.