In March 2023, President Biden acted to secure the U.S. Department of Labor Environmental, Social, Governance (ESG) Rule as foundational investment policy that permits fiduciaries of private retirement plans to consider climate change and ESG factors in investment decisions. The move was the first veto of the administrations term, signifying that ESG’s integration into the investment landscape has garnered the attention and action of the most powerful office in the nation. Despite these challenges, this means that pension plans that are pursuing these strategies can continue to do so.

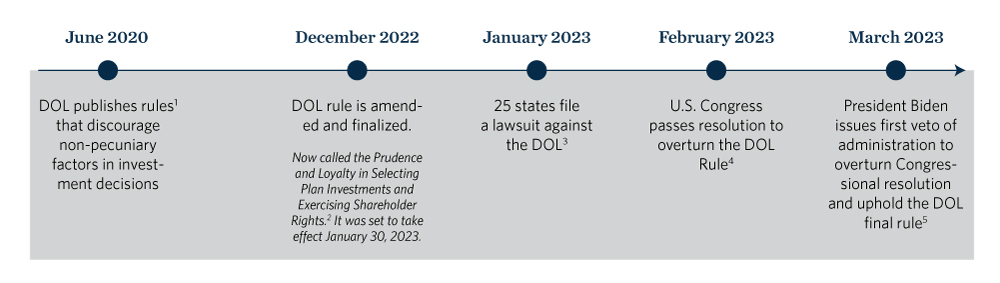

DOL ESG Rule Timeline

According to the Center for Retirement Research, public pensions have engaged in what is now considered ESG investing for many decades, from screening out “sin stocks” in the 1970s and gun manufacturers in more recent years, to state funds actively investing in domestic development goals like homeownership. But as the use of ESG factors has become a political flashpoint, their integration into investment strategies has prompted a national policy fight to counteract ESG activities. In June 2020, the DOL proposed a rule that would limit the ability of fiduciaries of ERISA-covered plans to use environmental, social, and governance (ESG) factors in investment decisions. The current administration’s DOL amended the rule to allow ESG considerations (dubbed the “final rule”), and in response to state and Congressional challenges, the presidential veto upheld the final rule.

Despite Challenges, Signs Point Toward Increase in ESG Investing

The Department of Labor rule applies to roughly $24 trillion in private retirement assets6 – commonly known as Defined Contribution Plans or 401K plans – that are protected under the Employee Retirement Income Security Act, or ERISA. That leaves rules around public pension plans in the hands of state legislatures.

A small but growing number of states have introduced bills prohibiting fiduciaries of those states’ pension plans from using any non-pecuniary factors in investment decisions – namely, ESG criteria. And there is potential for the anti-ESG coalition to grow and target other sources of public capital (e.g., multiple state treasurers have withdrawn funds from Blackrock in response to them integrating sustainability into their portfolios). Some of those state laws have been broader in scope, targeting investment managers and financial institutions, which could hinder strategies and relationships for endowments and foundations. College and university leaders are particularly concerned about bills that specifically ban institutions from working with asset managers that have any ESG strategies – which could reduce the pool of managers, increase costs and limit opportunities. Some are hesitant to implement ESG strategies simply to avoid potential controversy or backlash.

Certain benchmarking activities capturing investor sentiments across institution types seem to be trending toward more, rather than less, ESG integration and investment. A 2020 study by PwC found that 8 in 10 asset managers and institutional investors plan to increase their ESG investment over the next two years, and a 2021 survey of 114 institutional investors (40 percent of which were endowments or foundations) found that nearly 50 percent of respondents incorporated ESG into the investment process – a 7-percentage point increase from the prior year. Out of the endowments and foundations that do use ESG strategies, 60 percent do so because they consider it their fiduciary responsibility.

Within Commonfund’s research on nonprofit endowments, we also find increasing appetite for ESG strategies. In our 2022 Council on Foundations-Commonfund Study of Foundations (CCSF), 23 percent of respondents reported that they sought to include investments with high ranking ESG criteria, a 4-percentage point increase from the prior year. In the same study, 37 percent of private foundations reported that new managers’ commitment to ESG is important or very important in their hiring decisions, up from 34 percent the prior year.

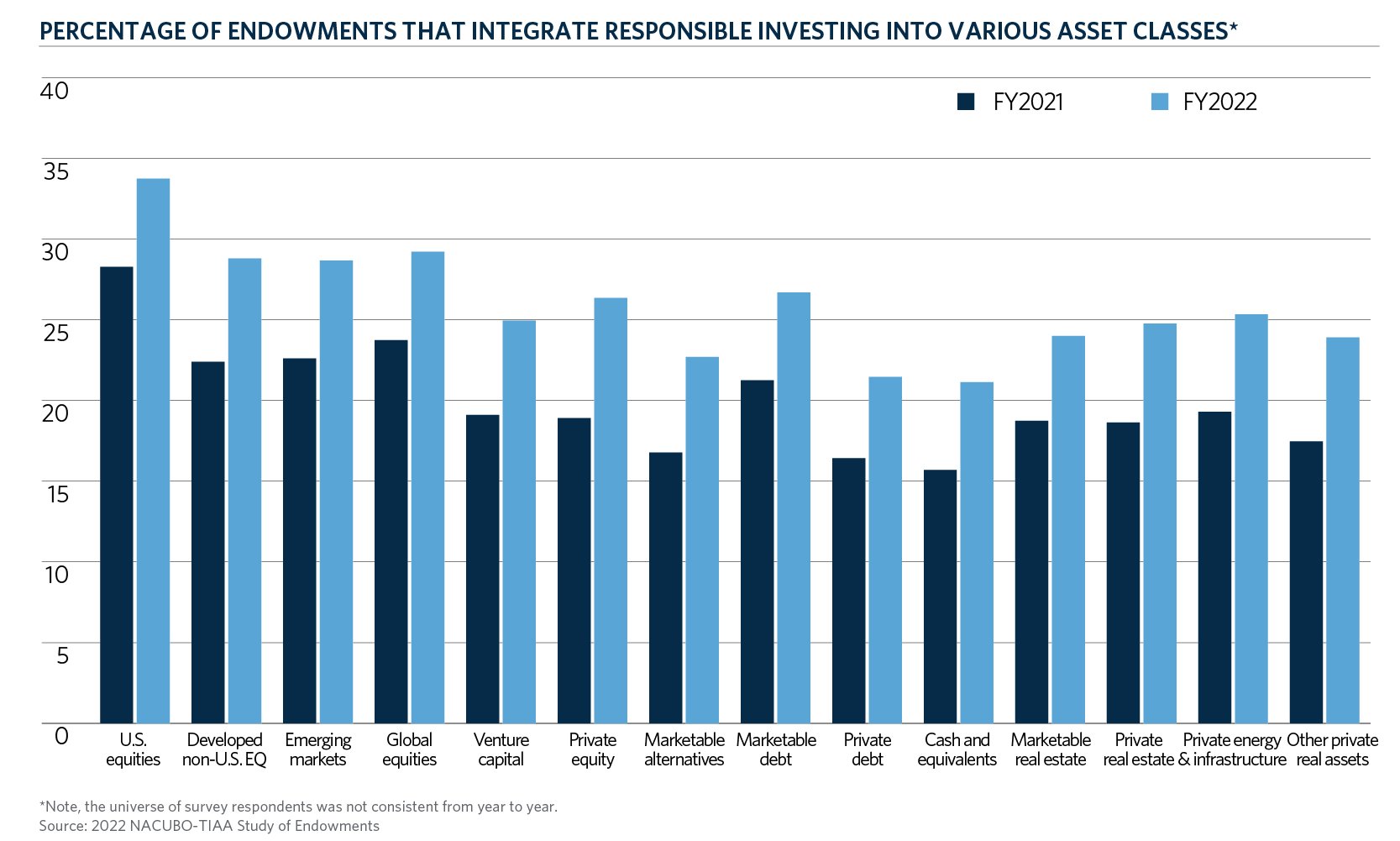

Looking at higher education endowments, the 2022 NACUBO-TIAA Study of Endowments showed an increase in interest and integration of responsible investing strategies, with more than 86 percent of 678 institutions reporting that ESG is included in their investment policy. More modest but increasing numbers of respondents report having responsible investments already integrated across their portfolio asset classes.

One might conclude that the rise in ESG appetite across the nonprofit sector has surpassed the rise in anti-ESG sentiments and policies, even during a time of growing uncertainty around the DOL ruling and state laws. Macroeconomic data and projections mirror these trends: assets under management (AUM) in ESG strategies across sectors are expected to increase dramatically.

The DOL Rule is One of Many Regulatory Signals to Watch

National and international policy and regulatory developments point toward further growth and development of this market segment across the nonprofit sector. More capital is flowing into these strategies, via the U.S. Inflation Reduction Act, which committed $369 billion in funding for clean energy and climate priorities, and the EU’s Green Deal, all adding to ongoing strides in global climate financing. But according to the latest United Nations report, mobilization of finance by public and private sources still poses a major constraint to sufficient climate action.

One bottleneck in deployment of those funds is a lack of concrete definitions, data, and benchmarking around sustainable investment and ESG more broadly. The EU’s attempts to standardize and increase transparency around such investments, through the Taxonomy, Sustainable Finance Disclosure, and other regulations, as well as the UK’s Stewardship Code for good investment governance, demonstrate the potential to address challenges often cited by U.S.-based investors about ESG. With more transparency and less regulatory confusion, U.S. pensions and the broader institutional investor landscape may follow in the footsteps of those in the EU with major climate and ESG investments to date. Upholding the DOL ESG rule is the first step in the process, and further frameworks being established by the SEC are forthcoming.

Conclusion

When institutions and managers are able to implement ESG strategies, they can and should be tailored to their own needs, measured, and fine-tuned over time. The ESG Rule and broader debate has caused confusion and made it harder for some institutions to be public with information that could lead to increased responsible investment practices and advancement in the field. But upholding the final DOL ESG rule was one step towards solidifying a foundational regulatory framework upon which to build. While the Uniform Prudent Management of Institutional Funds Act (UPMIFA) governs fiduciary responsibilities over charitable endowment funds, time and further legal research will tell if state actions could supersede those powers, and the potential effects on investment practices and charitable giving to institutions that pursue ESG strategies. Commonfund Institute will continue to track these public policy and regulatory discussions to better understand the implications for institutional investors.

- Department of Labor rules

- Prudence and Loyalty in Selecting Plan Investments and Exercising Shareholder Rights

- https://www.texasattorneygeneral.gov/sites/default/files/images/press/2023.01.26_1 Complaint.pdf

- https://www.reuters.com/business/us-senate-poised-consider-blocking-biden-esg-investment-rule-2023-03-01/

- https://news.bloomberglaw.com/esg/biden-wields-veto-pen-for-first-time-to-block-anti-esg-measure

- According to ICI, there were $11.5 trillion in IRA accounts, $9.3 trillion in private sector defined contribution (DC) plans (including 401(k) plans), and $3.1 in private sector defined benefit (DB) plans, as of Q4 2022. ICI’s estimates align with a CRS report that posted data through the end of 2021.