Research Center

Select a Topic:

Featured

Investment Strategy | Videos

Investing in Real Assets and Sustainability

In a session hosted by the Commonfund Institute, Ethan Levine and Dan Connell, managing directors of CF Private Equity's real assets and sustainability team, discuss the importance of investing in...

Featured

Governance And Policy | Podcasts

Real Assets and Sustainability: Investing in a Changing Policy Environment

POPULAR ARTICLES

Investment Strategy | Articles

Mind the Gap: The Strategic Risk of Skipping a Vintage in Private Equity

Private equity (inclusive of buyouts, growth equity, and venture capital) remains a compelling long-term asset class, but recent periods of muted distributions and below-average returns have created...

Perspectives | Press Releases

FY24 NACUBO-Commonfund Study Released

U.S. Higher Education Endowments Report 6.8% 10-Year Average Annual Return, Increase Spending to a Collective $30.0 Billion Annual NACUBO-Commonfund Study shows participating institutions spent...

Investment Strategy | Videos

Chief Investment Officers Share Their Thoughts at Forum 2025

Commonfund hosted its annual Commonfund Forum 2025, March 9-11th, in Orlando, Florida. The agenda included a range of sessions on relevant topics for institutional investors. This Forum Spotlight...

Stay connected with the Insights Blog

Featured

Market Commentary | Private Equity Insights

Private Markets Year in Review and 2026 Outlook

As we enter our 38th year, we write to share with you our year-end letter and observations of what may be ahead in 2026 in the private equity investment environment. Learn Morecommunity_college

Diversity | Videos

Commonfund Award Presentation and Leadership Discussion

Commonfund has been a partner and supporter of CASE for the past several decades. Our aligned missions of serving educational institutions and enhancing resources for ongoing financial success are...

community_college

Diversity | Insights Blog

Commonfund Trustee, Dr. David A. Thomas, Wins 62nd Annual HBR McKinsey Award

Commonfund's Trustee, Dr. David A. Thomas, wins the 62nd Annual HBR McKinsey Award, for co-authoring the article titled "Getting Serious About Diversity: Enough Already with the Business Case." The...

community_college

Market Commentary | Insights Blog

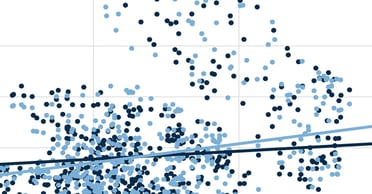

Chart of the Month | The Surprising Relationship Between Money Supply and Inflation

The potential for rising inflation is becoming a top concern for many investors and consumers. Many believe that inflation is already here as evidenced by price increases in commodities, homes,...

community_college

Outsourced Cio | Insights Blog

Top 5 Ways OCIO Fees Mislead

Fees are frequently overemphasized by Investment Committees when evaluating an Outsourced Chief Investment Officer (“OCIO”). Committees often believe that fees are a quantifiable and tangible way to...

community_college

Perspectives | Insights Blog

How Your Organization Can Nurture Innovation While Balancing Risk

The theme for Commonfund Forum 2021 was “Transformation.” The objective of the agenda was to deliver timely, useful content on core subjects related to nonprofit endowment and financial management...

community_college

Perspectives | Insights Blog

Fareed Zakaria Dissects the Challenges Shaping the Post-Pandemic World

The theme for Commonfund Forum 2021 was “Transformation.” The objective of the agenda was to deliver timely, useful content on core subjects related to nonprofit endowment and financial management...

community_college

Market Commentary | Private Equity Insights

Trends in the Growing Secondary Market

"The secondary market has become a mainstay for investors, both as 1) more investors move into the secondary market and, 2) as a way to manage investors' existing private portfolios. Both sides of...

community_college

Commonfund Forum | Videos

Forum 2021 | Welcome Address

Mark Anson, PhD, CFA, CAIA, Chief Executive Officer and Chief Investment Officer, Commonfund, welcomes you to Commonfund Forum 2021. This video is a Commonfund Forum 2021 Spotlight. Click here to...

community_college

Diversity | Videos

A Fireside Chat with Darren Walker | From Generosity to Justice

Forum 2021 keynote speaker and Ford Foundation President, Darren Walker, shares his bold vision for the future of philanthropy. Since his arrival in 2013, Mr. Walker has transformed the venerable...

community_college

Governance And Policy | Videos

Infinite Challenges, Endless Opportunities, Finite Resources

Board members, trustees and others that have oversight of endowed portfolios have well-documented fiduciary duties that govern how they carry out those responsibilities. In times of relative calm,...

community_college

Investment Strategy | Videos

Tools for Creating Effective Strategic Policy

Commonfund has worked with nonprofit investors for 50 years. Over that time, we have developed a set of proprietary tools and data to assist boards and investment committees in their quest to create...

community_college

Diversity | Videos

Promoting Gender Equity in Leadership Roles

Dr. Kellie A. McElhaney is on faculty as a Distinguished Teaching Fellow and the Founding Director of the Center for Equity, Gender and Inclusion (EGAL) at the Haas School of Business at the...

The New Era of Market Concentration