Deficit Spending Remains a Constant Despite a Change in Leadership

A few years ago, Commonfund published a commentary on the budget battles in Washington. The world was navigating a pandemic. Joe Biden had just been elected and needed to offset the economic impact...

Fiscal Policy Impacts on the Economy: Maybe too early to tell….

We are now more than 100 days into the Trump administration and six weeks past the “Liberation Day” tariff announcements. In that time the S&P 500 has reached it’s all time high, sold off more than...

Policy Uncertainty Impacts All Assets (Not Just Equities!)

Since the February peak in the S&P 500, reams of newsprint have been dedicated to the volatility in the equity markets and to a lesser extent the U.S. Treasury markets – but what about the U.S....

The Fed and Markets Expectations Start to Align

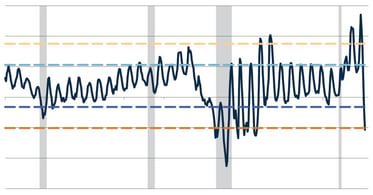

It took six months, but the FOMC and the short-term rates markets are finally in alignment with respect to the level of the Fed Funds rate as we approach the second half of 2024. Since the beginning...

Yesterday's Sector Laggards are Today's Leaders

Much to the surprise of market participants, global stocks have risen at an impressive pace year to date despite significant macroeconomic headwinds and regional bank troubles. In what can be deemed...

Real Estate Takes a Hit from the Fed

In this chart of the month, it is commonly cited that monetary policy tightening has a lagged impact on economic activity. However, as the Federal Reserve drives the cost of capital higher, the...

The Trouble with Europe

As U.S.-based investors, our clients tend to focus on issues closer to home when evaluating portfolio positioning. Most conversations are focused on the political climate, FOMC actions, localized...

Commonfund Perspective on the Russian Invasion of Ukraine

Key Takeaways As widely anticipated, Russia invaded Ukraine on Thursday, February 24th, causing volatility to spike across the capital markets globally. By the closing bell in the U.S., however,...

Exiting the Recovery Phase

Third Quarter 2021 Economic Outlook The end of the third quarter 2021 marks a turning point in the economic cycle. It’s the point where, despite the pandemic still being a part of daily lives,...

Digging Deeper into Inflation Fears

The current debate about whether the spike we are seeing in inflation is “transitory” should be reframed as “reflation vs sustained inflation.” Just like many other economic data points (ISM,...

A New Chapter for the Economy

The key driver of the economy, and of public sentiment, has been the aggressive distribution and acceptance of the COVID-19 vaccines. A litany of measures reflects the improved outlook for the U.S....

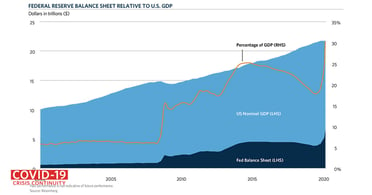

Chart of the Month | The Fed Rides to the Rescue

The Federal Reserve is determined to support the economy and the normal functioning of capital markets during the COVID-19 pandemic. As of April 29th, the total asset size of the Fed’s balance sheet...

Chart of the Month | Central Banks Increasingly Accommodative

World markets appeared to be returning to their upward trend in the beginning of February after a volatile start of the year. While concerns about global growth caused by the coronavirus outbreak are...

The Economy and Markets March On

Summary Positive signs on trade drove recent new highs in the U.S. equity markets The Fed continues to be accommodative and employment is strong Growth is slowing but is supported by the consumer,...

Recession – Maybe This Time is Different

The July Federal Open Markets Committee (FOMC) meeting signaled the end of central bank rate normalization with the first rate cut in more than a decade. The last time the FOMC cut rates was in...

The Crowded Liquidity Trade

The liquidity markets have experienced one of the largest disruptions since the inception of SEC Rule 2a-71 in the early 1970’s. Over the past few months, we have seen a massive shift of investor...

Where Did Our Operating Income Go?

Treasury managers face a new challenge to an old problem. Their institutions historically have relied on operating investment income to provide a necessary influx to operating budgets. Prior to 2008,...

Tariff Worries Are Likely Here to Stay