A Closer Look at Health Conversion Foundations

Commonfund, in partnership with the Council on Foundations (COF), recently released the 2024 Council on Foundations-Commonfund Study of Investment of Endowments for Private and Community Foundations...

Health Conversion Foundations: Preserving Community Health in a Changing Landscape

In the evolving terrain of American healthcare, health conversion foundations, also known as health legacy foundations, have emerged as powerful stewards of community well-being. These philanthropic...

Growing Use of OCIO by Private and Community Foundations

In the annual Council on Foundations-Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF; the "Study") data show concerns are rising regarding the ability to...

A Closer Look at Long-term Returns

In the annual Council on Foundations-Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF; the "Study") data was collected on longer-term returns for the first...

Study of Foundations - Key Highlights [Infographic] 2024

In this infographic, we report the key highlights from the 2024 Council on Foundations-Commonfund Study of Foundations. For the year ended December 31, 2024, participating foundations produced...

Summer Literary Journeys: A Pathway of Pages into Growth, Grit, and Collective Imagination

Commonfund Institute is excited to share our annual summer reading list, thoughtfully curated with recommendations from our Commonfund colleagues. Inspired by the spirit of the summer solstice –...

Study of Independent Schools Marks its 20-Year Milestone

In 2005, what was then called the National Business Officers Association (now NBOA: Business Leadership for Independent Schools) had reached the seventh anniversary of its founding. Having its...

Increased Use of OCIO for Independent Schools

Data from the 2024 Commonfund Benchmarks Study of Independent Schools (CSIS) show that schools across the size spectrum reported an increase in use of an outsourced chief investment officer (OCIO)...

In Pursuit of Intergenerational Equity: Inflation is the Big Headwind

For all the differing goals and objectives laid out by colleges and universities for their endowments, one that is universally shared is intergenerational equity, or the concept that endowed...

Independent Schools Increasingly Depend on Endowments for Operations

Amidst concerns about student enrollment, fundraising, inflation, market volatility, and more, independent schools are relying more on their endowments to cover any gaps. Data from the 2024...

Top Concerns in Higher Education

In the 2024 NACUBO-Commonfund Study of Endowments, a new area of inquiry was asked to participating institutions to identify their top two concerns from an inclusive list of 20 alternatives from...

Study of Independent Schools - Key Highlights [Infographic] 2024

For fiscal year 2024, independent schools reported an average return (net of fees) on their endowment assets of 12.3 percent. In this infographic, we report the key highlights from the 2024...

Study of Endowments - Key Highlights [Infographic] 2024

For fiscal year 2024, U.S. higher education endowments reported an average return (net of fees) on their endowment assets of 11.2 percent. In this infographic, we report the key highlights from the...

2025 Policy Outlook: What Endowments and Foundations Should Know

On January 30th, Commonfund Institute, in partnership with the National Association of College and University Business Officers (NACUBO), the Council on Foundations (COF), and the Council for...

Winter Wonders: Warming Reads for the Season

Commonfund Institute is excited to share our annual winter reading list, curated by our colleagues. These selections explore themes of personal transformation, resilience, and identity with stories...

Responsible Investing: Terminology and Background

In recent years there has been a rise in available investment strategies and governance considerations to help investors adapt to evolving challenges in the responsible investing space. Norms and...

Key OCIO Evaluation Factors

When choosing an Outsourced Chief Investment Officer (OCIO), there are eight key factors an organization should consider for increasing the likelihood of a good fit and successful partnership. These...

Considerations for Smaller Institutions Seeking OCIO

Recent data from the Commonfund Benchmarks Studies indicate that smaller nonprofit institutions are using an Outsourced Chief Investment Officer (OCIO) for investment management more often than their...

Understanding the OCIO Governance Model

Explore the intricate governance dynamics within Outsourced Chief Investment Officer (OCIO) models and how they shape investment outcomes.

Discover Your Next Summer Read!

Summer 2024 is finally here, and Commonfund has curated a list of illuminating books to make your sunny days even brighter! Perfect for beach days or cozy retreats, these selections celebrate the...

Viewpoint | Top Concerns for Independent Schools

For the first time since the inception of the Study, the FY2023 Commonfund Benchmarks Study® of Independent Schools (CSIS) report asked respondents to identify the top concerns for their...

Viewpoint | The Main Purpose of Independent School Endowments

The FY2023 Commonfund Benchmarks Study® of Independent Schools (CSIS) prompted survey respondents to select the main purpose of their school’s endowment for the first time.

Study of Independent Schools - Key Highlights [Infographic] 2023

For fiscal year 2023, independent schools reported an average return (net of fees) on their endowment assets of 9.2 percent. In this infographic, we report the key highlights from the 2023 Commonfund...

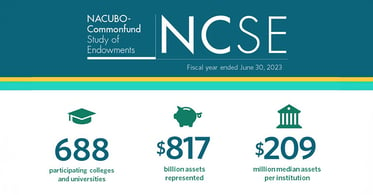

Study of Endowments - Key Highlights [Infographic] 2023

For fiscal year 2023, U.S. higher education endowments reported an average return (net of fees) on their endowment assets of 7.7 percent. In this infographic, we report the key highlights from the...

The NACUBO Endowment Study: A 50-Year Retrospective

Documenting a Period of Unprecedented Change The NACUBO-Commonfund Study of Endowments (NCSE) for fiscal year 2023 marks the 50th consecutive year that NACUBO has published a Study of the endowments...

Four Things we Learned from Foundation Leaders

Following the release of the Council on Foundations–Commonfund Study of Investment of Endowments for Private and Community Foundations (the “Study”), Commonfund Institute hosted a three-part Coffee...

A Winter Wonderland of Books to Warm Your Soul and Inspire Creativity!

Commonfund Institute is excited to share our staff-curated reading list this winter, filled with stories that warm the heart and spark imagination. We extend our warmest wishes for a season filled...

Viewpoint | Analyzing Community Foundation Data by Region

For the 2022 Council on Foundations - Commonfund Study of Foundations, we provided an analysis of community foundation data by five geographic regions. Community foundations lend themselves to this...

Study of Foundations - Key Highlights [Infographic] 2022

In this infographic, we report the key highlights from the 2022 Council on Foundations-Commonfund Study of Foundations. For the year ended December 31, 2022, participating foundations reported an...

Soak Up Some Sun with One of Our Favorite Books!

Commonfund Institute is excited to share our must-reads for summer 2023. These books are the perfect partner for some fun in the sun, or some time relaxing in the shade. We hope you have a great...

Study of Independent Schools - Key Highlights [Infographic] 2022

For fiscal year 2022, independent schools reported an average return (net of fees) on their endowment assets of -11.3 percent. In this infographic, we report the key highlights from the 2022...

Get Cozy This Winter with One of Our Favorite Books!

Commonfund Institute is excited to share our most recent picks for our annual winter reading list, gathered from our Commonfund colleagues. We send you our warmest wishes for the holidays and can’t...

Investment Objectives? Not Always.

The 2021 Council on Foundations—Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF) marked our tenth year in collaboration with the Council on Foundations. The...

Asset Allocation: Controlling for the Variables

Our 2021 Council on Foundations-Commonfund Study of Foundations marked our 10th year in collaboration with Council on Foundations and the Commonfund Institute to measure, analyze and document the...

Research Shows 10-Year Returns for Foundations Reach Highest Point

Our 2021 Council on Foundations-Commonfund Study of Foundations marked our 10th year in collaboration with Council on Foundations and the Commonfund Institute to measure, analyze and document the...

Key Governance Factors for Higher Education Prove to Be Quantifiable

A board self-assessment is one of the most commonly used tools to evaluate how effectively a board performs. The purpose of a board self-assessment is to help board members analyze their present and...

21st CASE Commonfund College and University Foundation Award

Since 2001, the CASE Commonfund College and University Foundation Award has recognized individuals who have contributed to the advancement of the college and university foundation field.

Forum 2022 Key Statistics [Infographic]

Commonfund recently hosted its 24th annual Commonfund Forum, March 16-18th, in Orlando, Florida. The event brought together institutional investors to engage in a three-day conference to explore...

Ten Tips for Successful Meetings

On November 9, 2021, Commonfund Institute held its first virtual Investment Stewardship Academy session since the program began nearly 30 years ago. The course focused on committee decision-making...

Viewpoint | Diverse Managers

The inclusion of diverse managers in institutional portfolios offers access to a broader array of investment talent. Data indicate that foundations are beginning to recognize and act on this...

Endowment Management and the Three Primary Responsibilities of a Board

The fourth blog in the “Six Ps of Investment Stewardship” series addresses People, specifically how boards function within an organization. To learn more about the first four principles in the series...

Constructing Investment Portfolios for Endowments

There are fundamental principles of effective endowment management that we have organized into what we call “the 6 Ps of Investment Stewardship” – Purpose, Policy, Process, Portfolio, People and...

CASE Commonfund College and University Foundation Award 20th Anniversary

For the past 20 years, the CASE Commonfund College and University Foundation Award has recognized individuals who have contributed to the advancement of the college and university foundation field.

Fareed Zakaria Dissects the Challenges Shaping the Post-Pandemic World

The theme for Commonfund Forum 2021 was “Transformation.” The objective of the agenda was to deliver timely, useful content on core subjects related to nonprofit endowment and financial management...

Spending at Independent Schools Impacted by COVID-19

The effects of COVID-19 have been felt across the entire nonprofit sector and the independent schools’ community is no different. For the Commonfund Benchmarks Study® of Independent Schools (CSIS)...

Viewpoint | Why are Gifts to Endowments Declining?

For the third straight year, Commonfund Benchmarks Study® of Independent Schools (CSIS) participants reported average new gifts to endowment declined, this year falling to an average of $1.2 million...

Board of Trustees and Investment Committee Roles and Responsibilities

There are fundamental principles of effective endowment management that we have organized into what we call “the 6 Ps of Investment Stewardship”– Purpose, Policy, Process, Portfolio, People and...

Balancing Purpose, Payout, and Permanence: A Strategy Guide for Foundations

In partnership with the Council on Foundations, the National Center for Family Philanthropy has released Balancing Purpose, Payout, and Permanence: A Strategy Guide. Commonfund Institute is very...

Five Key Points of the Investment Policy Statement

The central document guiding the management of a nonprofit institution’s endowment—essentially, the strategic plan of the investment committee—is the investment policy statement (IPS). The IPS should...

10 Tips for Stewarding People Remotely

Six key words – Purpose, Policy, Process, Portfolio, People, and Perspective – form a framework for effective endowment stewardship. As trustees, investment committee members, and senior management...

Purpose: What is an Endowment?

A critically important asset for many nonprofit organizations is their endowment, sometimes referred to by a different name such as long-term investment fund. So important is this pool of financial...

Looking at Gender Lens Investing

What is Gender Lens Investing? Gender lens investing has garnered significant traction in the last decade. Broadly speaking, it aims to achieve financial returns and benefit women. Given the breadth...

Summer Reading from the Stewardship Academy Faculty

As the last week of June approaches, investment stewards begin to prepare for summer – a time for relaxing, reflecting, and reading. We asked faculty members from the Investment Stewardship Academy,...

Surprising Stewardship Lessons from the Miracle on the Hudson

“When you’ve suffered a complete loss of engine thrust over the largest city in America, you must act quickly and independently to address the developing situation. But, you must also trust in the...

7 Major Findings - Commonfund Benchmarks Study of Healthcare Organizations

Fifty-six healthcare organizations participated in the 2016–2017 Commonfund Benchmarks Study® of Healthcare Organizations. These organizations reported an average investable asset pool of $2.1...

Viewpoint: Responsible Investing - Read All About It

The new and newsworthy in this year’s Council on Foundations–Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF) is headlined by responsible investing. No other...

The Four P’s of Investment Decisions: Lessons from the Commonfund Institute

Three days after becoming Executive Director of the Commonfund Institute, I found myself at Yale University in New Haven giving welcoming remarks at our annual educational program. Although I will...

Despite Strong FY2017, Endowments Report Decline in Ten-Year Return

Despite 12.2 percent return for FY2017, educational endowments report a decline in their 10-Year return while large institutions lead increase in effective spending rate Data gathered from 809 U.S....

A Primer on Outsourced Investment Management

Once seen primarily as a solution for small institutions with limited resources, outsourced investment management is now widespread, with a broad range of long-term investors – including those with...

Constraints Faced by Healthcare Endowments

As a result of the evolving landscape of the healthcare industry, organizations are increasingly being shaped by pressures affecting both the revenue and expense sides of the income statement. On one...

Healthcare Endowment Management: 3 Questions to Consider

Mounting cost pressures are forcing small and mid-sized nonprofit healthcare organizations to consider adopting endowment management practices similar to those used elsewhere in the nonprofit sector....

How Does Board Structure Affect Performance?

The structure of a board has an important influence on its effectiveness, and being cognizant of these matters is essential to improving a board’s performance. In this article, we’ll discuss four...

Fiduciary Responsibility: A Board’s Purpose and Roles

Excellent boards are made, not born. Achieving excellence in board governance requires success in four crucial areas: capable leadership, a sound organizational structure, attention to fiduciary...

Integration of ESG Factors in Practical Steps

In the current climate of slow global economic growth and resource constraints at many institutions, integration of ESG considerations in an organization’s investment portfolio may be perceived as a...

Responsible Investing for Foundations

Commonfund and the Council on Foundations are thrilled to announce the release of the 2016 Council on Foundations – Commonfund Study of Responsible Investing. It is the largest and most detailed...

Operating Charity Implements a Risk-Based Investment Policy

An operating charity in the Northeast is in the process of implementing a risk-based investment policy for its $30 million endowment. The organization’s seven-member Investment Committee includes...

Deciding if an OCIO Provider is Right: Three Factors to Consider

There are three main factors an institution will need to weigh in deciding if working with an outsourced PROVIDER is right for them. Those are: Degree of Discretion: What role do the institution’s...

What is an OCIO?

Outsourced investment management, once primarily a solution for small institutions with limited resources, is now used by a broad range of long-term investors. When properly implemented, outsourcing...