Research Center

Select a Topic:

Featured

Perspectives | Insights Blog

Navigate Now: Takeaways from Commonfund Forum 2026

Commonfund Forum 2026, held in Hollywood, FL, brought together registrants from some 263 institutions with more than $238 billion in assets representing 38 states, 2 territories, and 3 foreign...

Featured

Perspectives | Insights Blog

Study of Endowments - Key Highlights [Infographic] 2025

POPULAR ARTICLES

Investment Strategy | Articles

Mind the Gap: The Strategic Risk of Skipping a Vintage in Private Equity

Private equity (inclusive of buyouts, growth equity, and venture capital) remains a compelling long-term asset class, but recent periods of muted distributions and below-average returns have created...

Perspectives | Press Releases

2025 HEPI Report Released

Inflation for U.S. Higher Education Institutions Rises 3.6% in Fiscal 2025, Up from Fiscal 2024 Rate Norwalk, Conn., December 11, 2025 – Data from the annual Higher Education Price Index® (HEPI) show...

Investment Strategy | Videos

Chief Investment Officers Share Their Thoughts at Forum 2025

Commonfund hosted its annual Commonfund Forum 2025, March 9-11th, in Orlando, Florida. The agenda included a range of sessions on relevant topics for institutional investors. This Forum Spotlight...

Stay connected with the Insights Blog

Featured

Perspectives | Press Releases

Commonfund Study of Independent Schools Released for FY2025

Gains Amid Uncertainty: Independent Schools Report 11.5% Return on Endowment Assets for FY2025; 10-Year average returns rise to 7.7% New Gifts to Endowments Rebound, Use of OCIO Increased Norwalk,... Learn Moreeducational-endowments

Diversity | Spotlight

Metis Global Partners

In celebration of Black History Month, Commonfund Institute Executive Director, George Suttles, and Commonfund Director, Nicole Melwood, interview Machel Allen, President and CIO of Metis Global...

educational-endowments

Market Commentary | Insights Blog

Commonfund Perspective on the Russian Invasion of Ukraine

Key Takeaways As widely anticipated, Russia invaded Ukraine on Thursday, February 24th, causing volatility to spike across the capital markets globally. By the closing bell in the U.S., however,...

educational-endowments

Investment Strategy | Insights Blog

Commonfund's Third Annual Invitational Diverse Manager Day

From February 9th-11th, Commonfund held its third Diverse Manager Day event, with 20 managers identified through its Diverse Manager Portal and other sources. These diverse managers1 cover a broad...

cultural_organization

Governance And Policy | Articles

Strategic Planning May Be Saving the Day for Cultural Institutions

Given the disruption to “normalcy” brought on by the COVID-19 pandemic and the racial justice issues that erupted in the U.S. in 2020 and continue today, some may say it has been a time of reckoning...

educational-endowments

Market Commentary | Insights Blog

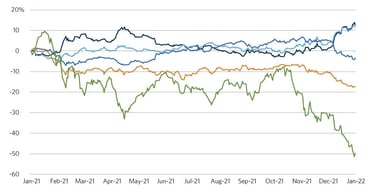

Tech Stocks Lead the Market Decline in Early 2022

2022 began with one of the worst market performance periods since 2009. While the tech-heavy NASDAQ index looks to finish January with a loss of around 10 percent, value equities will likely record...

private_family_foundation

Private Equity | Private Equity Insights

2022 Private Markets Investor Sentiment Survey

Institutional investors continue to increase allocations to private strategies – but with some caution and an increasingly targeted approach. Commonfund Capital’s fifth annual private markets...

community_foundation

Governance And Policy | Articles

Aligning Endowments & Investments with Foundation Values

Reflections from the Council on Foundations' webinar The 2020 Council on Foundations-Commonfund Study of Investment of Endowments for Private and Community Foundations (CCSF) is the field’s most...

Diversity | Insights Blog

Celebrating and Honoring Rev. Dr. Martin Luther King Jr.

On January 17, 2022, the nation will celebrate the legacy and leadership of Rev. Dr. Martin Luther King Jr. Dr. King—a graduate of Morehouse College—was a Baptist minister, a peace seeking civil...

educational-endowments

Market Commentary | Insights Blog

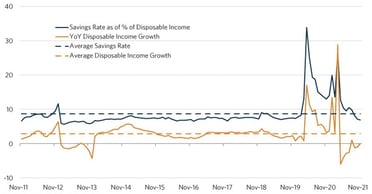

Consumer Savings and Disposable Income Under Pressure

As 2021 comes to an end, we enter 2022 with a good dose of uncertainty in the markets as the Fed begins to reduce and ultimately removes its accommodative policy which has been in place since the...

Perspectives | Articles

Commonfund Asset Management Announces Organization Changes

As a leading Outsourced CIO firm serving nonprofit organizations, we consistently re-evaluate our organization and processes looking for opportunities to improve how we work and serve our clients. To...

community_college

Perspectives | Insights Blog

In Remembrance: Verne O. Sedlacek

A Gentle Giant The Commonfund community was shocked and saddened this week by the news of the sudden passing of our former President and CEO, Verne Sedlacek at the age of 67.

Market Commentary | Insights Blog

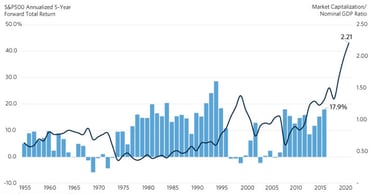

Sky High Valuations Could Spell Weaker Forward Returns

When we look for potential roadblocks that could spoil the breakneck pace of capital markets, the first risk that comes to mind is record-high valuations. While inflation risks have become more...

Commonfund OCIO Point of View