Viewpoint | Top Concerns for Community Foundations: Donor-Advised Fund Regulations

Potential regulations on donor-advised funds (DAFs) and their effect on the philanthropic sector was the most-cited concern among community foundations in this year’s Council on...

Policy Areas Impacting Endowments and Foundations Today

Commonfund Institute aims to lift up and provide insight into how significant policy developments may impact nonprofit institutional investors. In the prior article, we covered implications of the...

Affirmative Action: Implications for Endowments, Foundations, and the Broader Industry

Affirmative action, a practice used since the 1960s to edge toward equity and address historical and ongoing injustice through higher education attainment, was struck down last month by the Supreme...

The Value of Collective Learning: Takeaways from the Commonfund Institute 2023 Investment Stewardship Academy

In June 2023, the Commonfund Institute hosted 36 nonprofit leaders on the campus of Yale University for our premier educational event – the Investment Stewardship Academy (ISA). Much has changed...

Celebrate! 25 Years of NBOA: The Endowment Landscape

A deep dive into independent school endowment's trends FY2005-FY2022, including analysis of asset allocation, performance, spending and contributions, plus a perspective on future developments....

Taking a Regional Perspective

The Commonfund Benchmarks Study® of Independent Schools (CSIS) report provides and analysis of the investment and governance policies and practices of U.S. independent day and boarding schools. For...

Seven Promising Practices for the Future of Higher Education

Even before the pandemic, the college/university business model was under scrutiny. With rising tuition costs outpacing living wages, and student debt burdens crippling students, institutions of...

Viewpoint: The Move in Marketable Alternative Strategies

In the 2021 Commonfund Benchmarks Study® of Independent schools we continue to see the allocation to marketable alternative strategies decline, raising questions about why and whether it will...

Viewpoint: The Short and Long of It

There’s a lot to consider in each annual Commonfund Benchmarks Study® of Independent Schools, e.g., asset allocation, spending, gifts and donations, responsible investing and more. This year is no...

Commonfund Asset Management Announces Organization Changes

As a leading Outsourced CIO firm serving nonprofit organizations, we consistently re-evaluate our organization and processes looking for opportunities to improve how we work and serve our clients. To...

Viewpoint | The Climate for Responsible Investing is Changing

Climate change is a source of concern around the world—from environmental scientists to government policymakers to ordinary citizens. In a more figurative sense, the climate for responsible investing...

Viewpoint | The Ever-Evolving 80/20

On average over the past decade, independent schools participating in the Commonfund Benchmarks Study® of Independent Schools have maintained an asset allocation that stays within a few percentage...

Resource Management for College and Universities

William Massy has spent his entire career at the intersection of academia and administration, as a microeconomist; professor, dean and CFO at Stanford University; author; and now, an independent...

Increasing Giving During COVID-19: Thoughts for Philanthropy

The Council on Foundations has acted to support its members, their nonprofit partners, and the people and communities hit hardest by the impacts of COVID-19 by asking members to sign a pledge of...

Higher Ed in the Age of COVID-19

Commonfund convenes an expert panel to take on the short- and intermediate-term threats that higher education confronts in the face of a national emergency the likes of which have not been seen for...

How Can Trustees Achieve Intergenerational Equity in the Face of Rising Costs?

The Commonfund Higher Education Price Index® (HEPI) is an inflation index for colleges and universities. It has been calculated since 1983 and includes inflation data going back to 1961. Commonfund...

Viewpoint | Responsible Investing Practices: Evolution, Not Resolution

In recent years, responsible investing has received mounting levels of attention from all quarters of the investment management field, from institutional investors large and small to global asset...

Optimize Luck

"Instead of just optimizing for skill, why don’t we optimize for luck? " Optimize Luck originated in a group discussion I facilitated for the Investment Institute, a membership organization for...

Viewpoint: Actions Speak Louder than Data

In this Council on Foundations-Commonfund Study of Foundations viewpoint, it's about analyzing and interpreting the data we've collected. What do they tell us? What trends are emerging? How are...

Dynamic Workforce = Dynamic Portfolios

The Surprising Outcomes When Diverse Groups and Homogeneous Groups Tackle the Same Problem In late 2018, Commonfund established a Diversity Office with the objective of benefiting from the strengths...

The Global Economy and the Return of Risk

How to think about tariffs, deficits, valuations, leverage, growth and other issues What signals should institutions be mindful of as they make portfolio decisions in the current environment? A panel...

Viewpoint: Looking Back, Moving Forward - A Decade of Insight from CSIS

Fiscal 2009 was an epochal year. In March, the stock market decline wrought by the financial crisis and Great Recession reached its nadir as investors sensed the worst had passed. With the turn in...

Viewpoint: Being Objective

Every year, the NACUBO-Commonfund Study of Endowments® (NCSE) reports new data—on investment returns, asset allocation, risk management, donations and gifts, and much more. But some data points are...

Nonprofit Board Governance Best Practices

Since our founding in 1971, a core element of the Commonfund mission has been to provide insights on a broad range of governance, policy and investment challenges. An engaged governing board is...

Hedge Fund Land: An Expensive Amusement Park?

In a series of articles, we have addressed two recent investment “fatigues” experienced by institutional investors: Active vs. Passive; and Global (ACWI) vs. US benchmarks. In this article, we tackle...

Viewpoint: Counting the Cost

How much does investment management cost? Fiduciaries, donors and stakeholders at endowed institutions have a strong interest in finding a good answer to this question, particularly in this era of...

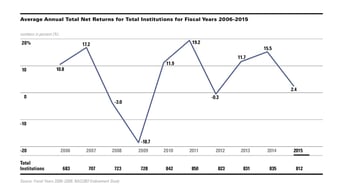

Viewpoint: A Firmer Foundation

How long is the long term? A year ago, private and community foundations appeared to many observers to have recovered from the losses suffered in the 2008–09 global financial crisis. Double-digit...

The Big Picture: Integrating Investments, Finance and Development

Most things function a lot better when all the moving parts work together—nonprofit institutions included. The synergies afforded by collaboration across organizational boundaries may be the most...

Viewpoint: Seven Years On

How long is the long term? A year ago, endowments appeared to many observers to have recovered from the losses suffered in the 2008-09 global financial crisis. Double-digit investment returns had...

Impact Investing: Balancing the Best of Responsibility & Opportunity

Impact investing is showing growth around the world. According to the most recent J.P. Morgan/Global Impact Investing Network Impact Investor Survey, the number of institutional investors engaging in...

Viewpoint: Changing Our Minds

It is often said that we live in a world of change, but it is surprising how slowly that change can occur. Seven years after the onset of the Great Recession, many business school students are still...

Smart money, crowded trades?

For investors building multi-manager portfolios, a look at an alternative hedge fund beta. Approaches to stock selection vary widely across the hedge fund universe, even among managers practicing the...

Greenhouse Effect

Investment returns of less well-diversified portfolios have flourished in the accommodative market environment created by central banks. But what will happen when rates rise? In the last five years,...

Working capital: challenge and opportunity

On campus, the thinking about operating asset management is changing with the times. In the wake of the 2008 financial crisis and Great Recession, liquidity was the primary concern on university...

Viewpoint: A Different Kind of Climate Change

How have cultural, religious and social service institutions’ investment portfolios changed in response to the financial and market environment that has prevailed over the last several years? While...

ESG and Your Institution: Doing Well by Doing Good

Investing according to environmental, social and governance principles is maturing into a distinct discipline. Robust research results dispute the conventional wisdom about performance trade-offs. If...

Tour de World: Global Equity Investing Now