A Closer Look at Higher Education Endowments Less Often in the Spotlight

Earlier this year, Commonfund, in partnership with the National Association of College and University Business Officers (NACUBO), released the 2024 NACUBO-Commonfund Study of Endowments (NCSE, or,...

A Closer Look at Private Family Foundations

Commonfund, in partnership with the Council on Foundations (COF), recently released the 2024 Council on Foundations-Commonfund Study of Investment of Endowments for Private and Community Foundations...

Four Takeaways from the 2025 Nest Climate Campus Event

At this year’s Nest Climate Campus event, held September 23-25, 2025, during NYC’s Climate Week, the conversation around climate shifted—from ideals to execution, and from rhetoric to financial and...

What a Government Shutdown Means for the Nonprofit Sector: Why It Matters to Boards

At midnight on October 1st, the U.S. government shut down after Congress failed to pass a short-term funding bill. The shutdown is a culmination of contentious policy differences between Republicans...

Commonfund Holds Third Convening for Foundations that Support Higher Education

Last month, Commonfund hosted its third Commonfund Convenes event dedicated to advancement of investment knowledge for institutionally-related foundations (IRFs). The latest workshop focused...

Higher Ed in 2025: Top 5 Business Concerns and How Institutions Can Respond

For the past four years, NACUBO has surveyed chief business officers and other financial and administrative professionals about the challenges that confront them—and how they are working to support...

A Closer Look at Health Conversion Foundations

Commonfund, in partnership with the Council on Foundations (COF), recently released the 2024 Council on Foundations-Commonfund Study of Investment of Endowments for Private and Community Foundations...

Health Conversion Foundations: Preserving Community Health in a Changing Landscape

In the evolving terrain of American healthcare, health conversion foundations, also known as health legacy foundations, have emerged as powerful stewards of community well-being. These philanthropic...

Growing Use of OCIO by Private and Community Foundations

In the annual Council on Foundations-Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF; the "Study") data show concerns are rising regarding the ability to...

Themes from the 2025 FAOG Conference for Community Foundations

Last week in Oklahoma City the 2025 FAOG (Finance, Administration & Operations Group) Conference convened experts and over 300 delegates from community foundations around the country to explore the...

A Closer Look at Long-term Returns

In the annual Council on Foundations-Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF; the "Study") data was collected on longer-term returns for the first...

Study of Foundations - Key Highlights [Infographic] 2024

In this infographic, we report the key highlights from the 2024 Council on Foundations-Commonfund Study of Foundations. For the year ended December 31, 2024, participating foundations produced...

In Memoriam: Mamak Shahbazi

It is with great sadness that we announce the passing of Commonfund Board Member, Mamak Shahbazi. Mamak was a dedicated and talented board member and a great friend to the firm, its clients, and...

Summer Literary Journeys: A Pathway of Pages into Growth, Grit, and Collective Imagination

Commonfund Institute is excited to share our annual summer reading list, thoughtfully curated with recommendations from our Commonfund colleagues. Inspired by the spirit of the summer solstice –...

Investment Stewardship Academy: Takeaways for Navigating an Evolving Landscape

For over 30 years, Commonfund Institute has hosted the Investment Stewardship Academy (ISA) to bring institutional investors together to learn, collaborate, and better support the missions they...

A Closer Look at Minority-Serving Higher Education Institutions

Following the release of the 2024 NACUBO-Commonfund Study of Endowments (NCSE), Commonfund conducted a focused analysis of data reported by the 97 participating Minority-Serving Institutions (MSIs)....

The Power of We: How Collective Learning and Data Sharing Make Us Stronger

In the midst of today’s volatile economic and policy landscape, collective learning has become not just beneficial but essential for institutional investors. The nonprofit sector as a whole is facing...

Study of Independent Schools Marks its 20-Year Milestone

In 2005, what was then called the National Business Officers Association (now NBOA: Business Leadership for Independent Schools) had reached the seventh anniversary of its founding. Having its...

Key Takeaways from the 2025 CASE Conference for College & University Foundations

Commonfund Institute provides analysis and thought leadership across the nonprofit institutional investing space. But investments don’t happen in a vacuum – they are part of the institutional...

Increased Use of OCIO for Independent Schools

Data from the 2024 Commonfund Benchmarks Study of Independent Schools (CSIS) show that schools across the size spectrum reported an increase in use of an outsourced chief investment officer (OCIO)...

In Pursuit of Intergenerational Equity: Inflation is the Big Headwind

For all the differing goals and objectives laid out by colleges and universities for their endowments, one that is universally shared is intergenerational equity, or the concept that endowed...

A Closer Look at Religious Independent Schools

Earlier this year, Commonfund Institute released the 20th annual Commonfund Benchmarks Study of Independent Schools (“CSIS” or the “Study”), reporting on key investment governance trends and insights...

Four Challenges Impacting Nonprofits Today

Commonfund OCIO President and CEO, Tim Yates, sat down with panelists, Janine Anthony Bowen, Trustee of Georgia State University Foundation and Partner at BakerHostetler, Dr. Alison Morrison-Shetlar,...

Reflections on the NACUBO-Commonfund Study of Endowments 2024

Mid-February can be a challenging time of year. For sports fans, the lull between the end of the football season and the beginning of baseball season can feel like an eternity. For many, February...

Independent Schools Increasingly Depend on Endowments for Operations

Amidst concerns about student enrollment, fundraising, inflation, market volatility, and more, independent schools are relying more on their endowments to cover any gaps. Data from the 2024...

Key Takeaways from Forum 2025

Commonfund Forum 2025, held in Orlando, brought together registrants from some 370 institutions with more than $800 billion in endowed assets representing 42 states and five foreign countries in a...

Forum 2025 Key Statistics [Infographic]

Commonfund recently hosted its 27th annual Commonfund Forum, March 9th-11th, in Orlando, Florida. The event brought together institutional investors to engage in a three-day conference to explore...

Top Concerns in Higher Education

In the 2024 NACUBO-Commonfund Study of Endowments, a new area of inquiry was asked to participating institutions to identify their top two concerns from an inclusive list of 20 alternatives from...

Study of Independent Schools - Key Highlights [Infographic] 2024

For fiscal year 2024, independent schools reported an average return (net of fees) on their endowment assets of 12.3 percent. In this infographic, we report the key highlights from the 2024...

A Closer Look at Historically Black Colleges and Universities

Earlier this year, in partnership with the National Association of College and University Business Officers (NACUBO), Commonfund released the 2024 NACUBO-Commonfund Study of Endowments (NCSE). The...

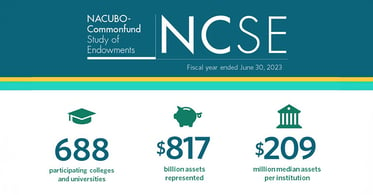

Study of Endowments - Key Highlights [Infographic] 2024

For fiscal year 2024, U.S. higher education endowments reported an average return (net of fees) on their endowment assets of 11.2 percent. In this infographic, we report the key highlights from the...

2025 Policy Outlook: What Endowments and Foundations Should Know

On January 30th, Commonfund Institute, in partnership with the National Association of College and University Business Officers (NACUBO), the Council on Foundations (COF), and the Council for...

Winter Wonders: Warming Reads for the Season

Commonfund Institute is excited to share our annual winter reading list, curated by our colleagues. These selections explore themes of personal transformation, resilience, and identity with stories...

Celebrating Native American Heritage Month: A Resource Guide

Commonfund, in conjunction with our Native American Heritage Month subcommittee, has created a resource guide to help all of us celebrate the contributions of Native Americans and Indigenous people...

How Nonprofits Eliminate the Noise to Strategically Achieve Long-Term Success

Commonfund has been partnering with boards and investment committees to design and implement investment structures that support and maintain intergenerational equity, the purchasing power of their...

Celebrating Hispanic Heritage Month: A Resource Guide

National Hispanic Heritage Month (Spanish: Mes Nacional de la Herencia Hispana) is an annual celebration commemorating the history, contributions, and culture of U.S. Latino and Hispanic communities.

Commonfund Convenes: Foundations that Support Higher Education

Last month, Commonfund OCIO hosted an inaugural convening of institutionally-related foundations (IRFs) - foundations that are a separate entity and serve as administrative and often fundraising...

Investment Stewardship Academy 2024: Lifetime Learning for Nonprofit Leaders

Commonfund Institute’s Investment Stewardship Academy (“ISA”), an intensive workshop for institutional investors and leaders that has been convening since 1993, came together on Yale’s campus in New...

Fiscal Year-End and Mid-Year 2024 Market and Investment Review

Over the last 12 months, the global stock markets demonstrated remarkable resilience and growth despite several challenges, including persistently high interest rates, geopolitical instability, and...

Discover Your Next Summer Read!

Summer 2024 is finally here, and Commonfund has curated a list of illuminating books to make your sunny days even brighter! Perfect for beach days or cozy retreats, these selections celebrate the...

Celebrating Pride Month: A Resource Guide

Pride month is the promotion of the self-affirmation, dignity, equality and increased visibility of lesbian, gay, bisexual, transgender, intersex and asexual people (LGBTQIA+) as a social group....

A Closer Look at Historically Black Colleges and Universities

Earlier this year, in partnership with the National Association of College and University Business Officers (NACUBO), Commonfund released the 2023 NACUBO-Commonfund Study of Endowments (NCSE),...

Celebrating Asian American and Pacific Islander Heritage Month

Asian American and Pacific Islander Heritage Month got its start as a congressional bill, inspired by Black History Month and Hispanic Heritage Month, with the mission of bringing attention to the...

A Closer Look at Community Colleges

Earlier this year, Commonfund, in partnership with the National Association of College and University Business Officers (NACUBO), released the 2023 NACUBO-Commonfund Study of Endowments (NCSE),...

Key Takeaways from the 2024 CASE Conference for College & University Foundations

Commonfund Institute provides analysis and thought leadership across the non-profit institutional investing space. But investments don’t happen in a vacuum – they are part of the institutional...

A Closer Look at Religious Independent K-12 Schools

Earlier this year, Commonfund Institute released the 2023 Commonfund Benchmarks Study® of Independent Schools (CSIS), reporting on key investment governance trends and insights over the July 1, 2022...

Viewpoint | Top Concerns for Independent Schools

For the first time since the inception of the Study, the FY2023 Commonfund Benchmarks Study® of Independent Schools (CSIS) report asked respondents to identify the top concerns for their...

Viewpoint | The Main Purpose of Independent School Endowments

The FY2023 Commonfund Benchmarks Study® of Independent Schools (CSIS) prompted survey respondents to select the main purpose of their school’s endowment for the first time.

Commonfund Forum 2024: 5 Key Takeaways

Commonfund Forum 2024 brought together 500+ attendees representing institutions with $890 billion in endowed assets in a 2.5-day conference. The event, themed “With Intention”, featured a...

Study of Independent Schools - Key Highlights [Infographic] 2023

For fiscal year 2023, independent schools reported an average return (net of fees) on their endowment assets of 9.2 percent. In this infographic, we report the key highlights from the 2023 Commonfund...

Study of Endowments - Key Highlights [Infographic] 2023

For fiscal year 2023, U.S. higher education endowments reported an average return (net of fees) on their endowment assets of 7.7 percent. In this infographic, we report the key highlights from the...

The NACUBO Endowment Study: A 50-Year Retrospective

Documenting a Period of Unprecedented Change The NACUBO-Commonfund Study of Endowments (NCSE) for fiscal year 2023 marks the 50th consecutive year that NACUBO has published a Study of the endowments...

Celebrating Black History Month: A Resource Guide

Black History Month is an annual celebration of achievements by African Americans and a time for recognizing their central role in U.S. history. Also known as African American History Month, the...

A Winter Wonderland of Books to Warm Your Soul and Inspire Creativity!

Commonfund Institute is excited to share our staff-curated reading list this winter, filled with stories that warm the heart and spark imagination. We extend our warmest wishes for a season filled...

Viewpoint | Analyzing Community Foundation Data by Region

For the 2022 Council on Foundations - Commonfund Study of Foundations, we provided an analysis of community foundation data by five geographic regions. Community foundations lend themselves to this...

Commonfund on the Road: Insights from our Portland Roundtable

For over 50 years, Commonfund has been working with boards and committee members on designing and implementing an investment structure that supports maintaining intergenerational equity or the...

Foundation Leaders Highlight Successful Long-Term Investment Strategies during Turbulent Times

On September 27, 2023, Commonfund Institute hosted a webinar, “Highlights of the 2022 CCSF: A Deep Dive with Foundation Leaders.” The panel featured Elizabeth McGeveran, Director of Investments at...

Bright Spots for Foundations in 2022 and Early 2023

In a period where individual giving was down, historic levels of inflation put pressure on markets and the real economy, private and community foundations were asked to provide more resources to...

Study of Foundations - Key Highlights [Infographic] 2022

In this infographic, we report the key highlights from the 2022 Council on Foundations-Commonfund Study of Foundations. For the year ended December 31, 2022, participating foundations reported an...

Observations from the 2023 NACUBO Annual Meeting

Last month, I had the pleasure of attending the NACUBO Annual Meeting in Orlando, FL, where nearly 2,000 representatives from higher education institutions across North America came together to share...

Commonfund on the Road: Insights from our Seattle Roundtable

Commonfund OCIO recently hosted a roundtable luncheon in Seattle, WA, for local nonprofit leaders. During our time together, we discussed how institutions can attain intergenerational equity in their...

Fiscal Year-End and Mid-Year 2023 Market and Investment Review

The end of fiscal year 2023, and mid-point of the calendar year, marks the end of the pandemic years. At this point, many have returned to the workplace, at least part time, in-person meetings have...

Soak Up Some Sun with One of Our Favorite Books!

Commonfund Institute is excited to share our must-reads for summer 2023. These books are the perfect partner for some fun in the sun, or some time relaxing in the shade. We hope you have a great...

The Investment Stewardship Academy Returns to Yale This June

The Investment Stewardship Academy, Commonfund Institute’s three-day intensive academic program is set to resume in-person June 20-23 for the first time since 2019.

Study of Independent Schools - Key Highlights [Infographic] 2022

For fiscal year 2022, independent schools reported an average return (net of fees) on their endowment assets of -11.3 percent. In this infographic, we report the key highlights from the 2022...

Celebrating Women's History Month

Women's History Month 2023 | Celebrating Women Who Tell Our Stories Women’s History Month is an annual declared month that highlights the contributions of women to events in history and contemporary...

Forum 2023 Key Statistics [Infographic]

Commonfund recently hosted its 25th annual Commonfund Forum, February 13-15th, in Boca Raton, Florida. The event brought together institutional investors to engage in a three-day conference to...

Commonfund Forum 2023: 5 Key Takeaways

Commonfund recently hosted its 25th annual Commonfund Forum in Boca Raton, Florida. The event, themed “Still We Rise”, brought together 500+ attendees representing institutions with almost $850...

Get Cozy This Winter with One of Our Favorite Books!

Commonfund Institute is excited to share our most recent picks for our annual winter reading list, gathered from our Commonfund colleagues. We send you our warmest wishes for the holidays and can’t...

Investment Objectives? Not Always.

The 2021 Council on Foundations—Commonfund Study of Investment of Endowments for Private and Community Foundations® (CCSF) marked our tenth year in collaboration with the Council on Foundations. The...

21st CASE Commonfund College and University Foundation Award

Since 2001, the CASE Commonfund College and University Foundation Award has recognized individuals who have contributed to the advancement of the college and university foundation field.

In Remembrance: Laurance (Laurie) R. Hoagland, Jr.

The Commonfund community was saddened to learn of the recent passing of Laurie Hoagland. Laurie served as a member of the Commonfund Board from 2000-2012 and was Board Chair from 2010-2012.

10 Key Takeaways from Commonfund Forum 2022

Commonfund recently hosted its 24th annual Commonfund Forum in Orlando, Florida. The event brought together 200+ institutional investors from the U.S., the Virgin Islands, and Canada in a 2.5 day...

Forum 2022 Key Statistics [Infographic]

Commonfund recently hosted its 24th annual Commonfund Forum, March 16-18th, in Orlando, Florida. The event brought together institutional investors to engage in a three-day conference to explore...

Commonfund Perspective on the Russian Invasion of Ukraine

Key Takeaways As widely anticipated, Russia invaded Ukraine on Thursday, February 24th, causing volatility to spike across the capital markets globally. By the closing bell in the U.S., however,...

Celebrating and Honoring Rev. Dr. Martin Luther King Jr.

On January 17, 2022, the nation will celebrate the legacy and leadership of Rev. Dr. Martin Luther King Jr. Dr. King—a graduate of Morehouse College—was a Baptist minister, a peace seeking civil...

In Remembrance: Verne O. Sedlacek

A Gentle Giant The Commonfund community was shocked and saddened this week by the news of the sudden passing of our former President and CEO, Verne Sedlacek at the age of 67.

Ten Tips for Successful Meetings

On November 9, 2021, Commonfund Institute held its first virtual Investment Stewardship Academy session since the program began nearly 30 years ago. The course focused on committee decision-making...

Viewpoint | Diverse Managers

The inclusion of diverse managers in institutional portfolios offers access to a broader array of investment talent. Data indicate that foundations are beginning to recognize and act on this...

Commonfund Celebrates 50 Years of Service

On July 1st, 1971, The Common Fund for Nonprofit Organizations commenced operations with a $2.8 million grant from the Ford Foundation under the leadership of President George Keane and the Board of...

Endowment Management and the Three Primary Responsibilities of a Board

The fourth blog in the “Six Ps of Investment Stewardship” series addresses People, specifically how boards function within an organization. To learn more about the first four principles in the series...

How to Invest in Diverse Managers

A U.S. capitalist system where approximately one percent of all capital is managed by women and people of color, who make up 70 percent of the population, perpetuates and increases inequality and...

In Memoriam: George F. Keane

George F. Keane, 91, of 7408 Eaton Court, Sarasota, FL, founder of The Common Fund, and noted philanthropic investment strategist, passed away Thursday, May 20, 2021, peacefully in the Spring Meadows...

CASE Commonfund College and University Foundation Award 20th Anniversary

For the past 20 years, the CASE Commonfund College and University Foundation Award has recognized individuals who have contributed to the advancement of the college and university foundation field.

Commonfund Trustee, Dr. David A. Thomas, Wins 62nd Annual HBR McKinsey Award

Commonfund's Trustee, Dr. David A. Thomas, wins the 62nd Annual HBR McKinsey Award, for co-authoring the article titled "Getting Serious About Diversity: Enough Already with the Business Case." The...

How Your Organization Can Nurture Innovation While Balancing Risk

The theme for Commonfund Forum 2021 was “Transformation.” The objective of the agenda was to deliver timely, useful content on core subjects related to nonprofit endowment and financial management...

Fareed Zakaria Dissects the Challenges Shaping the Post-Pandemic World

The theme for Commonfund Forum 2021 was “Transformation.” The objective of the agenda was to deliver timely, useful content on core subjects related to nonprofit endowment and financial management...

Spending at Independent Schools Impacted by COVID-19

The effects of COVID-19 have been felt across the entire nonprofit sector and the independent schools’ community is no different. For the Commonfund Benchmarks Study® of Independent Schools (CSIS)...

Managing Financial Challenges During Crisis – A Checklist for Higher Education

Many educational institutions are facing unpredictable financial challenges as a result of the COVID-19 pandemic. Costs associated with implementing technologies for virtual learning, decreased...

Viewpoint | Why are Gifts to Endowments Declining?

For the third straight year, Commonfund Benchmarks Study® of Independent Schools (CSIS) participants reported average new gifts to endowment declined, this year falling to an average of $1.2 million...

From Generosity to Justice | Observations from the President of Ford Foundation

The theme for Commonfund Forum 2021 was “Transformation.” The objective of the agenda was to deliver timely, useful content on core subjects related to nonprofit endowment and financial management...

Board of Trustees and Investment Committee Roles and Responsibilities

There are fundamental principles of effective endowment management that we have organized into what we call “the 6 Ps of Investment Stewardship”– Purpose, Policy, Process, Portfolio, People and...

Investment Governance | Are You Asking These Three Questions?

In the midst of a global pandemic, many non-profit business models are being challenged which has put significant pressures on staff, governing boards and committees. These pressures on time and...

Foundation Spending Strategy – Meeting the Moment in 2020 and Beyond

This year has been incredibly difficult. One of the most contentious and turbulent presidential elections and transitions in American History. COVID-19 and the consequential social and economic...

Top Ten Tips for Better OCIO RFPs

A tightly run RFP process can help ensure your organization will find an ideal investment partner to help you fulfill your organization’s mission. As the second installment of our blog series on the...

Balancing Purpose, Payout, and Permanence: A Strategy Guide for Foundations

In partnership with the Council on Foundations, the National Center for Family Philanthropy has released Balancing Purpose, Payout, and Permanence: A Strategy Guide. Commonfund Institute is very...

Chart of the Month | Inflation Expectations Surge, Driving Real Interest Rates Down

Chairman Powell’s speech at Jackson Hole during the last week of August confirmed the Fed’s dovish policy stance, giving investors ample support in terms of low rates and a flexible inflation...

Capturing Credit Opportunities in Times of Crisis

Key takeaways During periods of dislocation in high-quality credit, investors should stay the course within fixed income portfolios and maintain active risk to benefit from the inevitable rebound...

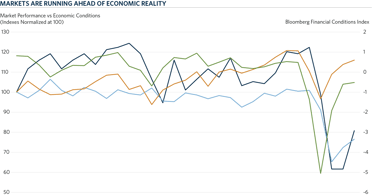

Chart of the Month | Markets are Running Ahead of Economic Reality

When investors open their second quarter investment reports, many will be shocked by the magnitude of stock market gains in the second quarter. Their surprise could be voiced by a rhetorical question...

Five Key Points of the Investment Policy Statement

The central document guiding the management of a nonprofit institution’s endowment—essentially, the strategic plan of the investment committee—is the investment policy statement (IPS). The IPS should...

COVID-19 and Nonprofits | Five Observations from China

Although the full effects of the COVID-19 pandemic on U.S. nonprofits will not be known for some time there may be something to learn from what we’re seeing in China. China was the first country to...

10 Tips for Stewarding People Remotely

Six key words – Purpose, Policy, Process, Portfolio, People, and Perspective – form a framework for effective endowment stewardship. As trustees, investment committee members, and senior management...

Coronavirus: Five Key Questions for Nonprofit Institutions

There is no question that we are in unprecedented times and will likely remain so for longer than we anticipated even a few weeks ago. The speed at which a new reality has been imposed on all of us...

Chart of the Month | Election Year Market Trends

As we enter the 12th year of economic expansion since the Great Financial Crisis, investors continue to wonder whether 2020 will be the year when equity markets finally experience a correction....

Purpose: What is an Endowment?

A critically important asset for many nonprofit organizations is their endowment, sometimes referred to by a different name such as long-term investment fund. So important is this pool of financial...

Recession – Maybe This Time is Different

The July Federal Open Markets Committee (FOMC) meeting signaled the end of central bank rate normalization with the first rate cut in more than a decade. The last time the FOMC cut rates was in...

Commonfund Hosts Girls Who Invest at NYC Event

Girls Who Invest (GWI) is an organization focused on bringing more women into the field of asset management, a goal that Commonfund strongly supports. Every year, GWI invites rising juniors into...

The Case for Using the Higher Education Price Index® (HEPI) to Define Inflation for Colleges

When calculating return targets for an endowment portfolio, a conventional piece of the equation is often the Consumer Price Index (CPI). CPI plus 5% is the common short-hand formula for institutions...

Investment Manager Fees Part II: Creating Alignment

In Part I of this blog series, “Investment Manager Fees: Out of Sight, Out of Mind”, we discussed our approach to determining the value of an asset manager and how we might calculate a fair price for...

Nonprofit Hospitals - Big Business in Nonprofit Clothing?

In the last few months, high profile nonprofit institutions have come under intense scrutiny for ethical dilemmas pertaining to the stewardship of resources meant to support mission. This is Part Two...

Summer Reading from the Stewardship Academy Faculty

As the last week of June approaches, investment stewards begin to prepare for summer – a time for relaxing, reflecting, and reading. We asked faculty members from the Investment Stewardship Academy,...

Museums and Cultural Institutions: To Accept or Not to Accept, That Is the Question

In the last few months, high profile nonprofit institutions have come under intense scrutiny for ethical dilemmas pertaining to the stewardship of resources meant to support mission. In a three-part...

Commonfund Forum: A Carbon Neutral Event in 2019

In just two years Commonfund will celebrate its 50th anniversary as a non-profit investment manager for educational endowments, foundations and other tax-exempt investors. Throughout those almost...

Investment Manager Fees: Out of Sight, Out of Mind

One of the most pressing questions facing fiduciaries is that of investment management fees. We think it is a healthy and necessary discussion, as even small fees can have a big impact on performance...

Taking a Fresh Look at Spending Models

Investors have limited control over the returns their portfolios generate. They have more control over their spending. That doesn’t make it easy. Compared to some earlier periods, volatility in the...

Surprising Stewardship Lessons from the Miracle on the Hudson

“When you’ve suffered a complete loss of engine thrust over the largest city in America, you must act quickly and independently to address the developing situation. But, you must also trust in the...

Donor Advised Funds: Changing the Philanthropic Landscape for Higher Education

Donor Advised Funds (DAFs) are the fastest growing giving vehicle in philanthropy. The Council on Foundations defines DAFs as: “A type of charitable giving fund that is established by a donor with an...

A sit-down with Richard Fisher

As a follow-on to the Commonfund Forum 2019 panel discussion, The Global Economy and the Return of Risk, Richard Fisher, former President and CEO of the Federal Reserve Bank of Dallas, further...

7 Major Findings - Commonfund Benchmarks Study of Healthcare Organizations

Fifty-six healthcare organizations participated in the 2016–2017 Commonfund Benchmarks Study® of Healthcare Organizations. These organizations reported an average investable asset pool of $2.1...

The Four P’s of Investment Decisions: Lessons from the Commonfund Institute

Three days after becoming Executive Director of the Commonfund Institute, I found myself at Yale University in New Haven giving welcoming remarks at our annual educational program. Although I will...

Investing in Diversity

At Commonfund, we scour the globe to find investment managers that we believe have the ability to consistently produce excess returns (alpha) over and beyond their benchmark. But alpha alone is not...

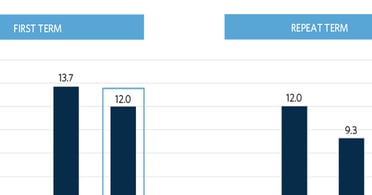

Despite Strong FY2017, Endowments Report Decline in Ten-Year Return

Despite 12.2 percent return for FY2017, educational endowments report a decline in their 10-Year return while large institutions lead increase in effective spending rate Data gathered from 809 U.S....

Tax Reform: CPI Plus More

It was another taxing weekend (literally) at Commonfund as we digested 1,097 pages of the conference agreement for the tax reform bill (the “Tax Act”) and its implications for our country and for the...

The Tax Man Cometh (And Not Just for the Ivies)

UPDATE: Since this blog was published there have been further developments related to the Tax Cuts and Jobs Act. Please see our post Tax Cuts and Jobs Act: CPI Plus More for our latest thinking. With...

On Complacency | Why Risk Management Always Matters

Like nearly everything in the financial markets, risk is cyclical. History repeats itself. The echoes of past crises are always heard in present ones, yet new crises are rarely predicted and not...

WannaCry? WannaRun, WannaHide! Managing Cybersecurity Risk

Over the last year there has been no shortage of things to keep investors, asset managers, and risk managers concerned. Despite these exogenous shocks most equity markets have continued to shake off...

Active Fee Management: Notes from the Front Lines

Few topics get investors’ attention as much as fees. We wouldn’t be human if we all didn’t want to know, in detail, how much something costs. In the world of investing, fees are an even more...

Long-Term Trends for Long-Term Investors

Nonprofit institutions have the distinct advantage of having the longest time horizon of any investors – often perpetuity. This affords an opportunity to consider investments based on secular trends...

Constraints Faced by Healthcare Endowments

As a result of the evolving landscape of the healthcare industry, organizations are increasingly being shaped by pressures affecting both the revenue and expense sides of the income statement. On one...

How Does Board Structure Affect Performance?

The structure of a board has an important influence on its effectiveness, and being cognizant of these matters is essential to improving a board’s performance. In this article, we’ll discuss four...

Fiduciary Responsibility: A Board’s Purpose and Roles

Excellent boards are made, not born. Achieving excellence in board governance requires success in four crucial areas: capable leadership, a sound organizational structure, attention to fiduciary...

Where Did Our Operating Income Go?

Treasury managers face a new challenge to an old problem. Their institutions historically have relied on operating investment income to provide a necessary influx to operating budgets. Prior to 2008,...

Responsible Investing for Foundations

Commonfund and the Council on Foundations are thrilled to announce the release of the 2016 Council on Foundations – Commonfund Study of Responsible Investing. It is the largest and most detailed...

Operating Charity Implements a Risk-Based Investment Policy

An operating charity in the Northeast is in the process of implementing a risk-based investment policy for its $30 million endowment. The organization’s seven-member Investment Committee includes...

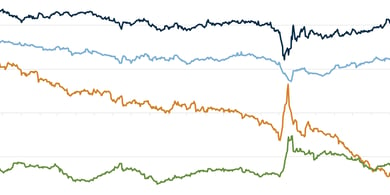

Fiscal Year-End and Mid-Year 2025 Market and Investment Review