Posts by Commonfund

Perspectives | Press Releases

Commonfund Study of Independent Schools Released for FY2025

Gains Amid Uncertainty: Independent Schools Report 11.5% Return on Endowment Assets for FY2025; 10-Year average returns rise to 7.7% New Gifts to Endowments Rebound, Use of OCIO Increased Norwalk,...

Perspectives | Press Releases

FY25 NACUBO-Commonfund Study Released

U.S. Higher Education Endowments Report Stable Returns, Increase Spending to $33.4 Billion in FY25 The NACUBO-Commonfund Study of 657 colleges and universities reports a 10-year average return of...

Investor Spotlight | Spotlight

Innovative Community Health in Southeast Idaho

Portneuf Health Trust is forging a new path that serves as an example of the power of aligning mission and money for the greater good.

Perspectives | Insights Blog

In Memoriam: Mamak Shahbazi

It is with great sadness that we announce the passing of Commonfund Board Member, Mamak Shahbazi. Mamak was a dedicated and talented board member and a great friend to the firm, its clients, and...

Outsourced Cio | Insights Blog

Nonprofit-Dedicated OCIO

Providing nonprofits with customized investment strategies and specialized expertise, a nonprofit-dedicated OCIO can ensure mission-aligned financial stewardship. By concentrating on the nonprofit...

Perspectives | Spotlight

Grove City College: Conservative, Christian, Committed to Excellence and Affordability

Grove City College is an institution of higher learning where values and value are inseparable.

Investment Strategy | Articles

CIO Roundtable: Meeting Complexity and Uncertainty with Clarity

A foundation, a university and an insurance company operate in different worlds and have different priorities—but make investment decisions in the same environment Institutions depend on their...

Investment Strategy | Videos

Chief Investment Officers Share Their Thoughts at Forum 2025

Commonfund hosted its annual Commonfund Forum 2025, March 9-11th, in Orlando, Florida. The agenda included a range of sessions on relevant topics for institutional investors. This Forum Spotlight...

Investment Strategy | Articles

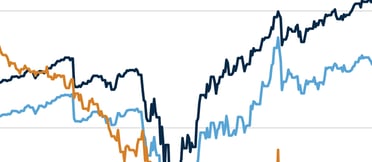

Portfolio Construction in the Era of the Mag 7

How do you build your U.S. equities allocation when a handful of stocks account for more than half of the S&P 500’s return? The aptly named Magnificent 7 stocks (Alphabet, Amazon, Apple, Meta...

Perspectives | Press Releases

Institutional Investors Split on U.S. Economic Outlook, Commonfund’s Annual Market Sentiment Survey Finds

Sixty eight percent of institutional investors surveyed (representing over $800 billion in total assets) expect the S&P 500 Index to have lower or negative returns in 2025, compared to the 10-year...

Perspectives | Insights Blog

Key Takeaways from Forum 2025

Commonfund Forum 2025, held in Orlando, brought together registrants from some 370 institutions with more than $800 billion in endowed assets representing 42 states and five foreign countries in a...

Perspectives | Insights Blog

Forum 2025 Key Statistics [Infographic]

Commonfund recently hosted its 27th annual Commonfund Forum, March 9th-11th, in Orlando, Florida. The event brought together institutional investors to engage in a three-day conference to explore...

Outsourced Cio | Press Releases

Commonfund OCIO Names Julia Mord Chief Investment Officer

Mord will also serve as Chair of Commonfund OCIO’s Investment and Asset Allocation Committees and as a member of the Commonfund OCIO Executive Group WILTON, CT, February 5, 2025 – Commonfund OCIO,...

Market Commentary | Insights Blog

U.S. Trade Deficit Reaches Record High Amid Global Trade Shifts

As of September 2024, the U.S. trade deficit stands at $84.4 billion, marking the highest level since the onset of the Russia-Ukraine war in 2022. During that period in the conflict, the deficit...

Diversity | Insights Blog

Celebrating Native American Heritage Month: A Resource Guide

Commonfund, in conjunction with our Native American Heritage Month subcommittee, has created a resource guide to help all of us celebrate the contributions of Native Americans and Indigenous people...

Market Commentary | Insights Blog

The Pivot Heard Around the World

A U.S. Federal Reserve (“Fed”) pivot is felt throughout global markets, affecting economies worldwide.

Diversity | Insights Blog

Celebrating Hispanic Heritage Month: A Resource Guide

National Hispanic Heritage Month (Spanish: Mes Nacional de la Herencia Hispana) is an annual celebration commemorating the history, contributions, and culture of U.S. Latino and Hispanic communities.

Market Commentary | Insights Blog

How Long Can the Yen Carry Trade Carry On?

Since Japan's economic crash in the 1990s, the Bank of Japan (BOJ) has maintained extremely low interest rates to combat deflation. For nearly a decade, Japan's benchmark rate has been negative,...

Investor Spotlight | Spotlight

Montana Tech’s Rigorous STEM Curriculum Produces In-Demand Graduates

Borrowing from the popular TV quiz show “Jeopardy!” the answer is: “Montana Technological University.” The question: “What is the only university in the U.S. with an underground mine located on...

Diversity | Insights Blog

Celebrating Pride Month: A Resource Guide

Pride month is the promotion of the self-affirmation, dignity, equality and increased visibility of lesbian, gay, bisexual, transgender, intersex and asexual people (LGBTQIA+) as a social group....

Diversity | Insights Blog

Celebrating Asian American and Pacific Islander Heritage Month

Asian American and Pacific Islander Heritage Month got its start as a congressional bill, inspired by Black History Month and Hispanic Heritage Month, with the mission of bringing attention to the...

Perspectives | Videos

CIO Roundtable

Commonfund hosted its annual Commonfund Forum, March 10-12th, in Orlando, Florida. The agenda included a range of sessions on relevant topics for institutional investors. This Forum Spotlight...

Market Commentary | Insights Blog

What's Driving Surprisingly Low Volatility in Energy Markets?

In the current geopolitical environment, we would have historically expected much more volatility in the energy complex. Oddly, that has not been the case over the last 6 months. In fact, crude oil...

Market Commentary | Insights Blog

The Economic Equation: Solving for the Unknowns

2 + 2 = ? In the world of economics—a lot of variables may mess with the answer. Two sessions early in the agenda at Commonfund Forum 2024 brought into focus the range of scenarios in play for...

Market Commentary | Insights Blog

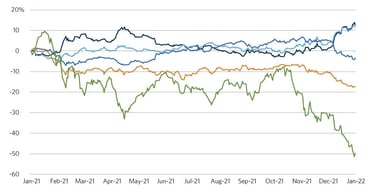

China Continues to Drag Emerging Markets into 2024

2023 marked the third year of drawdowns for the Chinese equity markets, reflecting a country still trying to emerge from the pandemic period. A combination of factors continued to hamper the once...

Diversity | Insights Blog

Celebrating Black History Month: A Resource Guide

Black History Month is an annual celebration of achievements by African Americans and a time for recognizing their central role in U.S. history. Also known as African American History Month, the...

Market Commentary | Insights Blog

Bad News is “Good” for Markets to Close 2023

As we inch closer to 2024, domestic markets have been largely driven by shifts in sentiment surrounding the macroeconomic environment, leading many to question the relationship between “bad news” and...

Market Commentary | Insights Blog

Yield Curve Dynamics in Focus to Close 2023

After a relatively tame summer, significant cross-asset volatility has returned with both the MOVE and VIX indices increasing by 37 and 48 percent respectively, after approaching the lows for 2023 in...

Diversity | Articles

2023 Diversity, Equity and Inclusion Report

It used to be, in the not-too-distant past, that a CEO could just focus on the four corners of her or his business plan without consideration for the broader societal impacts of that plan. Not so...

Market Commentary | Insights Blog

Lagarde Offers Little Comfort Amidst All Time High ECB Rates

Last Thursday marked the tenth hike of the European Central Bank (“ECB”) deposit rate.

Market Commentary | Insights Blog

Global Currency Returns Diverge

A year ago, the dollar was approaching multi-decade highs as global currencies coped with the most aggressive FOMC hiking cycle of the last forty years.

Market Commentary | Insights Blog

Markets Signal Higher for Longer Interest Rates

Market sentiment on bonds continues to trend lower, leaving the overall open interest in short-dated U.S. Treasury futures net short at an unprecedented level. There is the potential that these short...

Market Commentary | Insights Blog

Midyear Rally or Multiple Expansion?

The long-awaited decline in earnings growth appears to be upon us nearly halfway through 2023. Expectations for S&P 500 year-end earnings per share (EPS) growth range from flat to a tepid 1 percent.

Investment Strategy | Insights Blog

Unemployment Appears Poised to Increase

Other than the impending recession, one of 2023’s most anticipated economic changes has been a labor market slowdown, with both economists and investors expecting a deceleration in economic activity...

Investor Spotlight | Spotlight

The Forman Acton Foundation

A Community's Inheritance is a Scholar's Love of Learning Forman Acton valued education, no doubt about that: bachelor’s and master’s degrees from Princeton, a PhD in mathematics from Carnegie...

Investment Strategy | Insights Blog

Bond Market Expectations Take a Wild Ride

In today’s environment, commentary can seemingly become stale in periods as short as hours, let alone days. Just last month, we wrote how despite tightening lending conditions from banks, other...

Investment Strategy | Videos

CIO Roundtable - A Discussion on Investment Stewardship

At the 25th annual Commonfund Forum, in Boca Raton, Florida, we hosted a distinguished panel of CIOs who shared their perspectives on portfolio management. They discussed their best investment ideas,...

Perspectives | Press Releases

NACUBO and Commonfund Partner on Higher Education Endowment Research

Partnership to produce 50th annual Study of Endowments WILTON, CT, and WASHINGTON, DC, March 13, 2023 – Commonfund and the National Association of College and University Business Officers (NACUBO)...

Diversity | Insights Blog

Celebrating Women's History Month

Women's History Month 2023 | Celebrating Women Who Tell Our Stories Women’s History Month is an annual declared month that highlights the contributions of women to events in history and contemporary...

Perspectives | Insights Blog

Forum 2023 Key Statistics [Infographic]

Commonfund recently hosted its 25th annual Commonfund Forum, February 13-15th, in Boca Raton, Florida. The event brought together institutional investors to engage in a three-day conference to...

Investment Strategy | Insights Blog

Rate Hikes are Impacting Bank Lending Behavior

As investors grapple with adjusting to 450 basis points of rate hikes (and likely more in sight), the debate on just how quickly monetary policy will transmit through the real economy has returned to...

Perspectives | Press Releases

Commonfund Renames Its Two Core Businesses

The move will bring added clarity to an expanding range of offerings JANUARY 3, 2023, Wilton, CT - Commonfund is introducing new names for its two core businesses that will enhance clarity while...

Investment Strategy | Insights Blog

Markets Rally to Close 2022, but Sentiment Remains Dismal

Strong Fourth Quarter for Global Markets Following three quarters of bleak performance, global markets staged a rally to close what was a tumultuous 2022.

Investment Strategy | Insights Blog

Supply Chains Take a Wild Ride

In 2021, the word was transitory. This described the expectations of Fed officials and many other prognosticators that elevated inflation would quickly return to the pre-COVID level of at or around 2...

Diversity | Insights Blog

Diversity and Inclusion: Ways to Make a Change

Throughout American history, discrimination has not only been ever present, but era-defining. In each of those eras, however, there have been pivotal moments where activists organized, made...

Investment Strategy | Insights Blog

Chart of the Month | The Shape of Inflation

The Consumer Price Index continues to surprise central bankers, commentators, and market participants alike. The latest headline reading of 8.2 percent, which reflects year-over-year price increases...

Diversity | Spotlight

Melissa Madzel, Managing Partner of Axis Talent Partners and Board Member of Stonewall Community Foundation

In celebration of Pride Month, Commonfund Institute Executive Director, George Suttles, interviews Melissa Madzel, Managing Partner of Axis Talent Partners and Board Member of Stonewall Community...

Market Commentary | Insights Blog

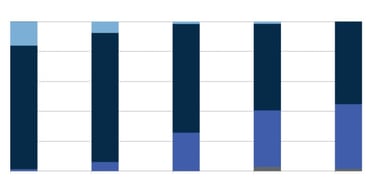

The “Divorcification” of Stocks and Bonds

It has been a difficult start for traditional portfolios of stocks and bonds in 2022 as the usual diversification benefits of these asset classes have failed to materialize. As high inflation remains...

Perspectives | Insights Blog

In Remembrance: Laurance (Laurie) R. Hoagland, Jr.

The Commonfund community was saddened to learn of the recent passing of Laurie Hoagland. Laurie served as a member of the Commonfund Board from 2000-2012 and was Board Chair from 2010-2012.

Private Equity | Private Equity Insights

Accessing Sustainable Opportunities Through Private Equity Strategies

Institutional investors around the world have appropriately turned their attention to the sustainability of their investment portfolios. Investors have pivoted from discussion to action as generally...

Perspectives | Videos

The Great Reset: The Emerging Age of Re-imagination, Reconnection and Renewal – and Generation RE

A great reset is now upon us. Less obvious is the reality that the world was quietly being reset prior to the pandemic. The rules of business were being rewritten by an extraordinary cadre of...

Market Commentary | Insights Blog

Are Stagflation Fears Justified?

Stagflation fears are growing among investors as inflation recently accelerated at the same time 2022 GDP growth projections declined due to weaker consumer sentiment and increased risk aversion. A...

Investment Strategy | Videos

CIO Roundtable

Fiduciaries are entrusted with fulfilling their organization’s mission largely through effective stewardship of financial assets. In the 50+ years since Commonfund was founded, perpetual investing...

Investment Strategy | Insights Blog

Hitting the Hot Buttons: Investing for the Next 2 to 4 Years

Commonfund Forum 2022 featured an expert panel representing diverse perspectives to probe beyond the headline-grabbing news that has been driving financial markets in recent months. The accompanying...

Investment Strategy | Videos

Imagining What's Next for the Global Economy

If someone had told you in January of 2020 that the world would be plunged into a global pandemic the likes of which had not been seen since 1918, you probably would have guessed that the impacts on...

Market Commentary | Insights Blog

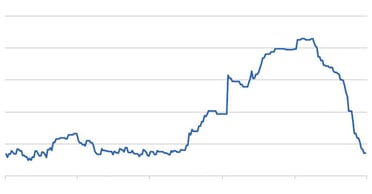

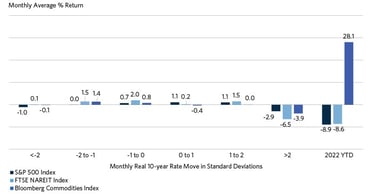

Is this Time Different? Risk Assets and Real Rate Moves

February ended in the same fashion as January, with elevated volatility across a wide spectrum of asset classes. Equities, fixed income, currencies, commodities, and cryptocurrencies all swung...

Diversity | Spotlight

Metis Global Partners

In celebration of Black History Month, Commonfund Institute Executive Director, George Suttles, and Commonfund Director, Nicole Melwood, interview Machel Allen, President and CIO of Metis Global...

Market Commentary | Insights Blog

Tech Stocks Lead the Market Decline in Early 2022

2022 began with one of the worst market performance periods since 2009. While the tech-heavy NASDAQ index looks to finish January with a loss of around 10 percent, value equities will likely record...

Diversity | Insights Blog

Celebrating and Honoring Rev. Dr. Martin Luther King Jr.

On January 17, 2022, the nation will celebrate the legacy and leadership of Rev. Dr. Martin Luther King Jr. Dr. King—a graduate of Morehouse College—was a Baptist minister, a peace seeking civil...

Market Commentary | Insights Blog

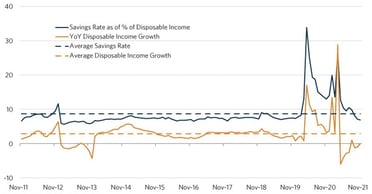

Consumer Savings and Disposable Income Under Pressure

As 2021 comes to an end, we enter 2022 with a good dose of uncertainty in the markets as the Fed begins to reduce and ultimately removes its accommodative policy which has been in place since the...

Perspectives | Articles

Commonfund Asset Management Announces Organization Changes

As a leading Outsourced CIO firm serving nonprofit organizations, we consistently re-evaluate our organization and processes looking for opportunities to improve how we work and serve our clients. To...

Perspectives | Insights Blog

In Remembrance: Verne O. Sedlacek

A Gentle Giant The Commonfund community was shocked and saddened this week by the news of the sudden passing of our former President and CEO, Verne Sedlacek at the age of 67.

Market Commentary | Insights Blog

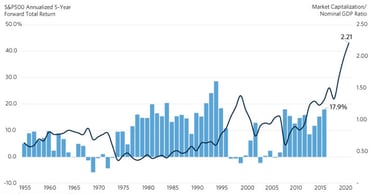

Sky High Valuations Could Spell Weaker Forward Returns

When we look for potential roadblocks that could spoil the breakneck pace of capital markets, the first risk that comes to mind is record-high valuations. While inflation risks have become more...

Market Commentary | Insights Blog

Chart of the Month | Fed Remains Patient on Rate Hikes Despite Market Expectations For A More Aggressive Move

In its latest meeting on November 3rd, the Fed announced its decision to begin scaling back its historic bond purchasing program, marking the beginning of the end of the program that was aimed at...

Investment Strategy | Private Equity Insights

The Price of Liquidity - Commonfund Coffee Talk

The Price of Liquidity for Perpetual Investors Our third and final Coffee Talk focused on the most important and impactful decision endowments and foundations can make within their strategic asset...

Risk Management | Videos

Asset Allocation and Risk - Commonfund Coffee Talk

ASSET ALLOCATION AND RISK | LOOKING BEYOND VOLATILITY Our second Coffee Talk focused on asset allocation and risk, and the key factors and inputs that maximize the likelihood of achieving...

Governance And Policy | Videos

Good Governance in a Crisis - Commonfund Coffee Talk

Good Governance as the Guardrails in a Crisis | What Does It Look Like for Nonprofits? Our first Coffee Talk webinar focused on good governance practices as key to surviving a crisis and thriving in...

Market Commentary | Insights Blog

Chart of the Month | Are We on the Verge of a Global Energy Crisis?

It is hard to imagine that in the short span of less than 18 months, energy markets went from a state of overabundance to one of severe shortages and skyrocketing prices. In April 2020, Brent oil...

Private Equity | Private Equity Insights

Commonfund Capital Closes 3rd Global Private Equity Fund at $236 Million

Commonfund Capital Global Private Equity Partners III, L.P. Includes Capital Commitments from Pensions, Foundations, Endowments, Insurance Companies and Family Offices Wilton, CT, September 15, 2021...

Market Commentary | Insights Blog

Chart of the Month | The Confusing State of the Labor Market

The U.S. labor market continues to recover from one of the worst declines in employment since the 1930s. In the early days of the pandemic last April, demand for labor plummeted and the unemployment...

Perspectives | Spotlight

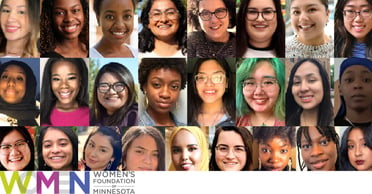

The Women’s Foundation of Minnesota: A Pioneer for 38 Years and Counting

If a pioneer is the first to open new ways of thought and action, the Women’s Foundation of Minnesota (WFMN) fits the definition perfectly. Founded in 1983, WFMN became the first statewide women’s...

Private Equity | Private Equity Insights

Commonfund Capital Closes its Third Co-Investment Fund at $160 Million

Commonfund Capital Co-Investment Opportunities III, LP includes Capital Commitments from Foundations, Endowments, and Family Offices

Market Commentary | Insights Blog

Chart of the Month | Home Prices Are Up 32 Percent In Five Years – And Still Climbing

Housing demand appears to be slowing down in the first half of 2021, yet home prices have continued to climb at an accelerated pace. This month’s chart highlights the supply and demand factors...

Perspectives | Insights Blog

Commonfund Celebrates 50 Years of Service

On July 1st, 1971, The Common Fund for Nonprofit Organizations commenced operations with a $2.8 million grant from the Ford Foundation under the leadership of President George Keane and the Board of...

Market Commentary | Insights Blog

Chart of the Month | Supply Chain Woes as the Pandemic Recedes in the U.S.

Supply chain woes continue to wreak havoc for retailers who are grappling with a strong rebound in consumer spending. Average six-month spending on durable goods, spurred by over $5 trillion in...

Market Commentary | Insights Blog

Chart of the Month | Emerging Markets Trail the Pack Despite Rising Demand and Commodities Prices

As growth continues to rebound around the world and investors return to their pre-pandemic way of life, global market performance is beginning to reflect the divergent speed of normalization within...

Perspectives | Insights Blog

In Memoriam: George F. Keane

George F. Keane, 91, of 7408 Eaton Court, Sarasota, FL, founder of The Common Fund, and noted philanthropic investment strategist, passed away Thursday, May 20, 2021, peacefully in the Spring Meadows...

Governance And Policy | Videos

Investing in ESG and Sustainability

ESG and environmentally sustainable investments are increasingly capturing the attention of the institutional investment community. Historically, we saw more conversation and less broad investment...

Diversity | Insights Blog

Commonfund Trustee, Dr. David A. Thomas, Wins 62nd Annual HBR McKinsey Award

Commonfund's Trustee, Dr. David A. Thomas, wins the 62nd Annual HBR McKinsey Award, for co-authoring the article titled "Getting Serious About Diversity: Enough Already with the Business Case." The...

Market Commentary | Insights Blog

Chart of the Month | The Surprising Relationship Between Money Supply and Inflation

The potential for rising inflation is becoming a top concern for many investors and consumers. Many believe that inflation is already here as evidenced by price increases in commodities, homes,...

Perspectives | Insights Blog

How Your Organization Can Nurture Innovation While Balancing Risk

The theme for Commonfund Forum 2021 was “Transformation.” The objective of the agenda was to deliver timely, useful content on core subjects related to nonprofit endowment and financial management...

Commonfund Forum | Videos

Forum 2021 | Welcome Address

Mark Anson, PhD, CFA, CAIA, Chief Executive Officer and Chief Investment Officer, Commonfund, welcomes you to Commonfund Forum 2021. This video is a Commonfund Forum 2021 Spotlight. Click here to...

Diversity | Videos

A Fireside Chat with Darren Walker | From Generosity to Justice

Forum 2021 keynote speaker and Ford Foundation President, Darren Walker, shares his bold vision for the future of philanthropy. Since his arrival in 2013, Mr. Walker has transformed the venerable...

Governance And Policy | Videos

Infinite Challenges, Endless Opportunities, Finite Resources

Board members, trustees and others that have oversight of endowed portfolios have well-documented fiduciary duties that govern how they carry out those responsibilities. In times of relative calm,...

Investment Strategy | Videos

Tools for Creating Effective Strategic Policy

Commonfund has worked with nonprofit investors for 50 years. Over that time, we have developed a set of proprietary tools and data to assist boards and investment committees in their quest to create...

Diversity | Videos

Promoting Gender Equity in Leadership Roles

Dr. Kellie A. McElhaney is on faculty as a Distinguished Teaching Fellow and the Founding Director of the Center for Equity, Gender and Inclusion (EGAL) at the Haas School of Business at the...

Diversity | Insights Blog

From Generosity to Justice | Observations from the President of Ford Foundation

The theme for Commonfund Forum 2021 was “Transformation.” The objective of the agenda was to deliver timely, useful content on core subjects related to nonprofit endowment and financial management...

Market Commentary | Insights Blog

Chart of the Month | The Stock Market Rally May Finally Be Broadening Beyond Tech Names

The trend of improving performance of sectors most sensitive to the strengthening economy remained on track in February 2021. For the most part of 2020, the traditional S&P 500 market-cap-weighted...

Market Commentary | Insights Blog

Chart of the Month | Are Bonds Still a Good Hedge for Equity Market Declines?

In the middle of January, the Biden administration announced the details on a new $1.9 trillion stimulus package, including enhanced unemployment benefits, an increase in the minimum wage, and...

Market Commentary | Insights Blog

Chart of the Month | Beware of High Yield Bonds

Income-hungry investors continued to push yields on speculative grade bonds to new lows despite the challenging business conditions this year. The yield on the Bloomberg Barclays Corporate High Yield...

Governance And Policy | Insights Blog

Investment Governance | Are You Asking These Three Questions?

In the midst of a global pandemic, many non-profit business models are being challenged which has put significant pressures on staff, governing boards and committees. These pressures on time and...

Market Commentary | Insights Blog

Chart of the Month | Are Value Stocks Finally Going to Make a Run?

The month of November saw a sharp rotation into value equities at the expense of technology and communication services companies, causing investors to wonder whether the long-run dominance of growth...

Governance And Policy | Videos

Implications of Increased Spending for Foundations

In this Commonfund Xchange, Commonfund Institute Executive Director, George Suttles, moderated a discussion with two leading practitioners: Mary Reynolds Babcock Foundation Chief Finance and...

Market Commentary | Insights Blog

Chart of the Month | Recession Impacts on Employment and Wages

It may come as a surprise to many that average disposable personal incomes have increased by 6.6 percent from February prior to the pandemic through August. This is down from a high of 9.8 percent in...

Market Commentary | Insights Blog

Chart of the Month | Low Rates Make Record Government Debt Manageable – For Now

Few people would have predicted that U.S. equity markets would be higher today than at the start of 2020 if told that a virus would infect over 7.0 million people in the U.S., cause over 200,000...

Investment Strategy | Insights Blog

Chart of the Month | Inflation Expectations Surge, Driving Real Interest Rates Down

Chairman Powell’s speech at Jackson Hole during the last week of August confirmed the Fed’s dovish policy stance, giving investors ample support in terms of low rates and a flexible inflation...

Diversity | Insights Blog

Investing in Racial Equity: A Primer for University & College Endowments

Commonfund and Commonfund Institute are very happy to contribute to the new report from Intentional Endowments Network (IEN), “Investing in Racial Equity: A Primer for University & College...

Governance And Policy | Videos

Cultural Institutions and the COVID-19 Crisis

Board members, investment committees, and senior staff are charged with the fiduciary responsibility to make informed decisions when guiding the investment activities of their organization. The...

Market Commentary | Insights Blog

Chart of the Month | Markets are Running Ahead of Economic Reality

When investors open their second quarter investment reports, many will be shocked by the magnitude of stock market gains in the second quarter. Their surprise could be voiced by a rhetorical question...

Investment Strategy | Insights Blog

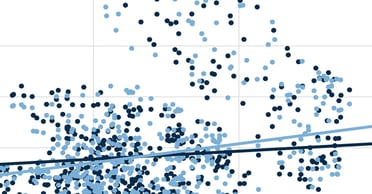

Balancing Risk and Return

Risk surrounds us, and for investment fiduciaries it is inescapable if meaningful real returns are to be sought. While risk and return constitute the axes upon which investment portfolios are built,...

Market Commentary | Insights Blog

Chart of the Month | Measuring Social Distancing with Mobility Trends

We continue to monitor the level of social distancing as an indicator for business activity and improvement in consumer sentiment. Personal spending experienced the largest month-over-month drop on...

Governance And Policy | Videos

Stewarding Foundations Through the COVID-19 Crisis

The COVID-19 crisis has put tremendous strain on local communities across the country and foundations have been asked to rise to the challenge while endowments have declined in value due to market...

Market Commentary | Videos

An Insider's Guide to the Chinese Economy

Commonfund CEO and CIO, Mark Anson, hosted Leland Miller, CEO of China Beige Book. Mr. Miller shared his proprietary research and insights in this exclusive session for Commonfund Forum registrants....

Governance And Policy | Videos

CARES Act | Implications and Opportunities for Nonprofits

On March 27, 2020, President Trump signed into law the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”), establishing the largest aid package in our nation’s history. The $2...

Market Commentary | Articles

Higher Ed in the Age of COVID-19

Commonfund convenes an expert panel to take on the short- and intermediate-term threats that higher education confronts in the face of a national emergency the likes of which have not been seen for...

Market Commentary | Insights Blog

Chart of the Month | The Dangers of Timing a Bear Market

It has been well documented that trying to avoid market downturns by selling out of stocks and moving to cash can be damaging to long-term portfolio values. And while there are strong behavioral...

Governance And Policy | Videos

Higher Ed in the Age of COVID-19 - A Panel Discussion

With COVID-19 exploding every expectation of normalcy in U.S. higher education, Commonfund convened a panel of experts to identify, analyze and offer potential responses to the critical challenges...

Market Commentary | Insights Blog

Chart of the Month | A Price War Erupts in the Oil Market

Oil prices declined over 21 percent on March 9, 2020, the largest single-day decline since January 1991 during the Gulf War[1]. There was optimism prior to the OPEC (Organization of Petroleum...

Investment Strategy | Insights Blog

Long-Term Equity Investors: A Global Perspective

Over the past decade U.S. equities have consistently outperformed international markets, leading many investors to question the role of non-U.S. equities in their portfolio. While the current cycle...

Investment Strategy | Videos

A Global Perspective for Long-Term Equity Investors

Watch this short video on our Global Perspective for Long-Term Equity Investors. Over the past decade U.S. equities have consistently outperformed international markets, leading many investors to...

Market Commentary | Insights Blog

Chart of the Month | Election Year Market Trends

As we enter the 12th year of economic expansion since the Great Financial Crisis, investors continue to wonder whether 2020 will be the year when equity markets finally experience a correction....

Private Equity | Private Equity Insights

Commonfund Forum Goes Global

During the week of October 14th, 2019 Commonfund Institute hosted our first Forum outside of the United States in Tokyo, Japan. We were honored to be joined by many leading Japanese institutional...

Private Equity | Private Equity Insights

Three Considerations for Your Private Equity Structure

This is the third blog in a private equity series based on our guide, “Succeed in Private Equity Investing”. You can see the previous blog here. Having determined the size of your private capital...

Private Equity | Private Equity Insights

An Investor’s Private Equity Guide

Commonfund recently hosted a panel discussion focused on the current state of private equity and venture capital, with an emphasis on the investor’s perspective of the industry today. The three...

Private Equity | Private Equity Insights

Commonfund Capital Appoints Head of Beijing Investment Office

Commonfund Capital Appoints Xiaonan Tian as Associate Director and Head of Beijing Investment Office Wilton, CT June 25, 2019 – Commonfund Capital, the private capital subsidiary of Commonfund,...

Investment Strategy | Videos

CIO Roundtable: The Past, Present and Future of Endowment Investing

Fiduciaries of nonprofit organizations are entrusted with fulfilling the missions of their organizations in large part through effective stewardship of financial assets. In the 50 years since the...

Investment Strategy | Insights Blog

Taking a Fresh Look at Spending Models

Investors have limited control over the returns their portfolios generate. They have more control over their spending. That doesn’t make it easy. Compared to some earlier periods, volatility in the...

Outsourced Cio | Insights Blog

5 Key Questions When Comparing OCIO Provider Fees

The market for Outsourced Chief Investment Officer (“OCIO”) services has boomed over the last decade. Today, OCIO assets under management are by some estimates nearly $1.5 trillion, 2.5 times the...

Private Equity | Private Equity Insights

Commonfund Capital Closes 2nd Secondaries Fund at $450M

Commitments More than Double Capital Raised for Inaugural Secondaries Fund in 2016 Wilton, CT, May 7, 2019 – Commonfund Capital today announced the closing of its second secondaries fund, Commonfund...

Diversity | Articles

Dynamic Workforce = Dynamic Portfolios

The Surprising Outcomes When Diverse Groups and Homogeneous Groups Tackle the Same Problem In late 2018, Commonfund established a Diversity Office with the objective of benefiting from the strengths...

Perspectives | Insights Blog

A sit-down with Richard Fisher

As a follow-on to the Commonfund Forum 2019 panel discussion, The Global Economy and the Return of Risk, Richard Fisher, former President and CEO of the Federal Reserve Bank of Dallas, further...

Market Commentary | Articles

The Global Economy and the Return of Risk

How to think about tariffs, deficits, valuations, leverage, growth and other issues What signals should institutions be mindful of as they make portfolio decisions in the current environment? A panel...

Investment Strategy | Videos

Playing to Win

In this Forum 2019 general session, Commonfund experts share research into much of the conventional wisdom around institutional portfolio management, with some surprising results into which...

Market Commentary | Videos

Welcome Address and Overview | Forum 2019

Mark Anson, Commonfund Chief Executive Officer and CIO opens Forum 2019 with welcome remarks and a review of the global economy. Download the slides in this presentation.

Investment Strategy | Insights Blog

The Fallacy of Manager Diversification – How “Horse Races” Can Increase, Not Reduce Risk

On the surface, hiring two (or more) multi-asset managers to manage an entire portfolio may seem like a good idea. Intuitively, it would seem to reduce manager concentration risk, and provide...

Investment Strategy | Insights Blog

How to get Started in Responsible Investing

The biggest challenge in implementing any type of responsible investment program is in clearly defining and prioritizing those issues most relevant to an organization. Although it may seem a...

Private Equity | Private Equity Insights

5 Steps to Success in Private Equity Investing

Investors participate in private equity markets for two main reasons: to pursue increased investment return and to add portfolio diversification. Even well-informed investors who are experienced in...

Mission-aligned Investing | Insights Blog

Identifying an “E” Factor

Over the past year the Commonfund investment teams have undertaken research to identify and isolate a new factor associated with the environmental sustainability of a stock (or a portfolio of...

Perspectives | Spotlight

Commonfund Partner Spotlight | Widener University

President and CEO, Commonfund Asset Management, Tim Yates, interviews Dr. Julie Wollman, President of Widener University. In this wide-ranging discussion Dr. Wollman describes how Widener is...

Investment Strategy | Insights Blog

A Cost-Effective Approach to Hedge Fund Allocations: Part 2

Let’s start with a quick recap of Part 1 of this story, which can be boiled down to three main points: Investors often spend too much for market beta, paying “2 and 20” for hedge funds that deliver...

Investment Strategy | Insights Blog

A Cost-Effective Approach to Hedge Fund Allocations: Part 1

At the risk of beating a dead horse, hedge funds are not an asset class. This is especially true in the way in which Commonfund selects and constructs its hedge fund portfolios: focusing...

Investment Strategy | Insights Blog

Equity Portfolio Construction – Through a Risk Factor Lens

At Commonfund, we aim to build multi-manager, active risk equity portfolios with a clear objective of consistent outperformance versus passive policy benchmarks. Our approach is to take intentional...

Perspectives | Spotlight

Rust College

Rust College: Where tomorrow’s leaders are students today In the wake of the Civil War, Rust College was founded in 1866 to provide an education for newly-freed slaves. Located in Holly Springs,...

Perspectives | Spotlight

The Lincoln University

Founded in 1854, The Lincoln University is the nation's oldest degree-granting institutions for persons of African descent. Lincoln is committed to maintaining a nurturing and stimulating environment...

Perspectives | Spotlight

Flagler College

Energetic youth in ‘America’s oldest city’. St. Augustine is the oldest continuously occupied European-established settlement in the continental U.S., having been founded in 1565. Flagler College is...

Perspectives | Spotlight

They dig plants at the Botanical Research Institute of Texas

Hundreds of thousands of plant species are scattered all over the earth, but if the plant world had a headquarters it might be the Fort Worth, Texas home of the Botanical Research Institute of Texas...

Perspectives | Spotlight

University of the Virgin Islands

These Buccaneers pursue a different treasure. There was a time when pirates plied the waters of the Caribbean in the pursuit of gold and other treasure. The Buccaneers mascot of the University of the...

Perspectives | Spotlight

University Corporation for Atmospheric Research

The Sky's No Limit. It doesn't issue public weather forecasts, but it tracks weather around the globe. It isn't the national hurricane center, but it studies hurricanes as well as other extreme...

Perspectives | Spotlight

Western Washington University

Active minds changing lives. Right-sized, well balanced, with an extensive range of strong academic programs and some enlightening stats that speak to all of it: Western Washington University (WWU)...

Investment Strategy | Videos

Evolving Asset Allocation and Policy Portfolios

In this Forum 2018 general session, Commonfund experts share research findings and techniques we employ to help investors understand not just the characteristics of their portfolio in isolation but...

Perspectives | Spotlight

Northampton Community College Foundation

The dictionary defines a foundation as “an underlying base or support.” Of course, there’s another type of foundation, defined as “funds given for the support of an institution.” Northampton...

Investment Strategy | Insights Blog

How Much Beta is in Your Equity Portfolio?

Leveling the Field in the “Tug of War” Between Active and Passive… Active Equity Manager Universal Objective: Outperform the Passive Alternative It’s undeniable that every active equity manager’s...

Perspectives | Videos

The Absent Superpower

In this Commonfund Forum 2017 Spotlight, geopolitical strategist and author Peter Zeihan examines how the hard rules of geography are eroding the American commitment to free trade; how much of the...

Investment Strategy | Insights Blog

Long-Term Trends for Long-Term Investors

Nonprofit institutions have the distinct advantage of having the longest time horizon of any investors – often perpetuity. This affords an opportunity to consider investments based on secular trends...

Perspectives | Videos

No More Gatekeepers

In this Commonfund Forum Spotlight, founder of DonorsChoose.org Charles Best shares how as a 24-year-old teacher at a Bronx high school, he created a model of giving hailed as "the future of...

Perspectives | Videos

Monkeynomics

In this Commonfund Forum 2017 Spotlight, Dr. Laurie Santos demonstrates that primates have much to teach us about our own economic decision-making. Both monkeys and humans know a bargain when they...

Investment Strategy | Insights Blog

What do the Cable Television and Hedge Fund Industries Have in Common?

These industries may seem an odd pairing, but both are in the midst of a disruption-led, industry-wide rationalization process. The two industries share in common a historically evolved “bundling”...

Investment Strategy | Insights Blog

Private Credit Opportunities – Direct Lending to U.S. Middle Market Companies

Much has been made of the challenges endowment, foundation and nonprofit investors face in achieving a CPI+ five percent return target. One way to improve the probability of attaining this goal is to...

Investment Strategy | Insights Blog

A False Sense of Diversification?

As we have undergone the process of re-underwriting all of Commonfund’s equity managers and funds over the last 6 months, we have tackled anew the age old question of how many funds does one...

Perspectives | Spotlight

Center for Natural Lands Management

These words—to protect, preserve and defend—come from the oath of office sworn by the President of the United States. At the Center for Natural Lands Management (CNLM), they refer to an unwritten but...

Perspectives | Spotlight

The William Penn Foundation

Fast Philly facts: The city is the site of the first library, hospital, medical school, stock exchange and zoo in the U.S. It’s the only World Heritage City in the U.S. William Penn founded the city...

Governance And Policy | Insights Blog

Bridging the Gap: Carbon and Fiduciary Responsibility

Most institutional investor discussions and actions regarding global warming have been at two ends of the spectrum: either divest from fossil fuels entirely or remain fully invested. A better...

Commonfund Forum | Articles

What’s Next for Cash Investors?

In the static low-rate environment of recent years, it seemed as though there was no “what’s next” for cash. Today, that has changed, as there are major forces reshaping the regulatory and interest...

Investment Strategy | Articles

Ideas for Next Gen Energy Investing

Advances in alternative energy technologies promise to reduce the world’s dependence on fossil fuels. Largely, however, they remain just that—a promise. So, where are the opportunities to invest in...

Investment Strategy | Articles

The Big Picture: Integrating Investments, Finance and Development

Most things function a lot better when all the moving parts work together—nonprofit institutions included. The synergies afforded by collaboration across organizational boundaries may be the most...

Investment Strategy | Articles

Rethinking Risk and Diversification

Asset allocation is still the foundation on which better risk-adjusted returns are built. But asset allocation has changed, along with all the associated tools for pursuing return and managing risk....

Perspectives | Videos

The One World Schoolhouse: Education Reimagined

Sal Khan is the founder of the Khan Academy, a nonprofit with the mission of providing free, high-quality education to “anyone, anywhere” in the world. A former hedge fund analyst with degrees from...

Outsourced Cio | Insights Blog

Six Key Questions To Ask OCIO Providers

“Outsourced CIO” (or OCIO) is a term that might not be familiar to many. In the past it has been defined as a traditional consulting model in which the process of interviewing potential investment...

Risk Management | Insights Blog

Defining Risk For Your Organization

Merriam-Webster’s defines risk as the “possibility of loss or injury.” The financial profession — borrowing from Modern Portfolio Theory — uses the standard deviation of a portfolio’s returns to...

Mission-aligned Investing | Articles

Impact Investing: Balancing the Best of Responsibility & Opportunity

Impact investing is showing growth around the world. According to the most recent J.P. Morgan/Global Impact Investing Network Impact Investor Survey, the number of institutional investors engaging in...

Perspectives | Articles

Working capital: challenge and opportunity

On campus, the thinking about operating asset management is changing with the times. In the wake of the 2008 financial crisis and Great Recession, liquidity was the primary concern on university...

Governance And Policy | Insights Blog

What is ESG Investing?

Generally speaking, Environmental Social and Governance, or ESG for short, is used to describe a group of characteristics that can have a material impact on the long-term success of a company and,...

Governance And Policy | Articles

Evolving Challenges in Nonprofit Governance

Commonfund recently convened an expert panel moderated by Myra Drucker (standing, left), Chair of the Board, TrustedPeer Inc. and former chair of the Commonfund Board of Trustees. The roundtable...

Mission-aligned Investing | Articles

ESG: Principles for Responsible Investment

Environmental, social and governance (ESG) factors are a topic for active discussion in board rooms. Here’s an update on Commonfund’s thoughts and actions and how ESG may relate to you. In general,...

Risk Management | Articles

Risk: The Fuel that Generates Portfolio Returns

Risk management: the process of harnessing risk in pursuit of better investment returns In a broad sense, how should nonprofit institutional investors think about investment risk and risk management?...

Mission-aligned Investing | Articles

ESG and Your Institution: Doing Well by Doing Good

Investing according to environmental, social and governance principles is maturing into a distinct discipline. Robust research results dispute the conventional wisdom about performance trade-offs. If...

The Housing Market Paradox